- United States

- /

- Hospitality

- /

- NYSE:YUMC

Yum China Holdings (NYSE:YUMC) Reports Strong Q3 Earnings with 14% Growth and International Demand Surge

Reviewed by Simply Wall St

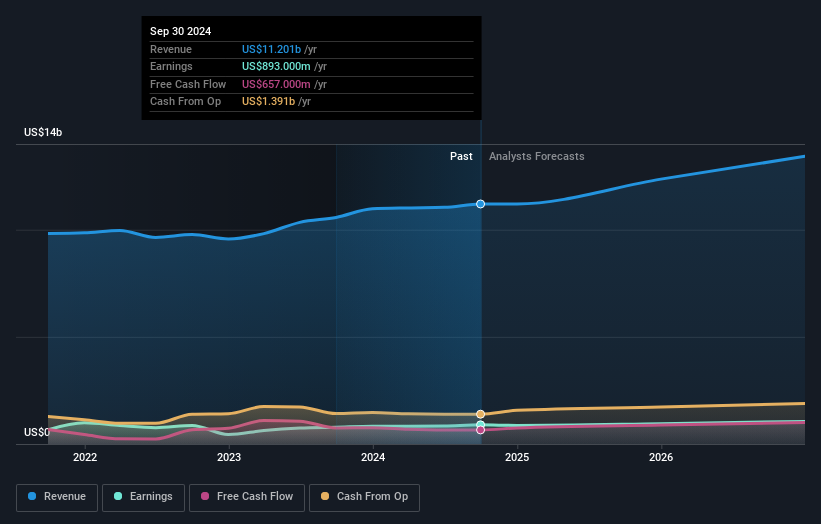

Yum China Holdings (NYSE:YUMC) has recently reported strong financial results for the third quarter of 2024, with a notable increase in revenue and net income compared to the previous year, highlighting its market position. Despite this growth, the company faces challenges such as relatively low return on equity and management's limited tenure, which may impact its ability to navigate market complexities. Readers should expect a detailed analysis of Yum China's strategic initiatives and potential risks, along with insights into its financial stability and market opportunities.

Click here and access our complete analysis report to understand the dynamics of Yum China Holdings.

Unique Capabilities Enhancing Yum China Holdings's Market Position

Yum China Holdings has demonstrated strong financial health, with earnings growth of 14% surpassing its 5-year average and the hospitality industry average. This indicates strong positioning, particularly in international markets, as highlighted by Joey Wat, CEO, who noted a 15% revenue increase driven by international demand. The company's strategic focus on cost optimization has led to a 200 basis point improvement in operating margins, showcasing effective management strategies. Additionally, Yum China's low dividend payout ratio of 5.8% and substantial cash reserves exceeding total debt underscore its financial stability. Notably, the company is trading at $48.3, below the SWS fair ratio of $51.13, suggesting it is undervalued in the market.

To dive deeper into how Yum China Holdings's valuation metrics are shaping its market position, check out our detailed analysis of Yum China Holdings's Valuation.Vulnerabilities Impacting Yum China Holdings

While Yum China Holdings shows strong financial metrics, its return on equity at 14.3% is relatively low compared to the desired benchmark of 20%. The management team, with an average tenure of 0.8 years, may lack the seasoned experience necessary to navigate complex market challenges. Furthermore, the company's revenue and earnings growth forecasts of 8.5% and 8.8% per year, respectively, fall short of the US market averages, potentially impacting its competitive edge. Dividend payments have also been inconsistent over the past seven years, which may concern investors seeking stable returns.

Learn about Yum China Holdings's dividend strategy and how it impacts shareholder returns and financial stability.Emerging Markets Or Trends for Yum China Holdings

Opportunities abound for Yum China Holdings to enhance its market position through strategic alliances and product innovation. The company's solid cash position can be leveraged for investments in growth initiatives, aligning more closely with market averages. Product-related announcements, such as the introduction of new menu items, have already contributed significantly to sales growth, indicating a proactive approach to capturing emerging consumer trends. Improving management experience could further bolster performance and drive strategic goals.

To gain deeper insights into Yum China Holdings's historical performance, explore our detailed analysis of past performance.Key Risks and Challenges That Could Impact Yum China Holdings's Success

Economic headwinds, including inflation and changing consumer spending habits, present challenges that could impact Yum China Holdings's sales. The company faces intense competition from established players and new entrants, putting pressure on market share. Regulatory hurdles in international markets also pose potential risks, as highlighted by Joey Wat, CEO, during the latest earnings call. These factors necessitate continuous innovation and strategic differentiation to maintain a competitive advantage.

See what the latest analyst reports say about Yum China Holdings's future prospects and potential market movements.Conclusion

Yum China Holdings is strategically positioned to capitalize on its strong financial health, evidenced by earnings growth surpassing industry averages and a significant revenue increase driven by international demand. This financial strength, coupled with effective cost optimization, enhances its competitive positioning, particularly in global markets. However, challenges such as lower-than-desired return on equity and management's limited experience could hinder its ability to navigate market complexities. Despite these vulnerabilities, the company's substantial cash reserves and proactive product innovation efforts provide a solid foundation for future growth. The current trading price of $48.3, compared to the fair value estimate of $51.13, suggests potential for share price appreciation as the company continues to leverage its financial stability and strategic initiatives to drive performance.

Seize The Opportunity

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:YUMC

Yum China Holdings

Owns, operates, and franchises restaurants in the People’s Republic of China.

Solid track record with excellent balance sheet.