- United States

- /

- Capital Markets

- /

- NasdaqCM:ALTI

3 US Growth Stocks With Up To 39% Insider Buy-In

Reviewed by Simply Wall St

As the U.S. markets experience mixed movements, with the Nasdaq gaining momentum while the Dow and S&P 500 retreat from record highs, investors are keenly observing sectors that continue to show resilience amid fluctuating economic indicators. In this environment, growth companies with significant insider ownership can offer unique insights into potential stock performance, as high insider buy-in often signals confidence in a company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's dive into some prime choices out of the screener.

AlTi Global (NasdaqCM:ALTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AlTi Global, Inc. offers wealth and asset management services to individuals, families, foundations, and institutions across the United States, the United Kingdom, and internationally with a market cap of approximately $545.32 million.

Operations: The company generates revenue through its Wealth Management Segment, which accounts for $149.77 million, and its Strategic Alternatives Segment, contributing $92.04 million.

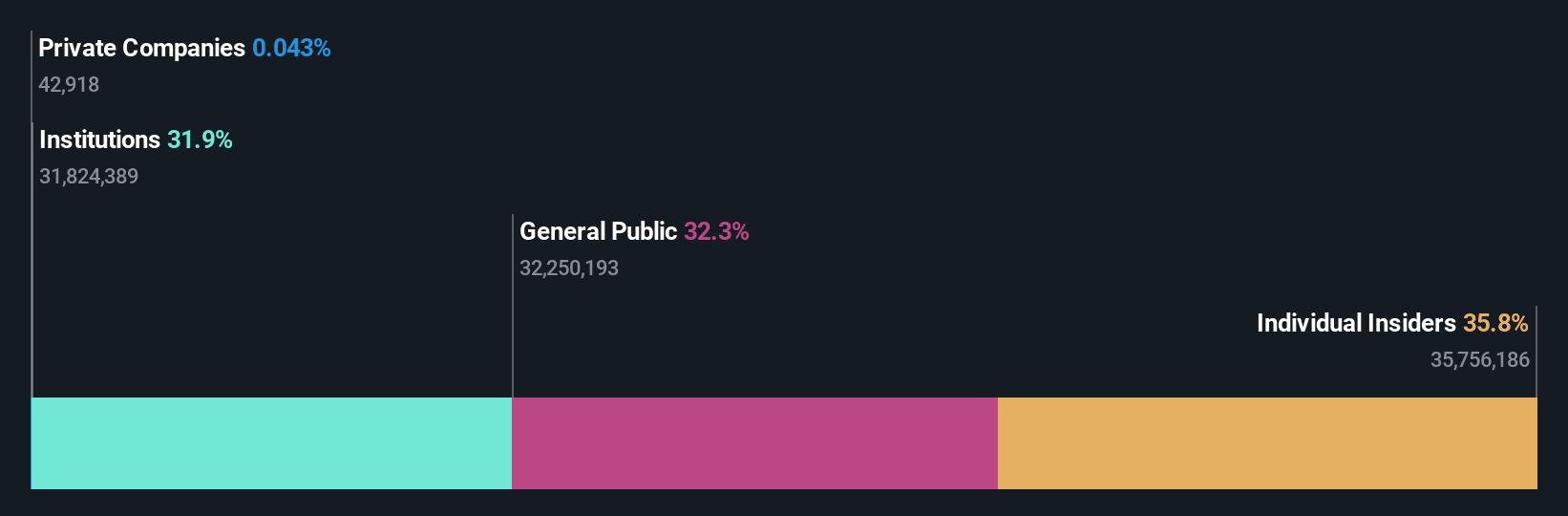

Insider Ownership: 39.2%

AlTi Global, a company with significant insider ownership, recently experienced a net loss of US$5.99 million for the second quarter of 2024, contrasting with a net income of US$42.74 million in the previous year. Despite this setback, AlTi's earnings are projected to grow significantly at 97.19% annually and become profitable within three years—an above-market growth rate. The recent US$250 million investment by Allianz reflects confidence in its long-term potential despite short-term challenges.

- Unlock comprehensive insights into our analysis of AlTi Global stock in this growth report.

- Our valuation report unveils the possibility AlTi Global's shares may be trading at a premium.

Super Micro Computer (NasdaqGS:SMCI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. develops and manufactures high-performance server and storage solutions based on modular and open architecture, with a market cap of approximately $27.99 billion.

Operations: The company's revenue segment includes developing and providing high-performance server solutions, generating $14.94 billion.

Insider Ownership: 25.7%

Super Micro Computer is experiencing significant growth, with revenues forecasted to increase by 20.9% annually, outpacing the US market. Despite recent legal challenges and volatility in its share price, the company remains a leader in AI and data center solutions, driven by innovative liquid-cooling technologies. However, past shareholder dilution and ongoing legal issues may pose risks. The company's high insider ownership aligns interests with shareholders but requires careful monitoring amidst these complexities.

- Dive into the specifics of Super Micro Computer here with our thorough growth forecast report.

- The analysis detailed in our Super Micro Computer valuation report hints at an deflated share price compared to its estimated value.

Contango Ore (NYSEAM:CTGO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Contango Ore, Inc. is an exploration stage company focused on the exploration and development of mineral properties in Alaska, with a market capitalization of approximately $258.29 million.

Operations: Contango Ore, Inc. does not currently report any revenue segments as it is an exploration stage company focused on developing mineral properties in Alaska.

Insider Ownership: 30.4%

Contango Ore is positioned for robust growth, with revenue expected to increase by 64.7% annually, surpassing US market averages. Despite recent insider selling and shareholder dilution, its inclusion in the S&P Global BMI Index highlights potential investor confidence. The company is on track to become profitable within three years, driven by promising gold production from the Manh Choh project. However, substantial losses reported recently underscore financial challenges that need addressing for sustained growth.

- Click to explore a detailed breakdown of our findings in Contango Ore's earnings growth report.

- Our comprehensive valuation report raises the possibility that Contango Ore is priced lower than what may be justified by its financials.

Make It Happen

- Get an in-depth perspective on all 181 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ALTI

AlTi Global

Provides wealth and asset management services in the United States, the United Kingdom, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives