- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

Dave (DAVE): Assessing Valuation After Strong Q2 Earnings and Unexpected Stock Drop

Reviewed by Kshitija Bhandaru

Dave (DAVE) reported Q2 earnings that easily topped forecasts, with a revenue jump of 65% from a year ago. Even with these stronger results, the stock retreated, losing 13% after the release.

See our latest analysis for Dave.

Despite headline-grabbing quarterly results, Dave’s share price has been volatile. It dropped more than 14% over the past month even as its year-to-date price return is up a remarkable 126%. The longer-term story is even more impressive. Dave boasts a 345% total shareholder return in the past year and over 1,600% for those who stuck with it for three years. This underscores that momentum is strong but also unpredictable in the near term as sentiment shifts quickly around growth names in fintech.

If you’re looking to spot other fast-movers beyond headline-makers like Dave, consider broadening your search and discover fast growing stocks with high insider ownership

With shares retreating sharply after an impressive earnings beat, the key question now is whether Dave is trading at a discount relative to its high growth or if the market has already priced in all future gains.

Most Popular Narrative: 28% Undervalued

Dave trades well below its projected fair value of $271.86, versus a last close of $195.07. The widely-followed narrative sees material upside if analysts' future targets play out.

Enhanced monetization from fee structure changes, including a successful rollout of a $3 monthly subscription fee (with no measurable negative impact on retention), offers meaningful ARPU and LTV uplift. This is further supported by secular demand for transparent, low-fee banking alternatives, directly supporting revenue growth and margin expansion.

Want to know the secret power fueling Dave’s price target? The narrative hinges on ramped recurring revenues and a massive step up in profitability. But which growth lever delivers the most value? Find out how a bold financial bet on rising margins could unlock blockbuster returns, if the forecasts prove true.

Result: Fair Value of $271.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory scrutiny on fee-based models and intensifying competition from larger fintechs could significantly impact Dave's growth story and future earnings projections.

Find out about the key risks to this Dave narrative.

Another View: Looking at Price Ratios

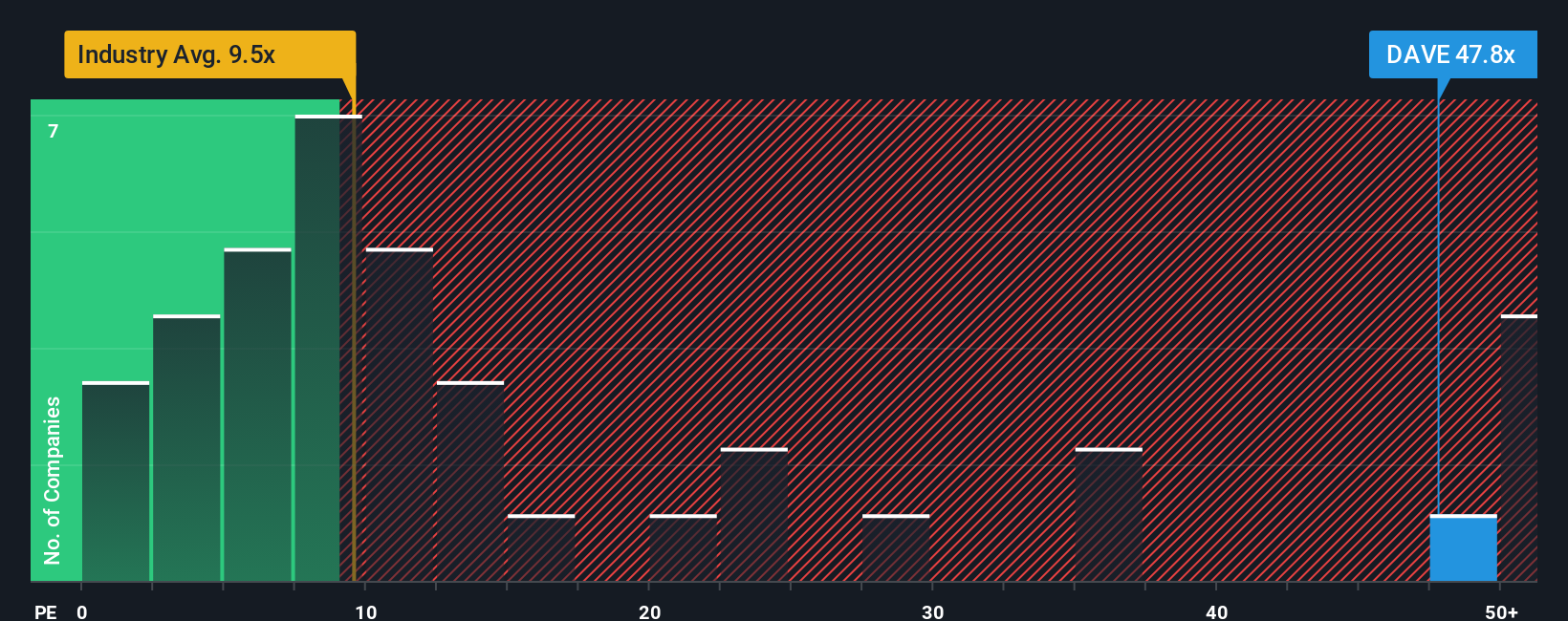

While many see Dave as undervalued based on analyst price targets, looking at its price-to-earnings ratio tells a different story. Dave trades at 47.8x earnings, much higher than both the industry average of 9.5x and even its peer average of 6.7x. The fair ratio for Dave, based on our models, sits at 26.6x, which is less than two-thirds of where it currently trades. This significant gap suggests real valuation risk if sentiment shifts or performance falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dave Narrative

If you’d rather rely on your own analysis or want to challenge the prevailing view, crafting your own narrative takes just a few minutes, so why not Do it your way

A great starting point for your Dave research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities pass you by. The Simply Wall Street Screener makes it simple to identify unique stocks aligned with your investment goals and curiosity.

- Capture explosive returns when you target underpriced growth stories using these 897 undervalued stocks based on cash flows that screen for strong cash flow value plays.

- Tap into the future of medicine and capitalize on innovation by checking out these 33 healthcare AI stocks poised at the intersection of healthcare and artificial intelligence.

- Uncover leading innovators in the race for next-level computing and harness potential with these 26 quantum computing stocks that focus on quantum breakthroughs and new technology frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives