- United States

- /

- Software

- /

- NasdaqGS:ALLT

Adagene And 2 Other US Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. market experiences a mixed performance, with the S&P 500 and Dow Jones Industrial Average slipping from record highs while the Nasdaq continues to climb, investors are keenly observing opportunities in various sectors. Penny stocks, though an older term, remain relevant for those interested in smaller or newer companies that might offer significant growth potential. By focusing on penny stocks with strong financial health and a clear path forward, investors can uncover opportunities that balance stability with potential upside.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7988 | $5.8M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.15 | $485.02M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.47 | $45.02M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.62 | $2.1B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.77 | $114.05M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $52.63M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.63 | $137.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.09 | $96.23M | ★★★★★☆ |

Click here to see the full list of 751 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Adagene (NasdaqGM:ADAG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Adagene Inc. is a clinical-stage biotechnology company focused on researching, developing, and producing monoclonal antibody drugs for cancer treatment, with a market cap of approximately $115.55 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage biotechnology company.

Market Cap: $115.55M

Adagene Inc., a clinical-stage biotechnology company with a market cap of US$115.55 million, remains pre-revenue, generating less than US$1 million annually. The company has faced increased losses, reporting a net loss of US$17.01 million for the first half of 2024 compared to the previous year. Despite this, Adagene maintains a sufficient cash runway exceeding three years based on current free cash flow and possesses more cash than its total debt. However, challenges include high share price volatility and an inexperienced board with an average tenure under three years. Revenue is forecasted to grow significantly at nearly 69% annually.

- Get an in-depth perspective on Adagene's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Adagene's future.

Acacia Research (NasdaqGS:ACTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acacia Research Corporation is engaged in acquiring and managing companies within the technology, energy, and industrials sectors, with a market cap of approximately $474.78 million.

Operations: The company's revenue is primarily derived from its Intellectual Property Operations, contributing $103.54 million, and Industrial Operations, which add $32.14 million.

Market Cap: $474.78M

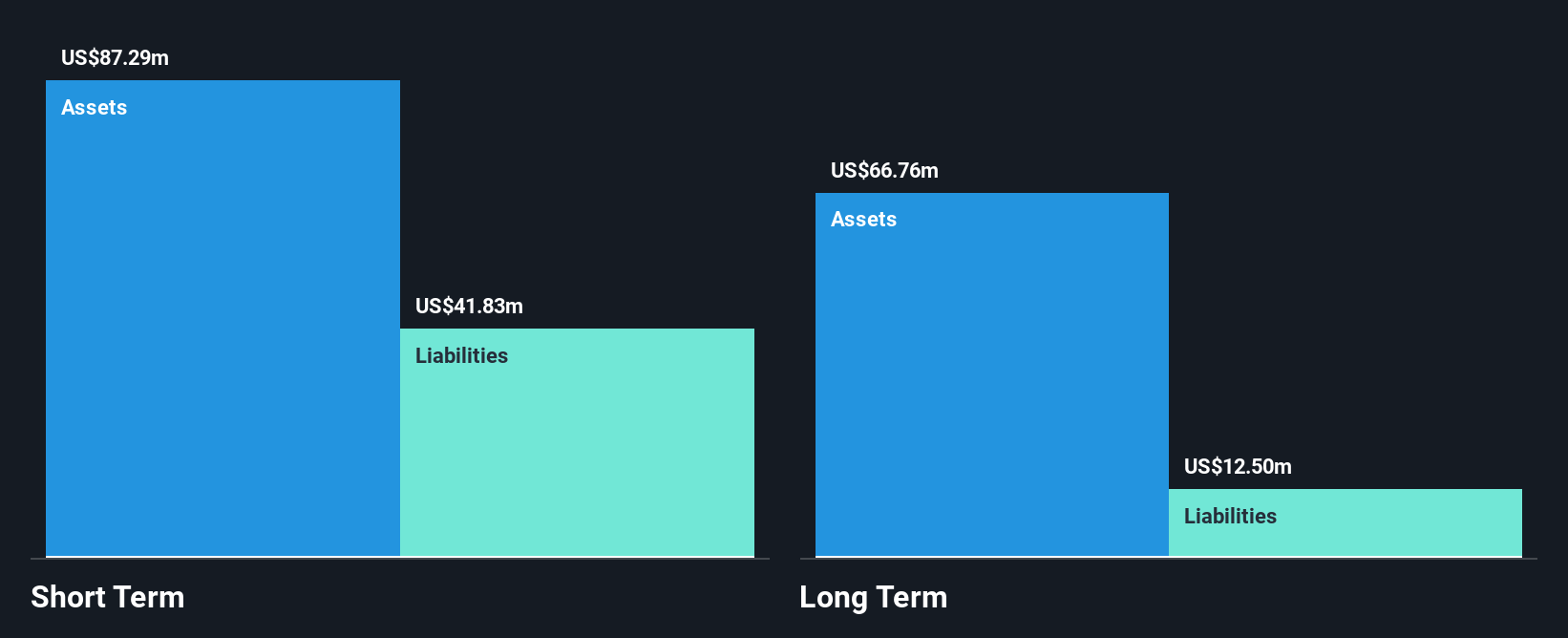

Acacia Research Corporation, with a market cap of US$474.78 million, has shown significant revenue growth, reporting US$25.84 million in Q2 2024 compared to US$7.9 million the previous year. Despite a net loss of US$8.45 million for the quarter, losses have narrowed from the prior year. The company's short-term assets significantly exceed its liabilities, and it has more cash than debt, indicating strong liquidity management. However, earnings are forecasted to decline sharply over the next three years. The board's average tenure suggests limited experience, which may impact strategic decisions moving forward.

- Unlock comprehensive insights into our analysis of Acacia Research stock in this financial health report.

- Explore Acacia Research's analyst forecasts in our growth report.

Allot (NasdaqGS:ALLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allot Ltd. develops, sells, and markets security and network intelligence solutions for mobile, fixed, and cloud service providers as well as enterprises globally, with a market cap of $133.56 million.

Operations: The company generates revenue from its Optical Networking Equipments segment, totaling $91.03 million.

Market Cap: $133.56M

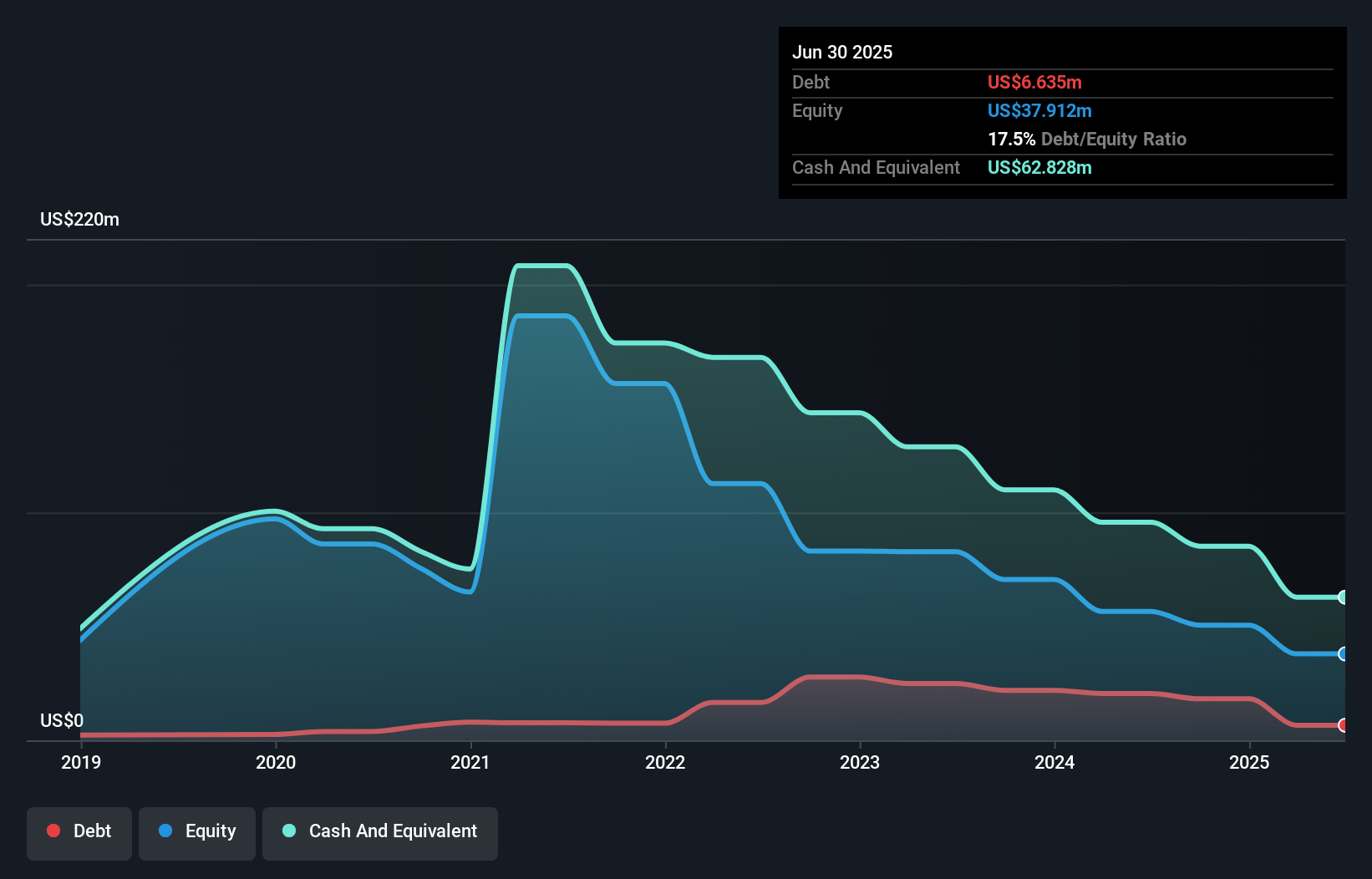

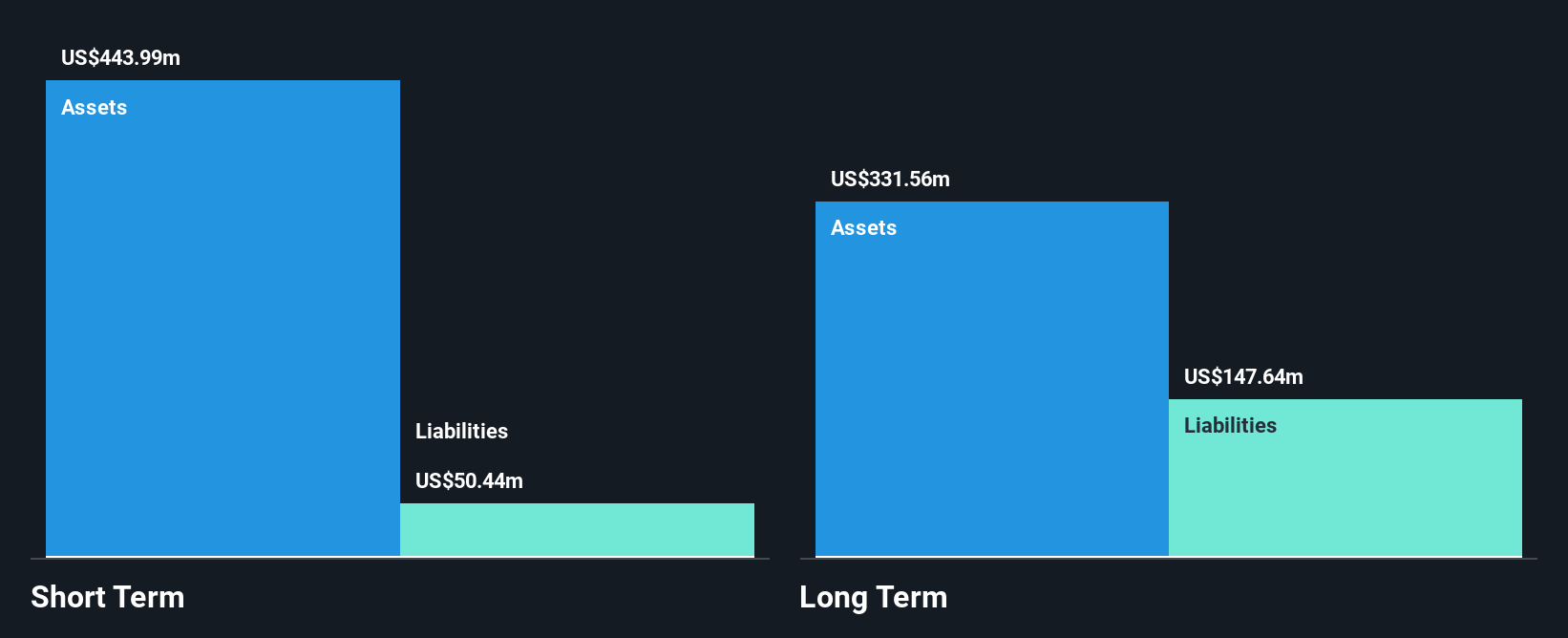

Allot Ltd., with a market cap of US$133.56 million, reported Q2 2024 sales of US$22.16 million, down from the previous year, but reduced its net loss significantly to US$3.36 million. Despite being unprofitable and having increased losses over five years, Allot's earnings are forecast to grow substantially at 70.88% annually. The company has more cash than debt and sufficient cash runway for over three years, although shareholders experienced dilution recently. Its short-term assets exceed both short- and long-term liabilities, reflecting solid liquidity management amid financial challenges in the Optical Networking Equipments segment.

- Jump into the full analysis health report here for a deeper understanding of Allot.

- Learn about Allot's future growth trajectory here.

Next Steps

- Explore the 751 names from our US Penny Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Allot, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALLT

Allot

Develops, sells, and markets network intelligence and security solutions in Israel, Europe, Asia, Oceania, the Americas, the Middle East, and Africa.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives