- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

Why Investors Shouldn't Be Surprised By The Carlyle Group Inc.'s (NASDAQ:CG) P/S

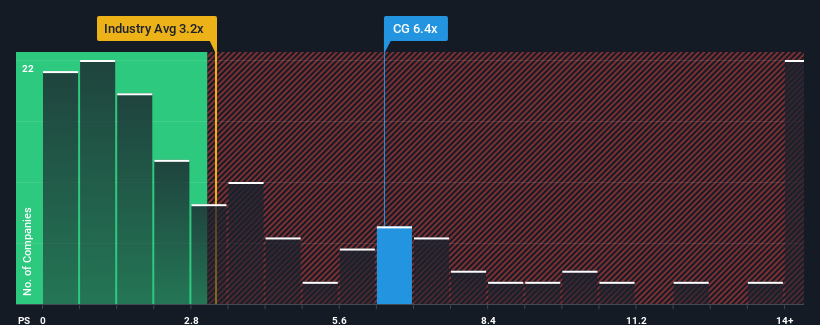

The Carlyle Group Inc.'s (NASDAQ:CG) price-to-sales (or "P/S") ratio of 6.4x may look like a poor investment opportunity when you consider close to half the companies in the Capital Markets industry in the United States have P/S ratios below 3.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Carlyle Group

How Carlyle Group Has Been Performing

While the industry has experienced revenue growth lately, Carlyle Group's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Carlyle Group will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Carlyle Group?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Carlyle Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. This means it has also seen a slide in revenue over the longer-term as revenue is down 62% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 92% during the coming year according to the twelve analysts following the company. That's shaping up to be materially higher than the 7.4% growth forecast for the broader industry.

In light of this, it's understandable that Carlyle Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Carlyle Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Capital Markets industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Carlyle Group that you need to be mindful of.

If these risks are making you reconsider your opinion on Carlyle Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Slight with imperfect balance sheet.