- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Is It Too Late To Consider Luckin Coffee After Its 50% One Year Surge?

Reviewed by Bailey Pemberton

- Wondering if Luckin Coffee is still a bargain after its comeback story, or if you are arriving late to the party? This breakdown is designed to help you decide whether the current share price makes sense.

- The stock has cooled off a bit in the short term, slipping about 1.4% over the last week and 7.0% over the last month, but it is still up roughly 31.5% year to date and an impressive 50.6% over the last year. A massive 275.8% gain over five years hints at how powerful sentiment swings can be.

- Those moves have come as Luckin continues expanding its store network across China and experimenting with new product launches, keeping the brand visible and top of mind with consumers. At the same time, ongoing efforts to rebuild credibility after its past accounting scandal and to refine its business model have reshaped how investors think about both its growth runway and its risks.

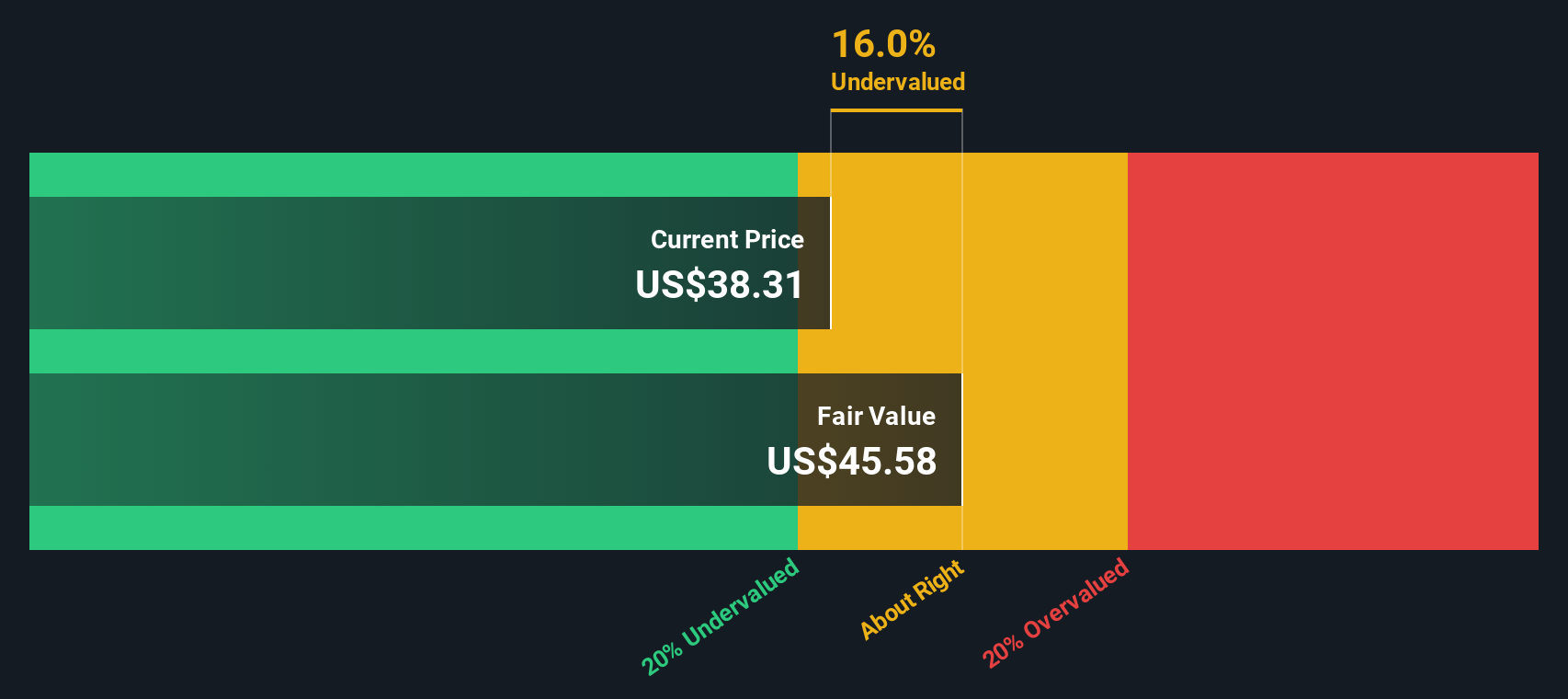

- On our valuation checks, Luckin Coffee currently scores 4 out of 6, suggesting it looks undervalued on several key metrics, but not all. Next, we will unpack what different valuation approaches say about that score and, by the end of the article, look at a more holistic way to think about what the market might really be pricing in.

Approach 1: Luckin Coffee Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those amounts back to the present. For Luckin Coffee, the model uses a 2 Stage Free Cash Flow to Equity approach.

Luckin generated about CN¥4.39 billion in free cash flow over the last twelve months, and analysts expect this to grow meaningfully over the coming years. Projections from analysts and extrapolations by Simply Wall St point to free cash flow of roughly CN¥5.39 billion in 2035, which implies steady expansion in the underlying business as the store network and customer base scale.

When all these future cash flows are discounted back to today, the model arrives at an intrinsic value of about $29.60 per share. With the DCF indicating the stock is roughly 19.6% above this estimate, Luckin Coffee screens as overvalued on this specific metric. This suggests expectations in the current price already account for a robust growth trajectory.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Luckin Coffee may be overvalued by 19.6%. Discover 907 undervalued stocks or create your own screener to find better value opportunities.

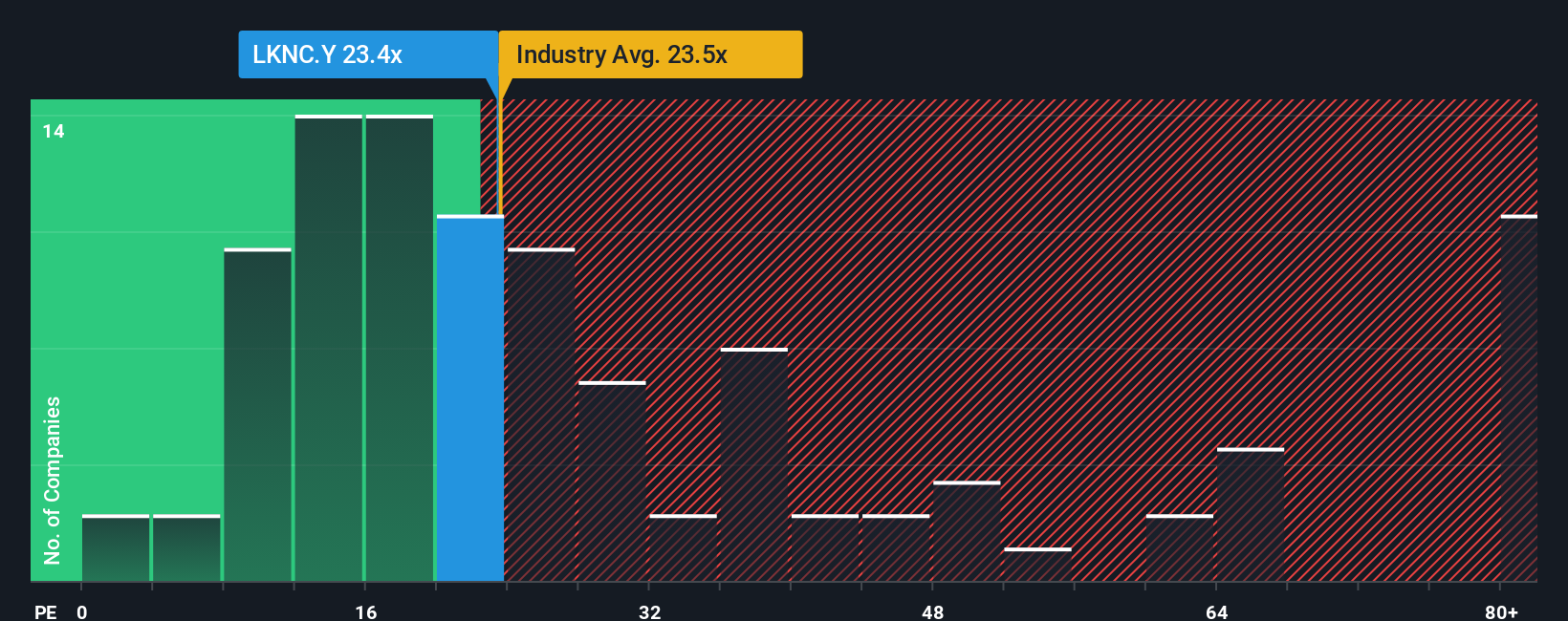

Approach 2: Luckin Coffee Price vs Earnings

For profitable companies like Luckin Coffee, the price to earnings, or P E, ratio is a practical way to gauge how much investors are paying for each dollar of current profits. In general, faster growing and lower risk businesses can justify higher P E multiples, while slower growth or higher uncertainty tends to push a fair multiple lower.

Luckin currently trades at about 20.5x earnings, which is below both the Hospitality industry average of roughly 24.6x and the broader peer group average of around 58.3x. On those simple comparisons alone, the stock might look inexpensive. However, these benchmarks do not fully capture Luckin’s specific growth profile, margins, competitive position, and risk factors.

That is where Simply Wall St’s Fair Ratio comes in. This proprietary measure estimates what a reasonable P E should be for Luckin, given its earnings growth outlook, profitability, industry, market cap, and risk characteristics. For Luckin, the Fair Ratio is about 26.9x, comfortably above the current 20.5x. This suggests the market is pricing the stock at a discount to what its fundamentals would typically warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Luckin Coffee Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the stories you tell about a company, tied directly to your assumptions for its future revenue, earnings, margins, and ultimately fair value.

A Narrative links three pieces together in a single, easy to use framework: what you believe about the business, how that belief translates into a financial forecast, and what that forecast implies as a fair value you can compare with today’s share price.

On Simply Wall St, Narratives live inside the Community page and are used by millions of investors as an accessible tool to decide when to buy or sell by checking whether their Narrative fair value sits above or below the current market price. Those values update dynamically as new data, news, or earnings are released.

For Luckin Coffee, for example, one investor might build a bullish Narrative that assumes continued double digit revenue growth, resilient margins, and a fair value above $49.95. Another more cautious investor might focus on store saturation, competition, and brand risk, leading to a much lower growth outlook and fair value closer to today’s price or below.

Do you think there's more to the story for Luckin Coffee? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)