- United States

- /

- Diversified Financial

- /

- NasdaqGM:BETR

Better Home & Finance (BETR) Is Up 165.2% After Activist Investor Backs AI-Driven Mortgage Strategy

Reviewed by Simply Wall St

- In the past week, shares of Better Home & Finance Holding surged after activist investor Eric Jackson of EMJ Capital publicly endorsed the company, calling it the 'Shopify of mortgages' and revealing a hedge fund stake.

- Jackson emphasized the company's use of artificial intelligence to streamline the mortgage process and expressed strong confidence in its transformative potential for the real estate finance industry.

- We'll explore how Jackson's advocacy of Better Home & Finance's AI-driven approach impacts the company's investment narrative moving forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Better Home & Finance Holding's Investment Narrative?

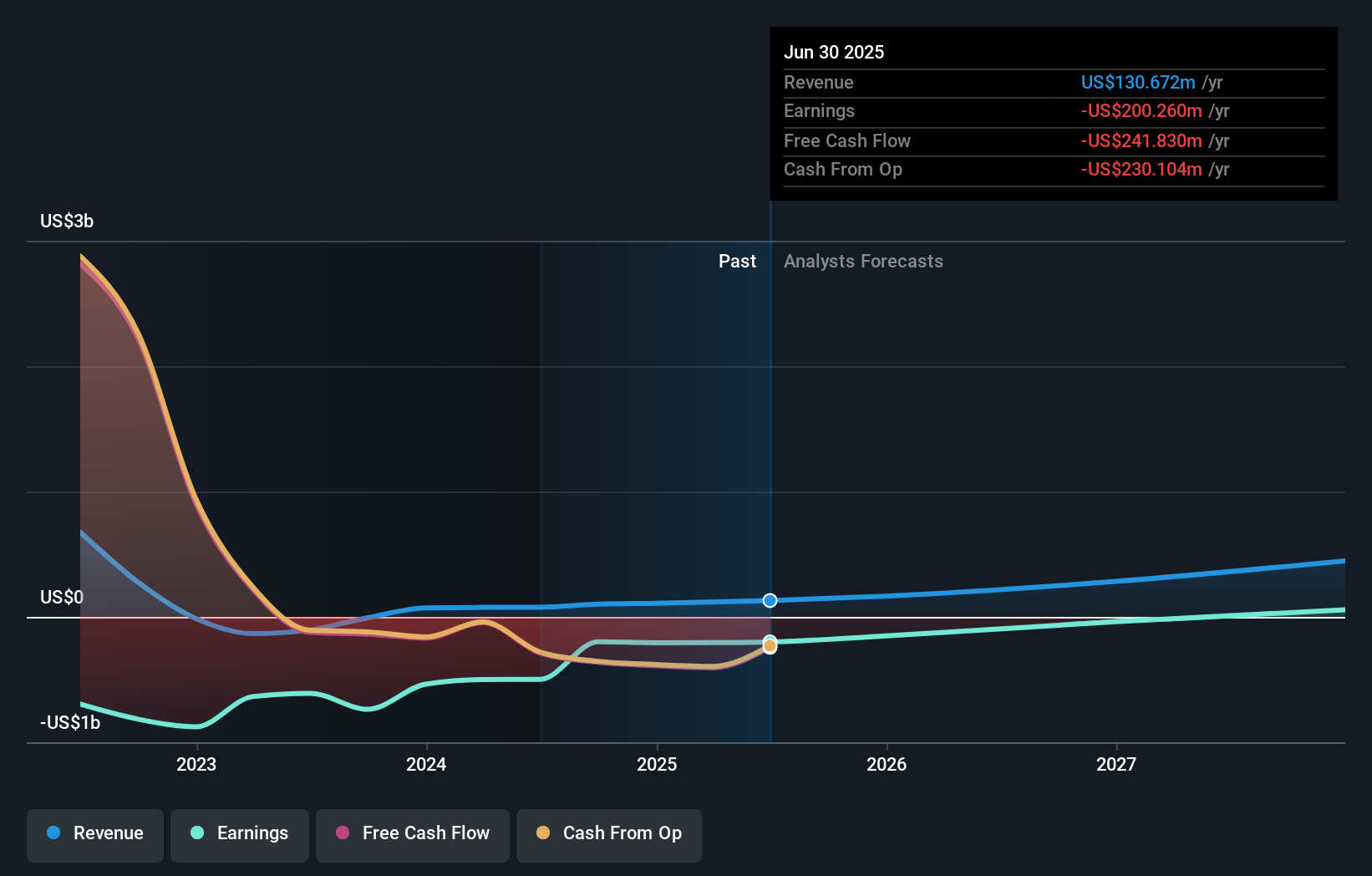

For anyone considering Better Home & Finance Holding, belief in its vision means buying into the transformative power of AI to reshape mortgage origination and home finance. The recent endorsement by activist investor Eric Jackson supercharged the stock and brought a flood of attention to the company's AI-driven strategy, potentially changing the short-term narrative by putting the technology roadmap front and center. However, this exuberance comes alongside ongoing concerns: the company is still unprofitable, its board lacks deep industry experience, it’s operating with less than a year’s cash runway, and its valuation is high relative to peers. While this renewed enthusiasm may lift near-term sentiment and keep volatility elevated, the fundamental risks around cashflow, profitability timelines, and execution remain. For now, the Jackson news feels like a catalyst for re-rating expectations but doesn’t fundamentally alter the underlying hurdles the business faces.

On the other hand, board inexperience remains a factor investors should not overlook.

Exploring Other Perspectives

Explore 2 other fair value estimates on Better Home & Finance Holding - why the stock might be worth as much as $48.92!

Build Your Own Better Home & Finance Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Better Home & Finance Holding research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Better Home & Finance Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Better Home & Finance Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Better Home & Finance Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BETR

Better Home & Finance Holding

Operates as a homeownership company in the United States.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives