- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Coinbase Global (NasdaqGS:COIN) Shares Slide 14% Despite Robust Financial Growth

Reviewed by Simply Wall St

Coinbase Global (NasdaqGS:COIN) recently revealed robust financial growth, showcasing a significant year-over-year increase in sales and net income. Despite this strong performance and an aggressive strategy for acquisitions, the company's shares declined 14% over the past week. This price movement occurred amid a broader market downturn, with major indices like the S&P 500 and Nasdaq Composite facing declines of 1.2% and 1.7%, respectively, influenced by concerns over economic policies and slowing growth. Furthermore, tech stocks, which include several of Coinbase's peers, experienced a notable slump. While Adobe and Tesla shares also dipped due to their respective outlooks, the overall market environment was challenging, contributing to Coinbase's price drop alongside these factors. During this period, the company's acquisition plans and cash reserves may not have been enough to outweigh negative market sentiment and investor worries about broader economic conditions.

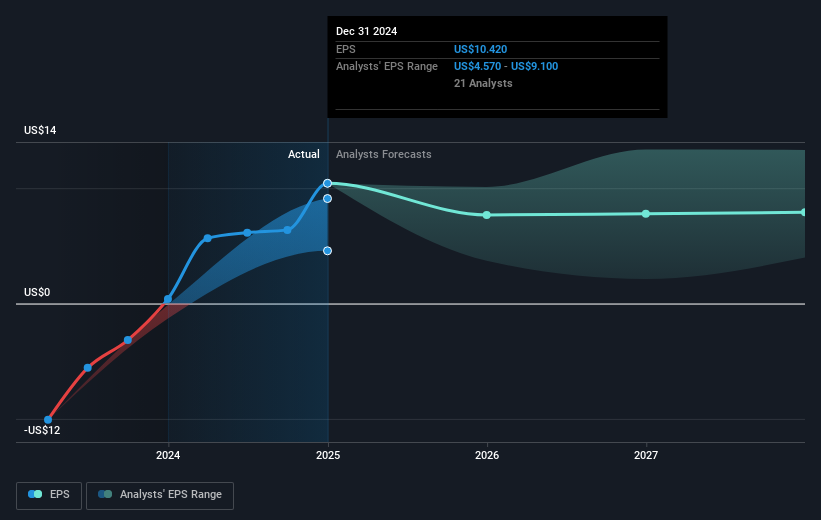

Over the last three years, Coinbase Global's total shareholder return, including dividends, reached 11.13%. This performance occurred alongside significant earnings growth, highlighted by COIN's FPS growth significantly exceeding the wider Capital Markets industry. Despite challenges over the past year where COIN underperformed both the US Market and Capital Markets industry, the company maintained a strong financial position with robust net profit margins.

Investment in growth and expansion has been underscored by exploring acquisitions globally. Notably, Coinbase's M&A activities and cash reserves were leveraged to enhance product offerings and facilitate global expansion. Partnerships, such as the Onchain Engagement Protocol with HYBE’s BINARY KOREA, further emphasize a focus on deepening market presence. The announcement of a share buyback plan, aimed at reinforcing shareholder value, marked another facet of Coinbase's strategy. These factors collectively contribute to its longer-term shareholder returns amidst a competitive and evolving market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives