- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Evaluating CME Group (CME) After CFTC’s Cross‑Margining Expansion for Treasuries and Digital Assets

Reviewed by Simply Wall St

The CFTC’s decision to expand cross margining between CME Group (CME) Treasury futures and cash Treasuries may sound technical, but it quietly reshapes how investors post collateral across bonds and digital asset exposure.

See our latest analysis for CME Group.

Despite a recent pullback that left the 1 month share price return at around minus 4 percent, CME’s roughly 18 percent year to date share price gain and strong multiyear total shareholder returns suggest positive momentum is still intact as investors reward its expanding clearing footprint.

If this kind of market structure story interests you, it could be a good moment to explore other listed exchanges and platforms by hunting through fast growing stocks with high insider ownership.

Yet with CME trading only modestly below analyst targets, despite premium profitability and regulatory tailwinds, investors now face a key question: is this a fresh entry point, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 4.4% Undervalued

With the narrative fair value sitting modestly above CME Group’s last close at $273.55, the story leans toward upside built on durable fee economics.

New product innovations (e.g., Micro contracts, expansion into crypto, FX Spot+), ongoing tech driven operating efficiencies (cloud migration and tokenization initiatives), and strengthening of strategic partnerships (such as the long term NASDAQ index license extension and Google Cloud collaboration) are enhancing operating leverage and EBITDA/net margin performance.

Curious how steady mid single digit growth, expanding margins, and a richer future earnings multiple can still support upside from here? The narrative’s forecasts spell it out.

Result: Fair Value of $286.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained low volatility or faster adoption of lower fee, decentralized rivals could compress volumes and margins and challenge the upbeat valuation narrative.

Find out about the key risks to this CME Group narrative.

Another Lens on Valuation

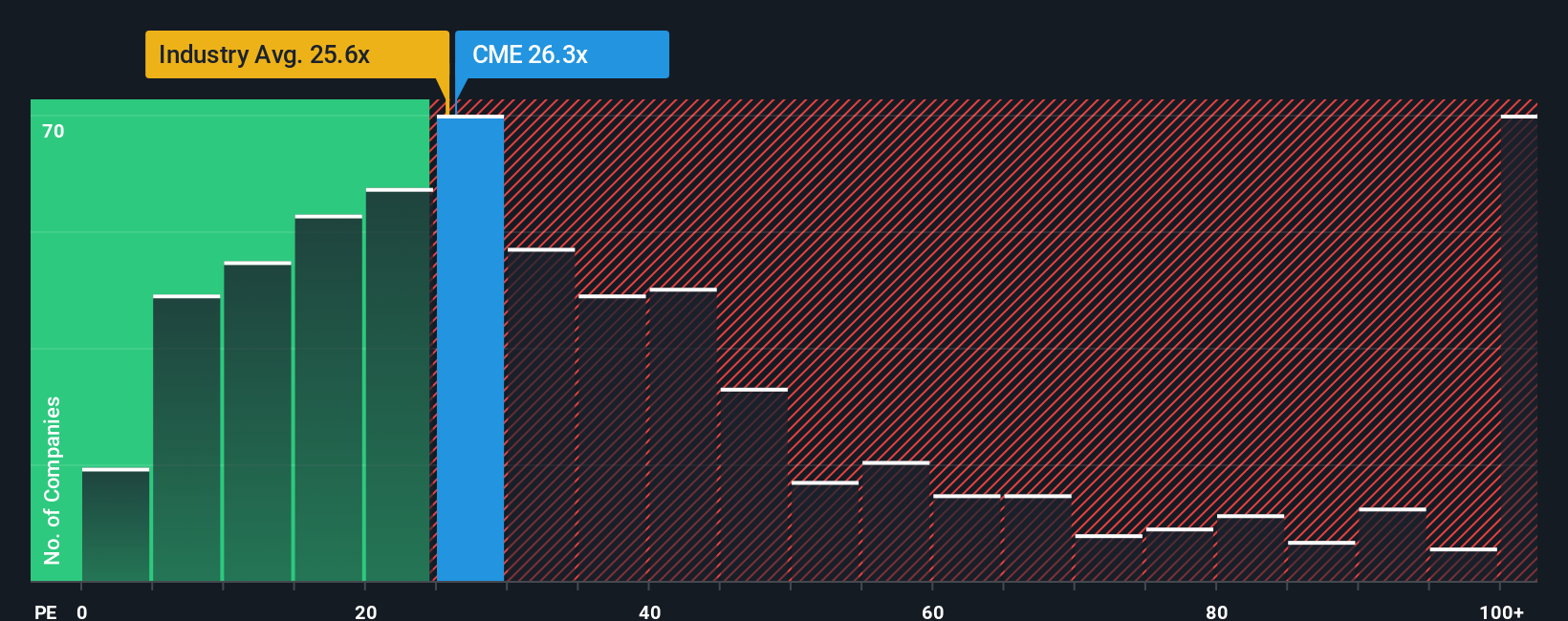

Step away from the narrative fair value and CME looks expensive on earnings. Its P/E sits around 26.5 times, a touch richer than the US Capital Markets industry at 25.4 times and far above a fair ratio of roughly 15 times. This implies meaningful de rating risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CME Group Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a fresh view yourself in just a few minutes: Do it your way.

A great starting point for your CME Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning fresh themes and sectors that could complement or even outperform your view on CME.

- Amplify potential growth by targeting emerging innovators using these 908 undervalued stocks based on cash flows that trade at compelling valuations despite strong fundamentals.

- Position ahead of powerful technology shifts by focusing on these 26 AI penny stocks reshaping entire industries with scalable, data driven business models.

- Strengthen portfolio income by reviewing these 13 dividend stocks with yields > 3% offering attractive yields underpinned by cash generative operations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)