- United States

- /

- Hospitality

- /

- NYSE:YUM

Yum! Brands (YUM) Valuation Check After Recent Momentum Cooldown and Pullback

Reviewed by Simply Wall St

Yum! Brands (YUM) has quietly outperformed many traditional restaurant peers over the past year, and its latest trading action is prompting a closer look at whether the recent pullback opens a reasonable entry point.

See our latest analysis for Yum! Brands.

At around a 7.1% year to date share price return and a 5.5% total shareholder return over the past year, Yum! Brands has seen momentum cool recently, but the share price still reflects confidence in its longer term growth and cash generation story.

If Yum! Brands has you thinking about what else could offer steady compounding, it is worth scanning stable growth stocks screener (None results) for other consistent performers beyond the restaurant space.

With shares trading below consensus targets yet still carrying a premium to some peers, the key question is whether Yum! Brands is modestly undervalued today or if the market is already baking in its next leg of growth.

Most Popular Narrative Narrative: 13.6% Undervalued

With Yum! Brands last closing at $143.04 against a narrative fair value of $165.56, the current gap frames an intriguing upside story for long term holders.

The asset light, heavily franchised operating model minimizes capital intensity and allows for recurring, predictable cash flows while enabling rapid global expansion with improved franchisee economics via proprietary tech (Byte). This further supports long term operating profit and EPS growth. The increasing digital mix (now at 57%, with significant year over year gains) and expansion of direct to consumer channels are expected to support greater efficiency, improved order accuracy, and higher margin sales, ultimately benefiting net margin and free cash flow over time as digital penetration continues to rise.

Want to see the math behind this premium fast food valuation, from revenue runway to margin lift and future earnings power, unpacked line by line?

Result: Fair Value of $165.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing Pizza Hut softness and higher input costs, particularly at Taco Bell, could pressure margins and challenge the otherwise upbeat undervaluation case.

Find out about the key risks to this Yum! Brands narrative.

Another Take on Valuation

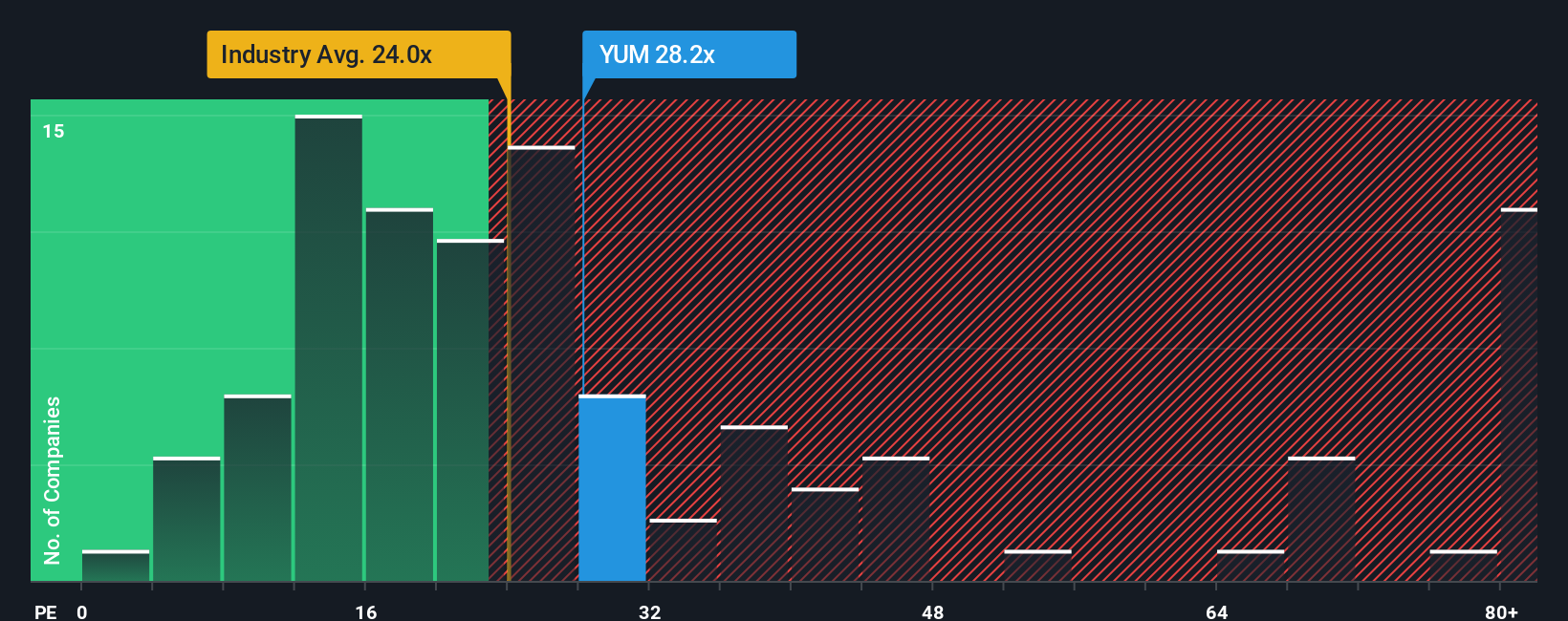

While the narrative fair value suggests Yum! Brands is 13.6% undervalued, its 27.4x earnings multiple tells a different story. That ratio sits above both peers at 22.7x and a fair ratio of 26.3x, which hints at a limited margin of safety if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yum! Brands Narrative

If this perspective does not fully align with your own, or you prefer digging into the numbers yourself, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Yum! Brands research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready to act on your next opportunity?

Do not stop at one great story when you can systematically uncover more. Use targeted screeners to spot tomorrow’s winners before everyone else catches on.

- Capture potential mispricings by reviewing these 903 undervalued stocks based on cash flows that could offer stronger upside than widely followed blue chips.

- Ride structural growth trends by assessing these 30 healthcare AI stocks at the crossroads of medicine and intelligent automation.

- Tap into market excitement by evaluating these 80 cryptocurrency and blockchain stocks shaping the future of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YUM

Yum! Brands

Develops, operates, and franchises quick service restaurants worldwide.

Average dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026