- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase Global (NasdaqGS:COIN) Slides 18% Amid Q4 2024 Earnings Growth

Reviewed by Simply Wall St

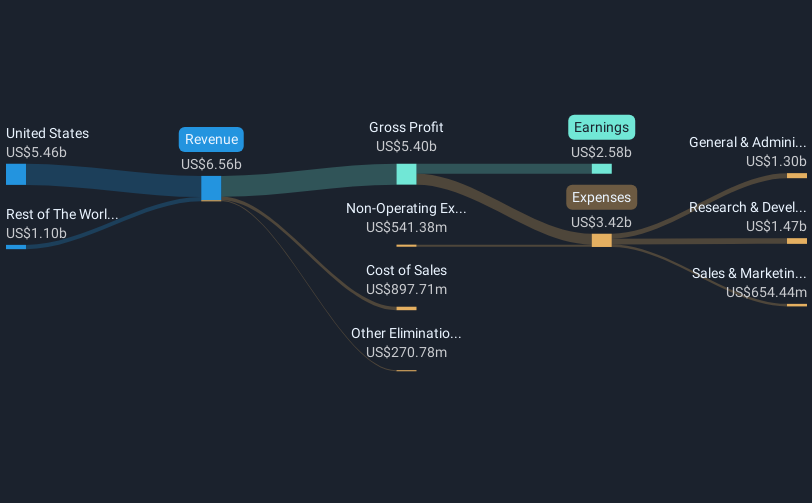

Despite Coinbase Global (NasdaqGS:COIN) announcing impressive Q4 2024 earnings growth, including a leap in sales and net income compared to the previous year, its stock experienced a 17.67% decline over the past week. The lack of stock repurchase activity, as confirmed by the completion of the repurchase program, may offer some insight into investor sentiment, while the uncertainty of a filed $4.18 billion Shelf Registration, which includes shares meant for an ESOP-related offering, may have introduced concerns about potential dilution. Meanwhile, broader market conditions saw major U.S. indices like the Nasdaq Composite slide 0.6%, reflecting general investor unease about economic health and recent trade policy announcements. Additionally, Tesla and other tech shares faced significant declines, contributing to the tech sector's overall pressures. The broader cryptocurrency market also grappled with challenges, seeing Bitcoin trade at low levels during the same period.

Click to explore a detailed breakdown of our findings on Coinbase Global.

Over three years, Coinbase Global's shares achieved a total return of 9.49%, reflecting a complex blend of market forces and company developments. Although its recent year performance fell short against the US Capital Markets industry, which saw a 30.6% return, Coinbase exhibited substantial annual growth, with earnings climbing to US$2.58 billion in full-year 2024. Diversification efforts such as the collaboration with Worksport for crypto treasury management in January 2025 focused on expanding Coinbase's footprint across sectors.

In the realm of strategic growth, Coinbase pursued acquisitions, with CEO Brian Armstrong underlining a vigorous acquisition strategy aimed at bolstering international reach. The October 2024 announcement of a US$1 billion stock buyback plan signaled shareholder return intentions. Regulatory challenges, like the February 2024 class action lawsuit, however, underscored ongoing legal hurdles. These dynamics illustrate the complex path steering Coinbase's longer-term share performance amidst a rapidly evolving market landscape.

- Get the full picture of Coinbase Global's valuation metrics and investment prospects—click to explore.

- Gain insight into the risks facing Coinbase Global and how they might influence its performance—click here to read more.

- Invested in Coinbase Global? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives