- United States

- /

- Specialty Stores

- /

- NYSE:RERE

Three Stocks Estimated To Be Trading Below Intrinsic Value In December 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a modest uptick following key inflation data, major indices like the Dow Jones and S&P 500 are nearing all-time highs, reflecting investor optimism despite recent economic uncertainties. In this environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on undervalued assets amid fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WEBTOON Entertainment (WBTN) | $14.34 | $28.20 | 49.1% |

| Super Group (SGHC) (SGHC) | $11.14 | $21.52 | 48.2% |

| Signet Jewelers (SIG) | $85.02 | $167.01 | 49.1% |

| Schrödinger (SDGR) | $18.42 | $35.34 | 47.9% |

| Perfect (PERF) | $1.77 | $3.43 | 48.5% |

| Pattern Group (PTRN) | $13.35 | $25.43 | 47.5% |

| Lyft (LYFT) | $22.52 | $43.57 | 48.3% |

| Investar Holding (ISTR) | $26.13 | $50.75 | 48.5% |

| DexCom (DXCM) | $65.25 | $126.43 | 48.4% |

| BioLife Solutions (BLFS) | $25.83 | $49.93 | 48.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Axogen (AXGN)

Overview: Axogen, Inc., along with its subsidiaries, focuses on developing and commercializing technologies for peripheral nerve regeneration and repair globally, with a market cap of approximately $1.31 billion.

Operations: Axogen's revenue segment primarily consists of $214.71 million from peripheral nerve repair technologies.

Estimated Discount To Fair Value: 28.2%

Axogen is trading at US$32.86, significantly below its estimated fair value of US$45.78, indicating potential undervaluation based on cash flows. The company recently reported a net income of US$0.708 million for Q3 2025, marking a turnaround from a loss the previous year. Furthermore, Axogen's revenue growth forecast of 14.6% per year surpasses the broader U.S. market growth rate and aligns with its raised annual revenue guidance to at least US$222.8 million for 2025.

- Our comprehensive growth report raises the possibility that Axogen is poised for substantial financial growth.

- Navigate through the intricacies of Axogen with our comprehensive financial health report here.

Webull (BULL)

Overview: Webull Corporation operates as a digital investment platform with a market cap of $4.65 billion.

Operations: The company generates revenue primarily from its brokerage services, totaling $514.80 million.

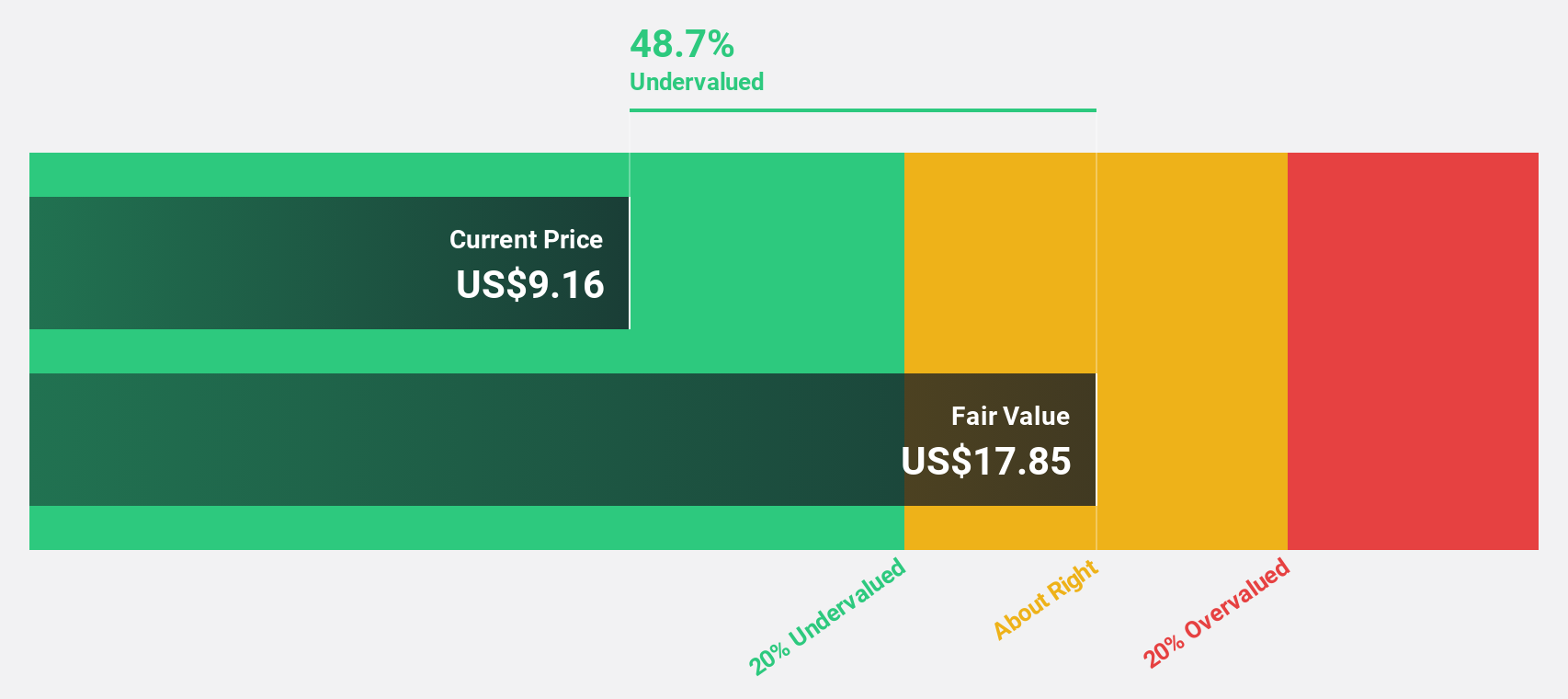

Estimated Discount To Fair Value: 46%

Webull, trading at US$9.62, is significantly undervalued with an estimated fair value of US$17.82. The company's recent earnings report shows a strong turnaround, with Q3 revenue reaching US$156.94 million and net income at US$36.92 million compared to a loss last year. Revenue growth is projected at 25.1% annually, outpacing the U.S. market average and supporting its potential as an undervalued stock based on cash flows despite past shareholder dilution concerns.

- The growth report we've compiled suggests that Webull's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Webull's balance sheet health report.

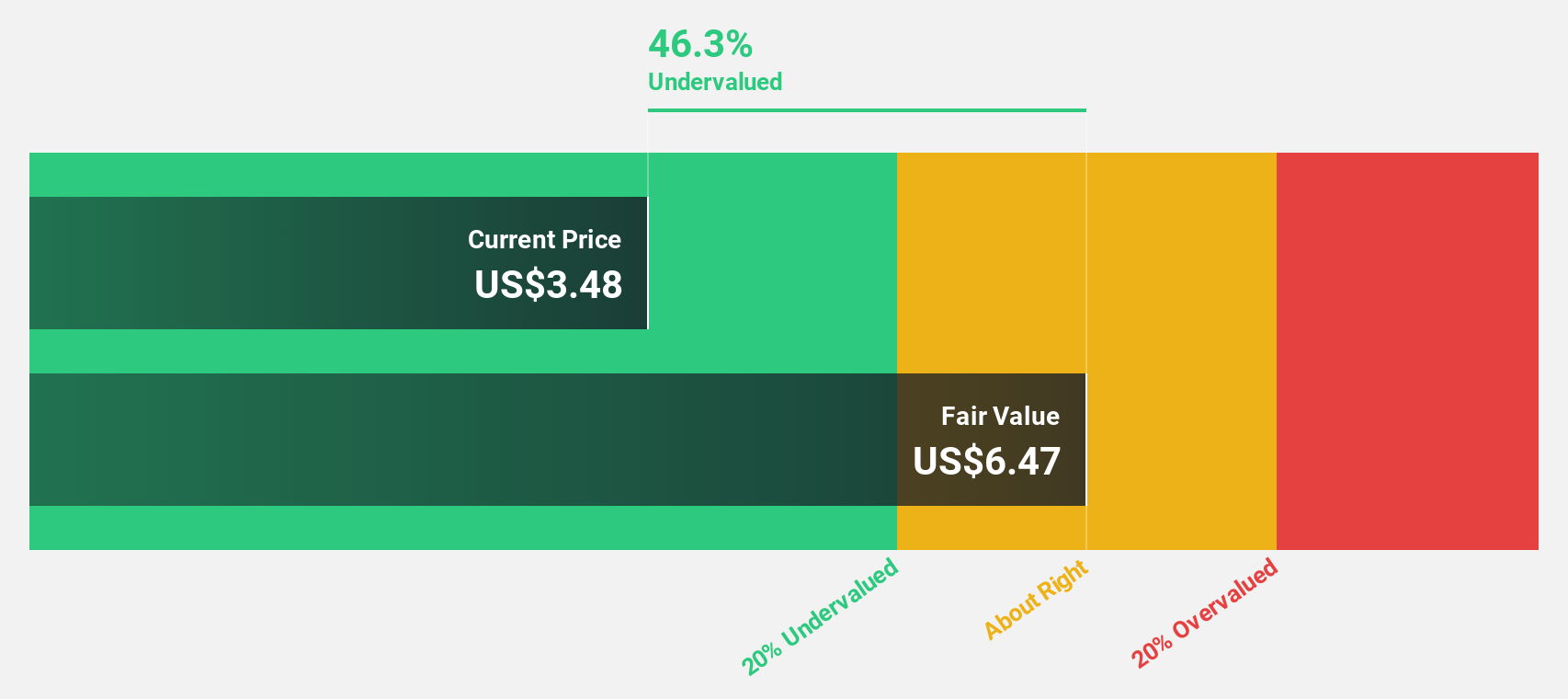

ATRenew (RERE)

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in China, with a market cap of approximately $1.10 billion.

Operations: The company's revenue primarily comes from its retail electronics segment, generating CN¥19.64 billion.

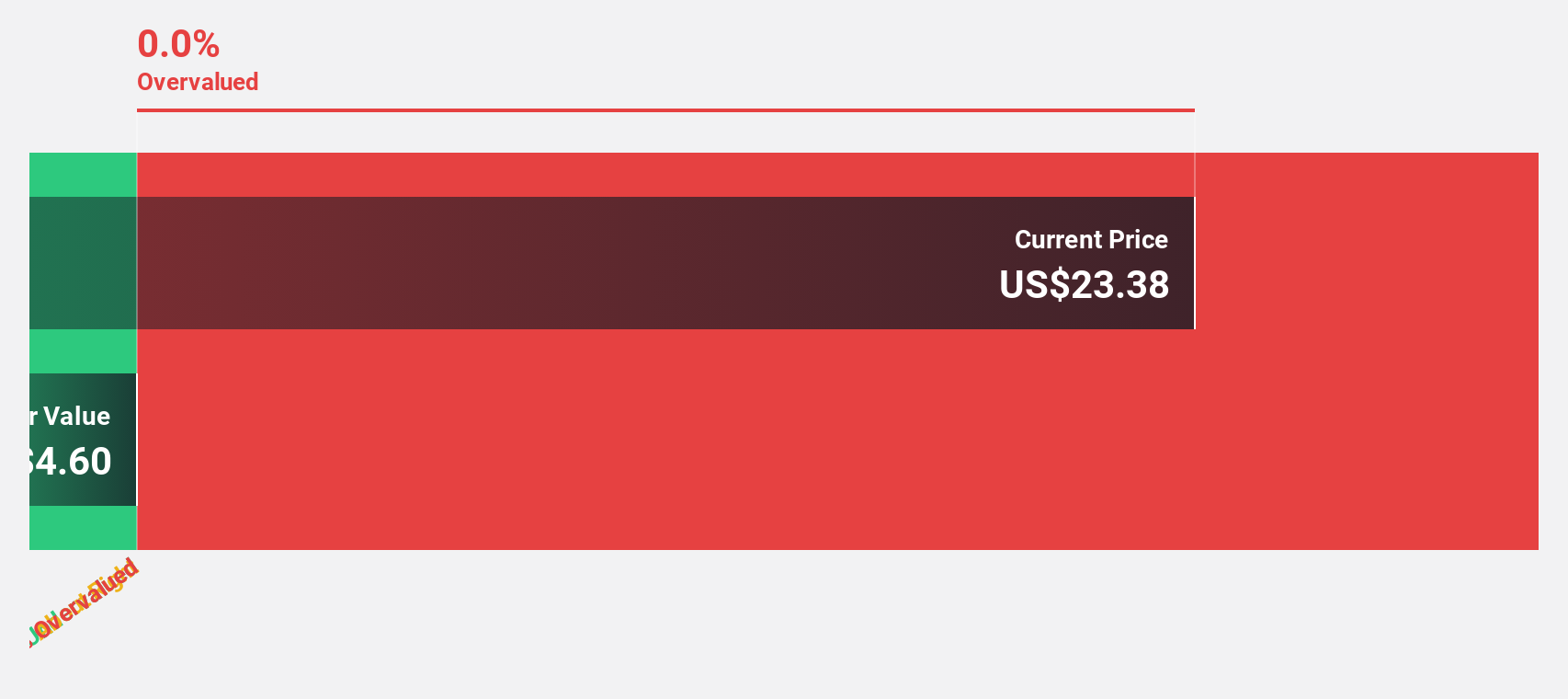

Estimated Discount To Fair Value: 22.6%

ATRenew, trading at US$5.34, is undervalued relative to its fair value of US$6.9. The company has shown a significant earnings turnaround, reporting third-quarter net income of CNY 90.82 million compared to CNY 17.88 million last year and projecting annual revenue growth of over 20%. Despite a low forecasted return on equity, the company's robust profit growth and recent share buyback enhance its position as an undervalued stock based on cash flows.

- Insights from our recent growth report point to a promising forecast for ATRenew's business outlook.

- Take a closer look at ATRenew's balance sheet health here in our report.

Where To Now?

- Unlock our comprehensive list of 208 Undervalued US Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RERE

ATRenew

Operates pre-owned consumer electronics transactions and services platform in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026