- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

Does CME Group's (CME) Strong Earnings and Legal Win Signal a More Durable Business Model?

Reviewed by Simply Wall St

- In the past week, CME Group Inc. reported strong second quarter earnings and secured a unanimous jury verdict in its favor in a longstanding class action lawsuit filed by certain Class B shareholders and CBOT members.

- This series of events highlights CME’s ability to deliver operational growth while successfully managing legal risks tied to its core business structure.

- We'll examine how CME's combination of earnings growth and legal resolution could reinforce the company’s outlook and broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

CME Group Investment Narrative Recap

To be a CME Group shareholder, you generally need to believe in the continued demand for risk management and hedging solutions as macroeconomic and geopolitical uncertainty supports robust trading activity. The recent favorable legal verdict eliminates a material risk tied to the company’s governance structure, but the biggest short-term catalyst, sustained market volatility, remains fundamentally unaltered, and the verdict itself has no significant impact on this dynamic.

Among recent announcements, CME’s second quarter results stand out: revenue climbed to US$1,692 million and net income rose to US$1,025.1 million versus a year ago, reflecting resilience in its trading franchise. These earnings reinforce CME’s reputation for operational consistency, supporting the thesis that persistent global volatility can drive strong financial results regardless of outside legal challenges.

In contrast, investors should also consider upcoming regulatory changes and their potential effects on CME’s core business model, as these are risks that...

Read the full narrative on CME Group (it's free!)

CME Group's narrative projects $7.2 billion in revenue and $4.2 billion in earnings by 2028. This requires 3.7% yearly revenue growth and a $0.5 billion earnings increase from the current $3.7 billion.

Uncover how CME Group's forecasts yield a $281.50 fair value, in line with its current price.

Exploring Other Perspectives

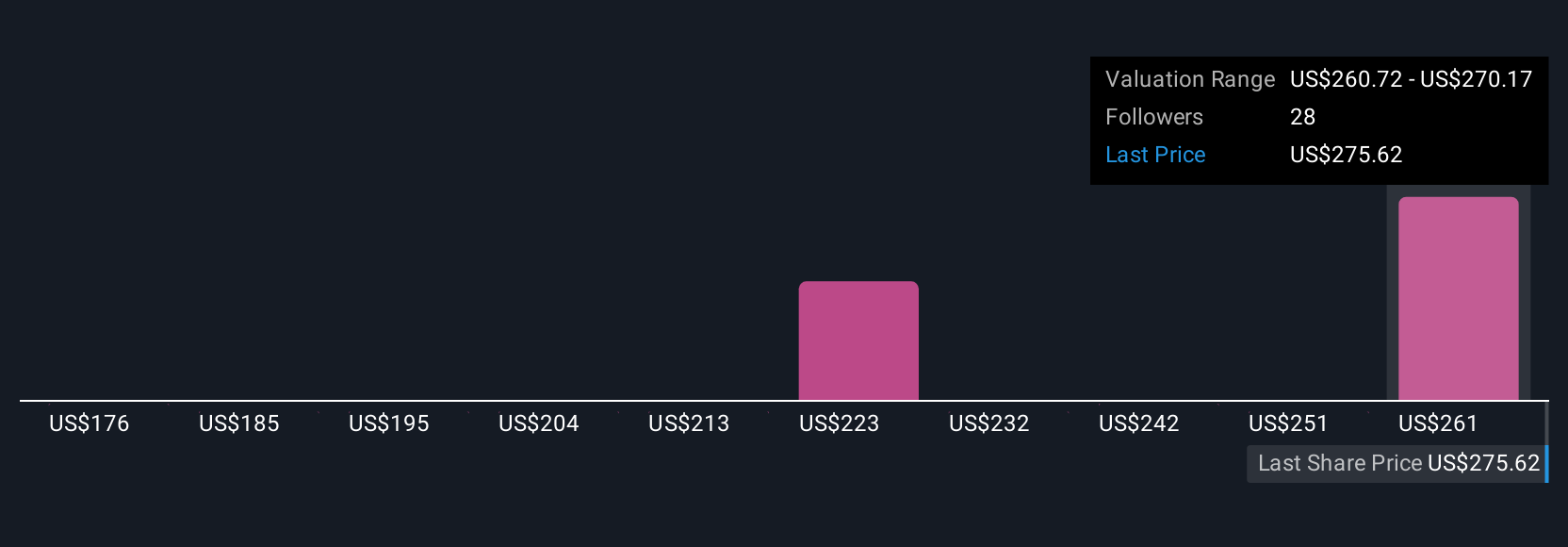

Five fair value estimates from the Simply Wall St Community range from US$175.71 to US$281.50 per share, revealing a broad set of expectations. While many believe risk-hedging demand bolsters CME’s growth, you should compare these perspectives with current market catalysts and explore several viewpoints before making any decisions.

Explore 5 other fair value estimates on CME Group - why the stock might be worth 37% less than the current price!

Build Your Own CME Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CME Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CME Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CME Group's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives