- United States

- /

- Hospitality

- /

- NYSE:YUMC

Returns On Capital Signal Tricky Times Ahead For Yum China Holdings (NYSE:YUMC)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Although, when we looked at Yum China Holdings (NYSE:YUMC), it didn't seem to tick all of these boxes.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Yum China Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = US$1.1b ÷ (US$12b - US$2.7b) (Based on the trailing twelve months to June 2024).

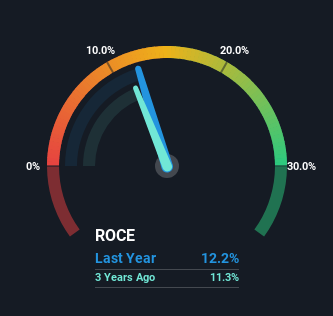

Therefore, Yum China Holdings has an ROCE of 12%. That's a relatively normal return on capital, and it's around the 10% generated by the Hospitality industry.

View our latest analysis for Yum China Holdings

In the above chart we have measured Yum China Holdings' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Yum China Holdings for free.

What The Trend Of ROCE Can Tell Us

In terms of Yum China Holdings' historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 12% from 17% five years ago. However it looks like Yum China Holdings might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

In Conclusion...

In summary, Yum China Holdings is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. And investors may be recognizing these trends since the stock has only returned a total of 12% to shareholders over the last five years. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

Yum China Holdings could be trading at an attractive price in other respects, so you might find our free intrinsic value estimation for YUMC on our platform quite valuable.

While Yum China Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you're looking to trade Yum China Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:YUMC

Yum China Holdings

Owns, operates, and franchises restaurants in the People’s Republic of China.

Solid track record with excellent balance sheet.