- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

How Investors May Respond To Credit Acceptance (CACC) Strong Q3 Results and Aggressive Share Buybacks

Reviewed by Sasha Jovanovic

- Credit Acceptance Corporation reported third quarter results in the past, with revenue rising to US$582.4 million and net income reaching US$108.2 million, both higher than the previous year, alongside the completion of a significant share repurchase program totaling over 1.83 million shares since 2023.

- The combination of improved earnings and active buybacks may indicate both operational momentum and management's confidence in the company’s longer-term prospects.

- We'll examine how Credit Acceptance's strong quarterly performance and ongoing share repurchases shape the company's investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Credit Acceptance Investment Narrative Recap

To be a shareholder in Credit Acceptance, you need to believe the company can sustain profitable growth in the non-prime auto lending space, weathering competition and credit risk cycles. The recent strong revenue and earnings results, paired with share buybacks, reinforce the view of operational resilience but do not materially alter the most important short-term catalyst, a turnaround in loan origination volumes, nor do they solve the ongoing risk tied to underperforming recent loan vintages, which remains a concern for future earnings.

The conclusion of the significant share repurchase program, totaling over 1.83 million shares for US$921.17 million, is the most relevant announcement linked to this earnings report. While these buybacks may support per-share earnings and signal internal optimism, the company’s future still hinges on improving collection trends and stabilizing credit performance as competitive and economic pressures persist.

On the flip side, investors should absolutely be aware that even with rising earnings, persistent weakness in loan performance could still…

Read the full narrative on Credit Acceptance (it's free!)

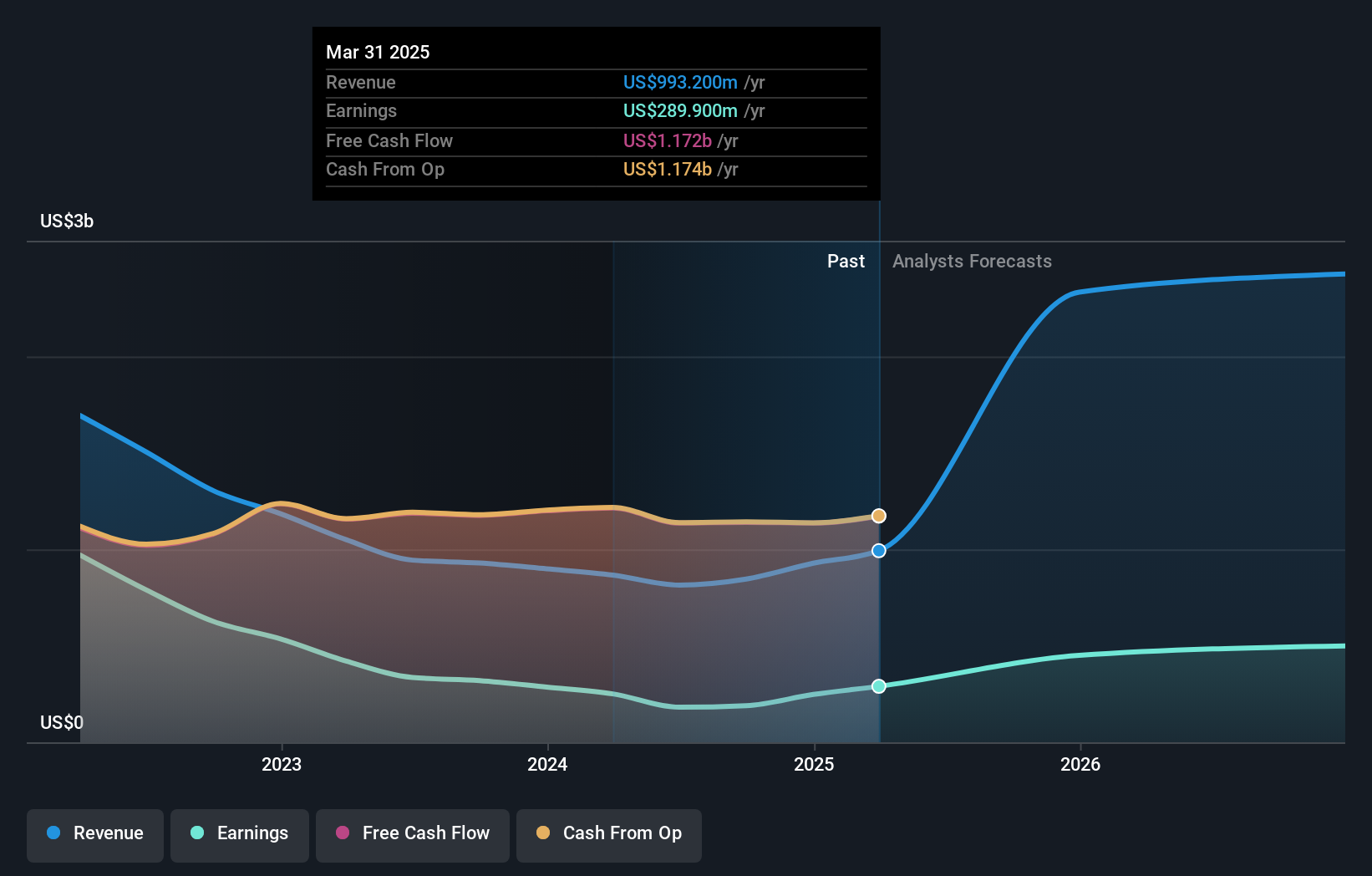

Credit Acceptance's narrative projects $4.5 billion revenue and $504.0 million earnings by 2028. This requires 56.2% yearly revenue growth and a $79.6 million earnings increase from $424.4 million.

Uncover how Credit Acceptance's forecasts yield a $446.25 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members value Credit Acceptance anywhere from US$283 to US$446 per share, based on two unique estimates. With competition intensifying and origination volumes shrinking, these diverse views remind you that opinion is split on the company’s medium-term trajectory.

Explore 2 other fair value estimates on Credit Acceptance - why the stock might be worth 36% less than the current price!

Build Your Own Credit Acceptance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Credit Acceptance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Credit Acceptance's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives