- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase Global (NasdaqGS:COIN) Soars With US$9 Billion Cash Reserves Despite 13% Stock Dip

Reviewed by Simply Wall St

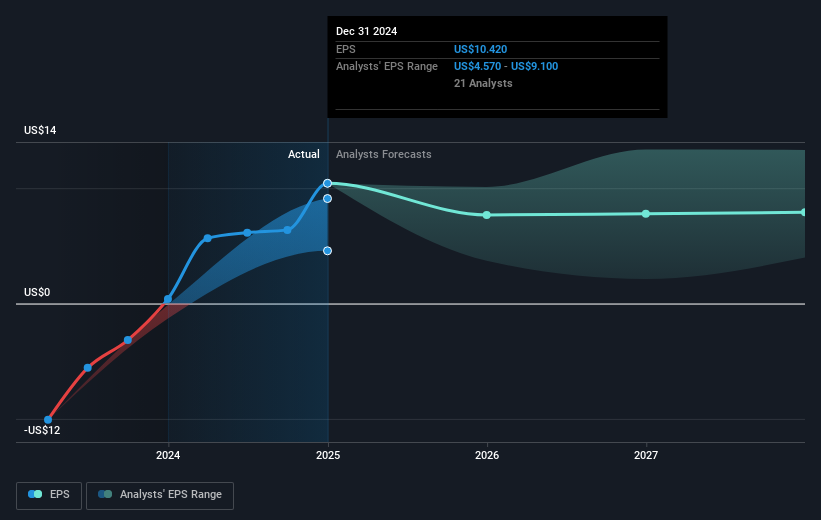

Coinbase Global (NasdaqGS:COIN) recently announced its pursuit of strategic acquisitions to bolster its business, underpinned by $9 billion in cash reserves. This news comes amid a challenging market backdrop where the Nasdaq slid 0.3% over the last week, reflecting broader economic uncertainties stemming from tariff increases posed by the Trump administration. Despite Coinbase's robust Q4 FY 2024 earnings that exhibited a significant year-on-year growth, the company's stock price fell 12.89% over the past week. Investor sentiment was likely affected by wider market volatility, as the tech-heavy Nasdaq and other major indices faced downturns due to fears of economic slowdown linked to tariffs. This climate created a sharp contrast to Coinbase's own positive financial results and acquisition plans, potentially weighing heavily on its on-market total returns.

Dig deeper into the specifics of Coinbase Global here with our thorough analysis report.

Over the past three years, Coinbase Global has delivered a total return of 17.00%, reflecting a complex interplay of various factors. The company's exceptional earnings growth, highlighted by substantial increases in both revenue and net income over the last year, stands out as a key element in its longer-term share performance. Specifically, for the full year ending December 31, 2024, revenue rose to US$6.56 billion, and net income increased to US$2.58 billion, showcasing its financial robustness. Despite these achievements, Coinbase's stock underperformed the US market and the Capital Markets industry over the past year, which may reflect investor concerns over potential growth challenges.

Moreover, Coinbase's proactive strategy of seeking acquisitions, supported by US$9 billion in cash reserves, points to a continued focus on scaling its business through mergers and acquisitions. Legal and regulatory challenges, including a class action lawsuit about risks with its British unit, likely exerted some pressure on investor sentiment. Additionally, the company's ongoing efforts to expand its presence by securing alliances, such as the partnership with Worksport Ltd. for digital asset custody, highlight Coinbase's commitment to enhancing its market position. These factors collectively shaped the company's returns over the examined period.

- Discover whether Coinbase Global is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Analyze the downside risks for Coinbase Global and understand their potential impact—click to learn more.

- Are you invested in Coinbase Global already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Coinbase Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives