- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

Carlyle Group (CG): Revisiting Valuation After Recent Pullback in a Strong Year-To-Date Rally

Reviewed by Simply Wall St

Carlyle Group (CG) has had an interesting stretch lately, with the stock giving back about 3% in the past day but still sitting on solid gains year to date and over the past month.

See our latest analysis for Carlyle Group.

That dip takes the latest share price to $58.35, but it comes after a strong run, with a double digit year to date share price return and a powerful multi year total shareholder return. This suggests momentum is cooling slightly rather than reversing.

If Carlyle's move has you thinking about where capital could work harder, this is a good moment to explore fast growing stocks with high insider ownership.

With double digit annual growth and the stock still trading at a discount to analyst targets, is Carlyle quietly undervalued after its pullback, or has the market already priced in the next leg of growth?

Most Popular Narrative: 11.2% Undervalued

With Carlyle Group last closing at $58.35 against a narrative fair value near $65.73, the latest models point to meaningful upside if assumptions hold.

Surging institutional allocations to alternatives, reinforced by significant momentum in areas like private credit and asset-based finance (with AUM up 40% YoY), as well as a growing insurance channel (notably Fortitude Re and reinsurance flows), increasingly diversify Carlyle's revenue streams and enhance margins by providing higher recurring, stable fee income across cycles.

Curious how modest headline revenue expectations can still underpin a richer valuation? The real story blends expanding margins, rising earnings power, and a future multiple usually reserved for market darlings. Want to see the exact growth and profitability path behind that fair value? Read on to unpack the full narrative.

Result: Fair Value of $65.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on continued fundraising strength and benign credit markets, and tougher competition or regulatory shifts have the potential to derail that path.

Find out about the key risks to this Carlyle Group narrative.

Another Angle on Valuation

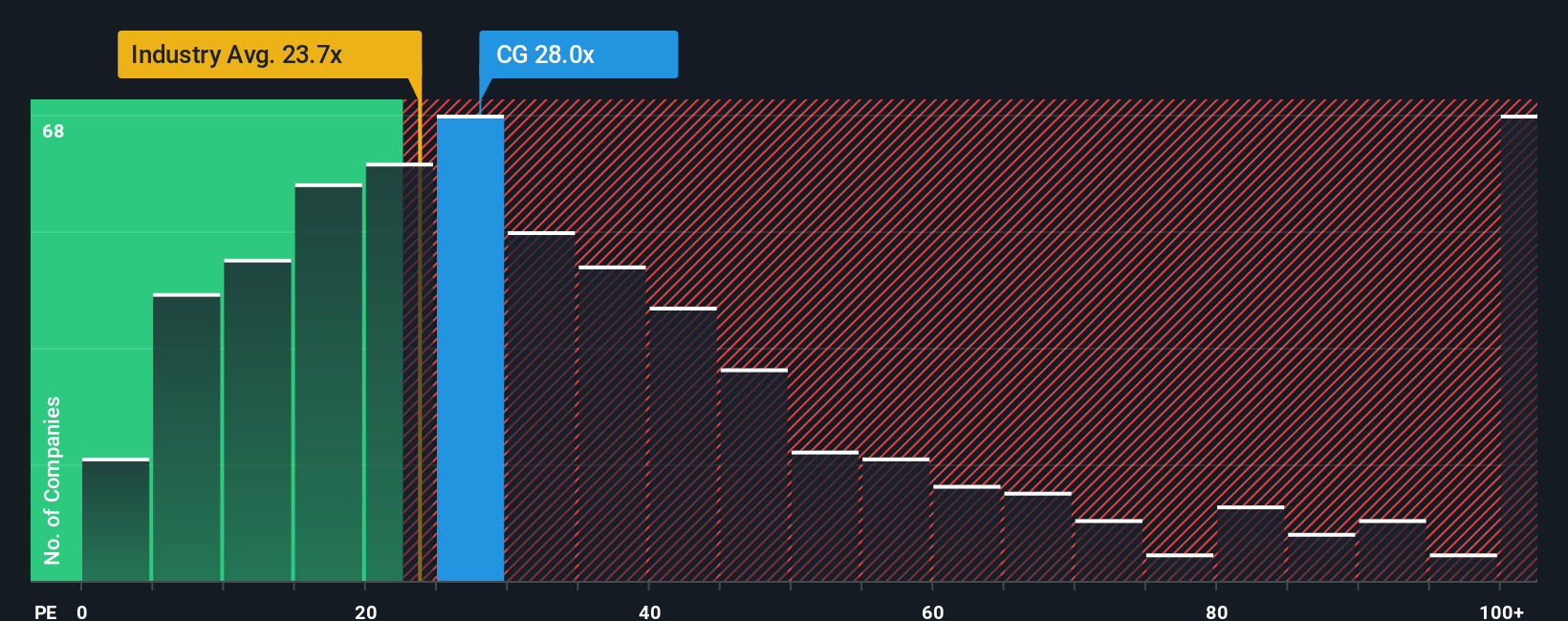

On earnings, Carlyle looks far less forgiving. The current P/E of about 31.8x is richer than both the Capital Markets industry at 25.2x and a fair ratio of 19.1x. This implies investors are already paying up for growth, leaving less room for error if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carlyle Group Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your Carlyle Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your research momentum to work by checking smart, data driven stock lists that could surface your next big winner.

- Capture early stage potential with these 3611 penny stocks with strong financials that already show robust balance sheets and real earning power behind their low share prices.

- Position yourself for the next wave of innovation through these 30 healthcare AI stocks transforming diagnostics, treatment pathways, and medical efficiency worldwide.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with the financial resilience needed to keep paying through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)