- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

How Investors Are Reacting To Affirm Holdings (AFRM) Expanding Buy Now Pay Later Integration With Google

Reviewed by Sasha Jovanovic

- Affirm Holdings recently announced its support for Google's Agent Payments Protocol (AP2), an open, payment-agnostic standard developed to securely enable agent-led transactions across platforms, extending its long-standing partnership with Google.

- This collaboration integrates Affirm's Buy Now, Pay Later technology into emerging digital commerce channels such as AI assistants, chatbots, and digital wallets, reflecting the company's commitment to innovation and broadening its reach in the evolving payments landscape.

- We'll explore how Affirm's move into agent-led payment platforms with Google could influence its growth story and competitive positioning.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Affirm Holdings Investment Narrative Recap

To consider owning shares of Affirm Holdings, you need to believe that the company's technology can drive mainstream adoption of buy now, pay later (BNPL) across digital and physical commerce, outpacing both legacy and emerging competitors. Affirm's recent collaboration with Google on the Agent Payments Protocol (AP2) extends its reach into AI-driven transactions, but this move is unlikely to materially offset the looming risk of losing a large enterprise merchant partner, currently the most pressing near-term catalyst or threat to revenue stability.

Among Affirm's latest partnership announcements, the rollout of BNPL with Ace Hardware is especially relevant, expanding Affirm's in-store presence at over 5,200 locations and demonstrating continued traction in offline retail. This complements the Google collaboration by showing Affirm’s ability to integrate its offerings into broader merchant ecosystems, a factor that could enhance its appeal to other large partners, or conversely, limit the impact if it loses a major one.

On the other hand, investors should not overlook the consequences if Affirm's integration with a key merchant is discontinued at the end of fiscal Q1, as this could...

Read the full narrative on Affirm Holdings (it's free!)

Affirm Holdings' outlook anticipates $6.0 billion in revenue and $756.6 million in earnings by 2028. This is based on a projected annual revenue growth rate of 22.9% and a $704.4 million increase in earnings from the current $52.2 million.

Uncover how Affirm Holdings' forecasts yield a $96.48 fair value, a 25% upside to its current price.

Exploring Other Perspectives

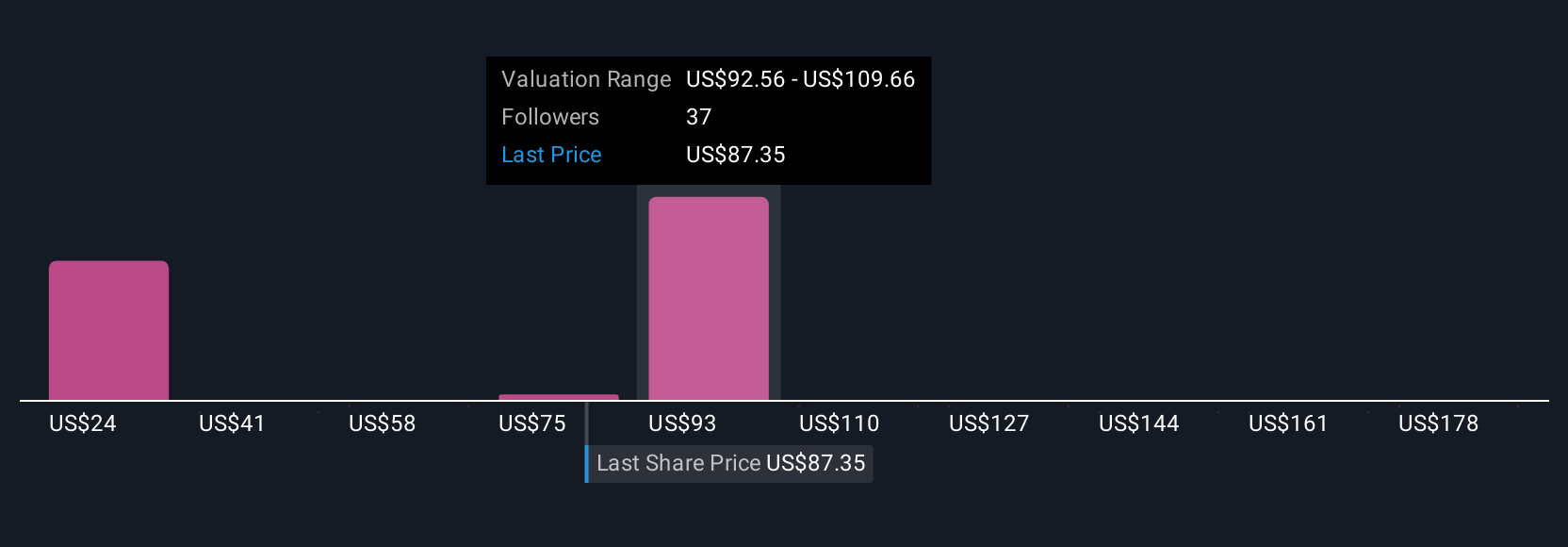

Nineteen individual fair value estimates from the Simply Wall St Community for Affirm span from US$24.03 to US$195.17 per share. While many expect accelerating merchant and consumer adoption to drive future growth, this wide range reinforces how investor views can sharply diverge based on the same information.

Explore 19 other fair value estimates on Affirm Holdings - why the stock might be worth less than half the current price!

Build Your Own Affirm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Affirm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affirm Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives