- United States

- /

- Diversified Financial

- /

- NasdaqGS:CASS

Cass Information Systems (NASDAQ:CASS) Ticks All The Boxes When It Comes To Earnings Growth

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Cass Information Systems (NASDAQ:CASS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Cass Information Systems

Cass Information Systems' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Cass Information Systems grew its EPS by 6.1% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

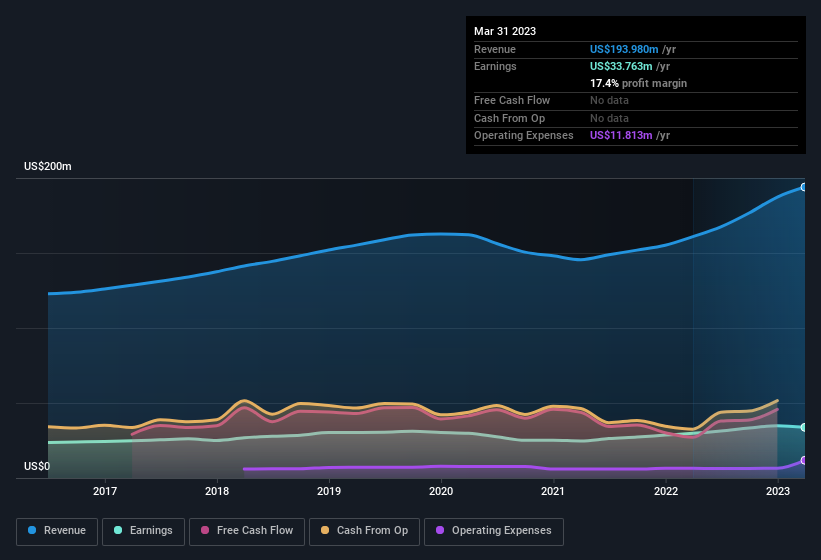

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Cass Information Systems' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Cass Information Systems maintained stable EBIT margins over the last year, all while growing revenue 21% to US$194m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Cass Information Systems Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Cass Information Systems shareholders is that no insiders reported selling shares in the last year. Add in the fact that Martin Resch, the President & COO of the company, paid US$18k for shares at around US$35.70 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

The good news, alongside the insider buying, for Cass Information Systems bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at US$15m. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 2.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Cass Information Systems Worth Keeping An Eye On?

One important encouraging feature of Cass Information Systems is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. Of course, just because Cass Information Systems is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Cass Information Systems is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CASS

Cass Information Systems

Provides payment and information processing services to manufacturing, distribution, and retail enterprises in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026