- United States

- /

- Hospitality

- /

- OTCPK:WPFH

WPF Holdings (OTCPK:WPFH): Assessing Valuation After 1-for-4 Stock Split Reshapes Share Structure

Reviewed by Simply Wall St

If you’ve been wondering what’s next for WPF Holdings (OTCPK:WPFH), yesterday's news might have grabbed your attention. The company just completed a 1-for-4 stock split, making each share more affordable for investors and potentially sparking fresh interest in the name. Stock splits like this can shift how the market views a company, changing not only the price per share but also the way investors react to perceived value and opportunity.

This move comes at an interesting time for WPF Holdings. While the split could attract new buyers, the share price has lost nearly 79% over the past year, even after rallying 56% in the past 3 months and ticking up more modestly month-to-date. Volatility has been part of the picture recently, with short-term momentum attempting to rebound from a tumultuous year and a tough backdrop for the company’s fundamentals.

With a fresh stock split behind us and momentum showing signs of life, investors may be wondering whether WPF Holdings is being underestimated by the market or if all the future growth is already reflected in the share price.

Price-to-Book Ratio: Is it justified?

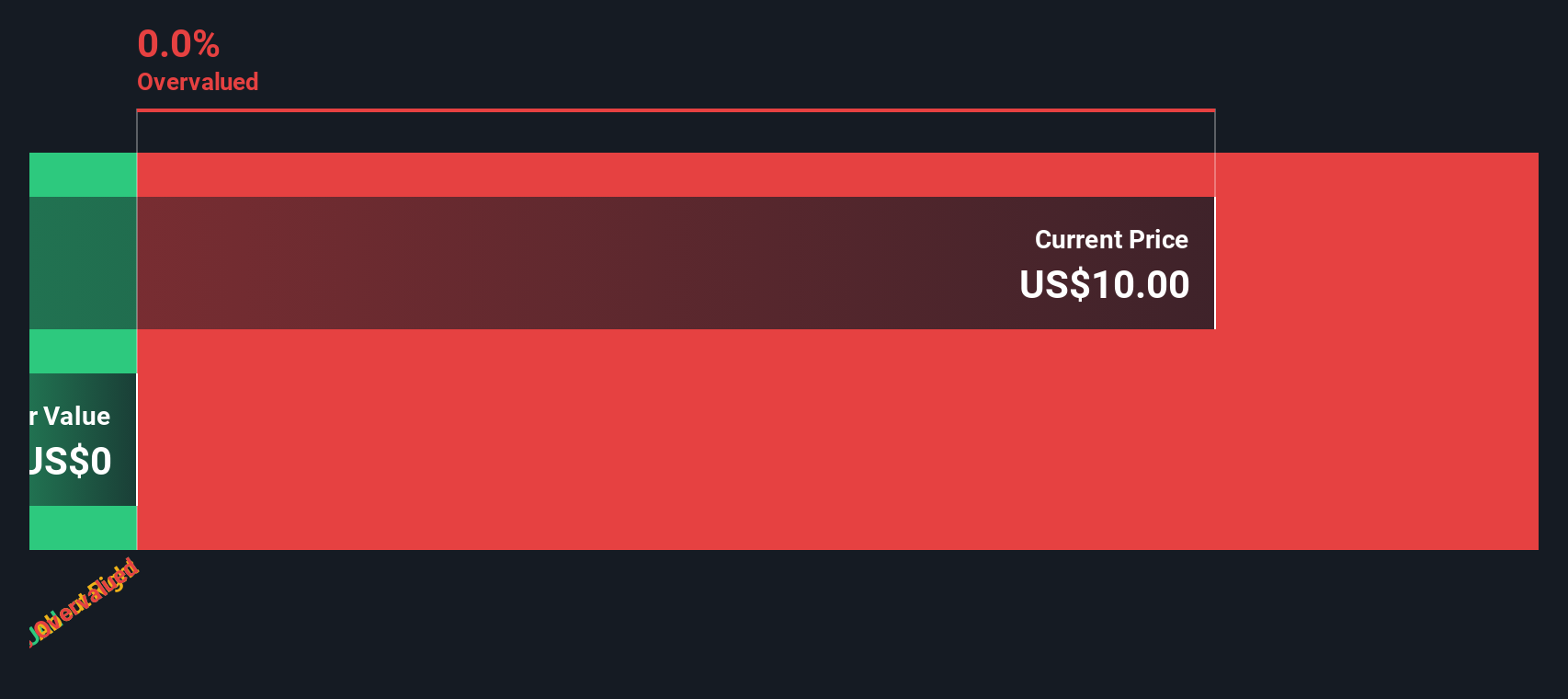

The valuation of WPF Holdings cannot currently be assessed using the price-to-book ratio because there is insufficient data available to compare it against either peers or the broader industry. Without these benchmarks or reported financials, it remains unclear whether the current valuation accurately reflects the company's fundamentals.

The price-to-book ratio is a traditional metric for evaluating companies, especially in asset-heavy sectors. It compares the company’s market value to its book value, providing insight into how the market values the company’s net assets.

Because no figures are available for WPF Holdings or its comparable group, investors cannot determine if the market is underpricing or overpricing the company based on its assets. As a result, this important valuation lens is unavailable for decision-making at this time.

Result: Fair Value of $-- (--)

See our latest analysis for WPF Holdings.Still, the absence of recent financial data and ongoing share price declines pose clear risks, which could challenge any bullish case for WPF Holdings.

Find out about the key risks to this WPF Holdings narrative.Another Perspective: What Does Our DCF Model Say?

Taking a different approach, the SWS DCF model also cannot determine a fair value for WPF Holdings because there simply is not enough data available. When both methods reach the same conclusion, where does the answer lie for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own WPF Holdings Narrative

If these conclusions do not match your take or you want to dig deeper, you can analyze the numbers for yourself and shape your own view in just a few minutes. Do it your way

A great starting point for your WPF Holdings research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let a narrow focus hold you back from your next winning stock. See how these standout sectors are reshaping portfolios and delivering new advantages:

- Boost your search for high-yield stability by starting with dividend stocks with yields > 3%. This helps narrow the field to financially strong picks with attractive income potential.

- Spot stocks trading below their true worth by using undervalued stocks based on cash flows. This opens doors to bargains most investors overlook.

- Tap into the AI-driven companies accelerating innovation by checking out AI penny stocks and join the rush toward tomorrow’s technology leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WPF Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:WPFH

WPF Holdings

Provides e-commerce and digital solutions to small and mid-sized businesses.

Very low risk with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026