- United States

- /

- Capital Markets

- /

- NasdaqGM:CNCK

3 Growth Companies With High Insider Ownership Expecting 155% Earnings Growth

Reviewed by Simply Wall St

As the U.S. market grapples with renewed trade tensions and fluctuating indices, investors are increasingly seeking companies that demonstrate resilience and potential for substantial earnings growth. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those within the company, aligning well with growth expectations despite broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 25.3% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 67.1% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.3% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

| Eagle Financial Services (NasdaqCM:EFSI) | 15.8% | 82.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and AI-powered technology to serve financial services, service providers, their customers, and asset investors across the United States, Israel, and the Cayman Islands with a market cap of approximately $1.06 billion.

Operations: Pagaya Technologies Ltd. generates its revenue from the Software & Programming segment, which amounts to $1.08 billion.

Insider Ownership: 16%

Earnings Growth Forecast: 155.3% p.a.

Pagaya Technologies is demonstrating strong growth potential, with earnings forecasted to increase significantly by 155.33% annually and revenue expected to outpace the US market's growth. The company recently launched POSH, a $300 million asset-backed securitization program for point-of-sale financing, enhancing its lending capacity and capital efficiency. Despite high share price volatility, Pagaya has raised its earnings guidance for 2025 and reported improved profitability in Q1 2025 with net income of US$7.89 million.

- Delve into the full analysis future growth report here for a deeper understanding of Pagaya Technologies.

- The valuation report we've compiled suggests that Pagaya Technologies' current price could be quite moderate.

Coincheck Group (NasdaqGM:CNCK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coincheck Group N.V. operates cryptocurrency exchanges in Japan and has a market cap of $779.52 million.

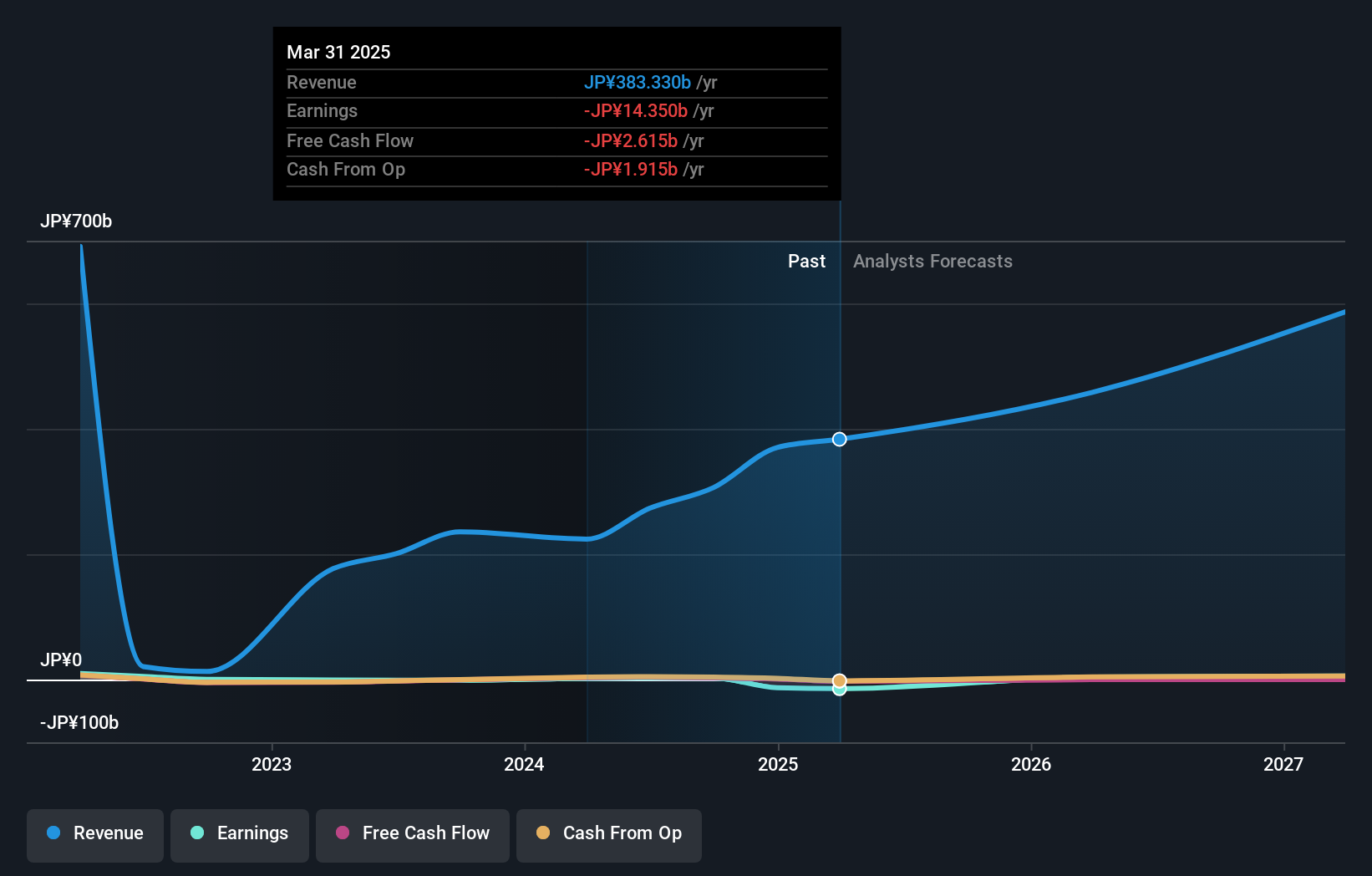

Operations: The company generates revenue from its cryptocurrency exchange operations, with a reported segment revenue of ¥383.33 million.

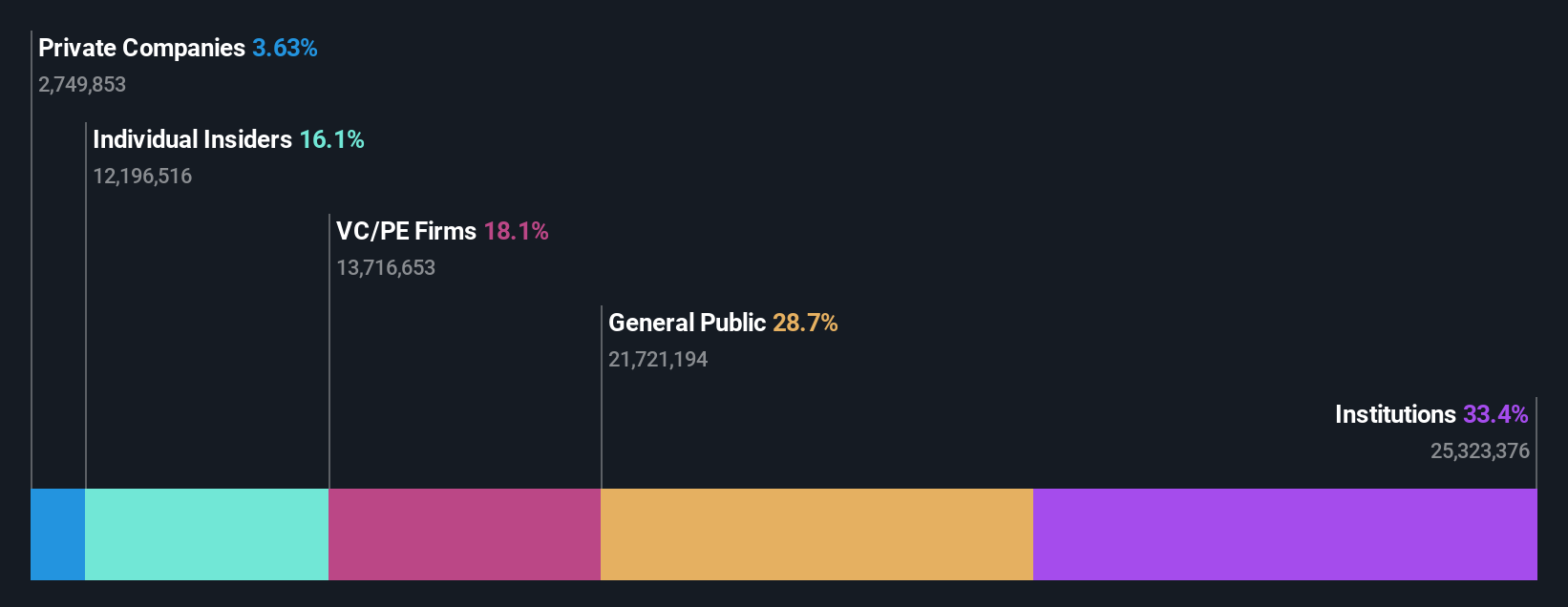

Insider Ownership: 10.7%

Earnings Growth Forecast: 125.7% p.a.

Coincheck Group is poised for significant growth, with revenue expected to increase by 23.4% annually, surpassing US market averages. Despite a volatile share price and recent shareholder dilution, the company is forecasted to achieve profitability within three years. Recent earnings reports show substantial year-over-year sales growth but also highlight a full-year net loss of JPY 14,350 million. Coincheck's strategic moves include a $73.73 million shelf registration filing and appointing KPMG as its auditor for fiscal year-end March 2025.

- Unlock comprehensive insights into our analysis of Coincheck Group stock in this growth report.

- Our comprehensive valuation report raises the possibility that Coincheck Group is priced lower than what may be justified by its financials.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers digital data and analytics services to support critical business decisions across various regions globally, with a market cap of approximately $606.49 million.

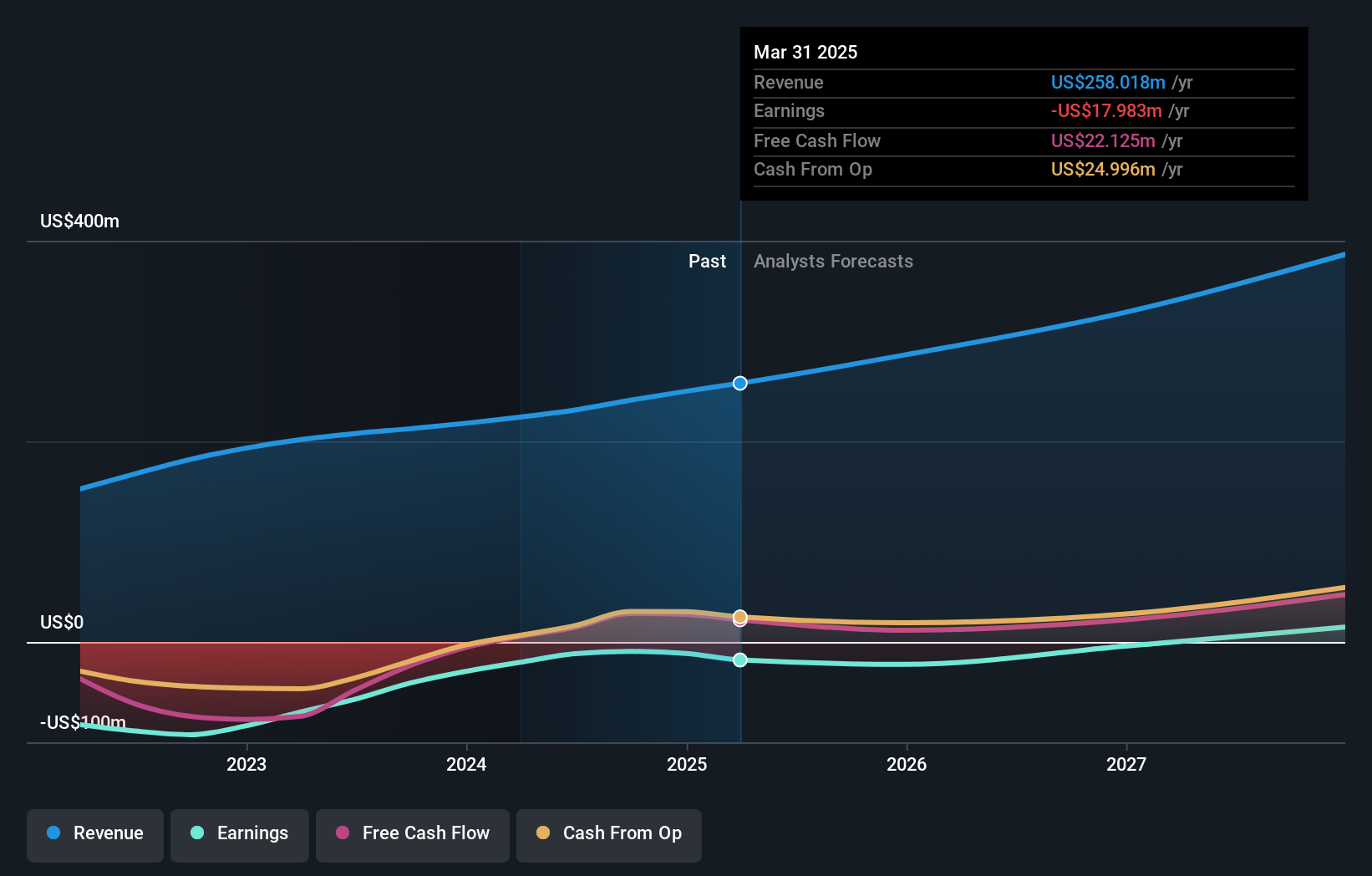

Operations: The company generates revenue from its On Line Financial Information Providers segment, amounting to $258.02 million.

Insider Ownership: 14.9%

Earnings Growth Forecast: 71.8% p.a.

Similarweb is experiencing notable growth, with revenue increasing to US$67.09 million in Q1 2025, up from US$58.98 million a year prior. Despite a net loss of US$9.26 million for the quarter, the company is forecasted to achieve profitability within three years and expects revenue between US$68.6 million and US$69 million in Q2 2025. Recent product innovations like AI Chatbot Traffic and App Intelligence aim to strengthen its competitive edge in digital analytics.

- Click to explore a detailed breakdown of our findings in Similarweb's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Similarweb shares in the market.

Seize The Opportunity

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 186 more companies for you to explore.Click here to unveil our expertly curated list of 189 Fast Growing US Companies With High Insider Ownership.

- Looking For Alternative Opportunities? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CNCK

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives