- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (VIK): Assessing Valuation Following Mizuho’s Cautious Initiation and Growth Concerns

Reviewed by Kshitija Bhandaru

Mizuho has started coverage on Viking Holdings (VIK) with a cautious outlook, raising flags over the company’s premium valuation, capacity constraints, and the possible impact of new competitors in its markets.

See our latest analysis for Viking Holdings.

Viking Holdings has delivered a robust year-to-date share price return of 40.4 percent; its one-year total shareholder return stands even stronger at nearly 60 percent. This suggests considerable momentum despite new concerns around competition and valuation. Investors seem to be keeping an eye on the bigger picture, weighing these recent gains against the potential risks flagged by analysts.

If you’re curious how other stocks with fast growth and insider backing are performing, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Viking Holdings trading just below its average analyst price target, investors may be considering whether this presents a rare opportunity to enter before additional growth occurs, or if the market has already factored in all potential future upside in the stock price.

Most Popular Narrative: 7.3% Undervalued

With a narrative fair value of $66.35 compared to the latest closing price of $61.51, the gap remains notable and sets the stage for further debate around whether recent momentum truly reflects Viking Holdings’ potential.

Advanced bookings for core products remain exceptionally strong, with 96% of 2025 capacity and 55% of 2026 capacity already sold at higher rates. This indicates durable repeat demand and allows for mid-single-digit pricing growth that directly benefits company earnings and net margins.

Want to know the story behind this bullish valuation? Discover which blockbuster growth drivers and profit assumptions are fueling Viking’s future. The headline figures might surprise you. See the full narrative to unlock every detail behind these projections.

Result: Fair Value of $66.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on affluent older travelers and new environmental regulations could threaten Viking Holdings’ earnings and long-term growth momentum.

Find out about the key risks to this Viking Holdings narrative.

Another View: Reality Check from Market Ratios

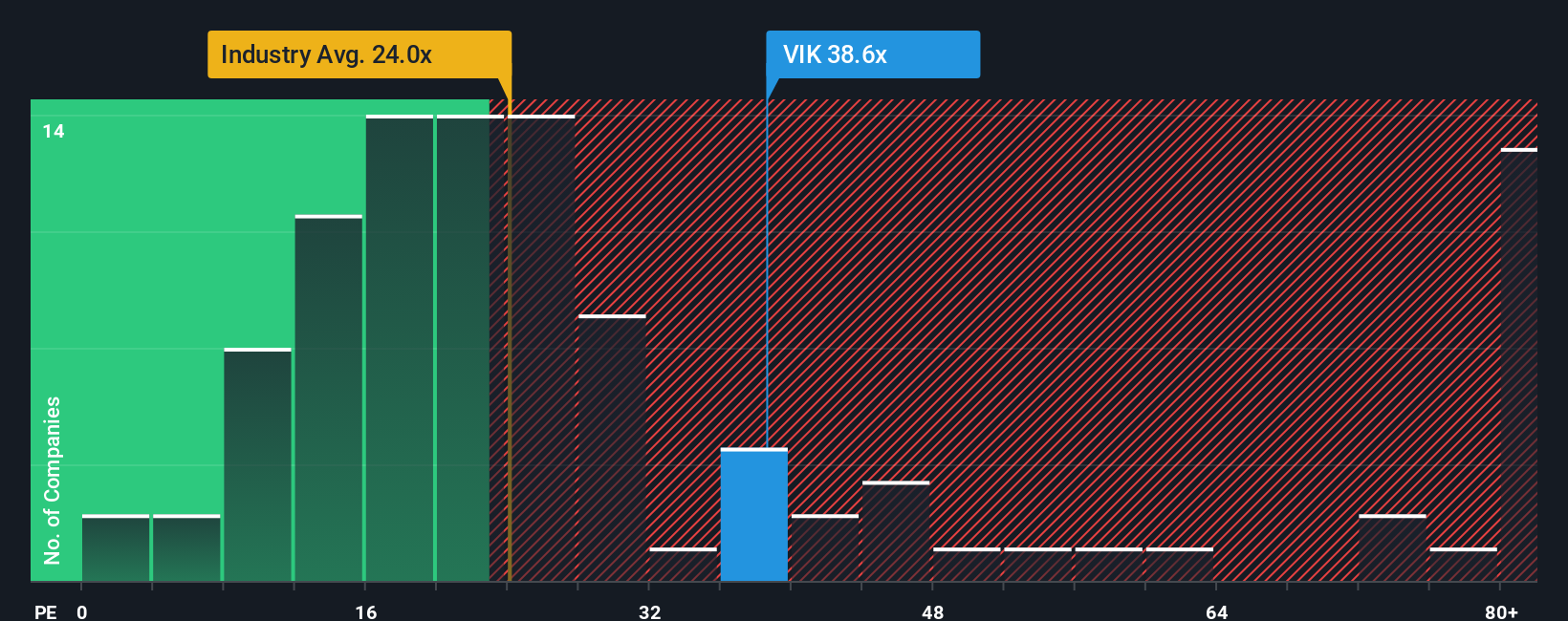

While narrative valuation paints Viking Holdings as undervalued, market multiples suggest a different angle. The company trades at a price-to-earnings ratio of 39.3x, which is much higher than both the US Hospitality industry average of 23.1x and the peer average of 22.5x. Interestingly, this is still slightly below the fair ratio of 41x, a level the market could trend toward.

Such a premium indicates that investors may be paying up for Viking’s growth and quality, but it also poses valuation risk if expectations do not materialize. Is the confidence in future earnings justified, or could a rerating put pressure on the share price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viking Holdings Narrative

If you see Viking Holdings differently, or want to reach your own conclusions, you can dive into the data and build a personal outlook in just a few minutes with Do it your way

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Push your portfolio further by tapping into fresh market opportunities with hand-picked investment themes. You don’t want to miss the next big winner hiding in plain sight.

- Maximize income potential by checking out these 18 dividend stocks with yields > 3%, which offers attractive yields greater than 3 percent.

- Gain an edge on emerging tech shifts by following these 25 AI penny stocks, highlighting companies that are shaping the future of artificial intelligence.

- Seize undervalued opportunities before the crowd by investigating these 881 undervalued stocks based on cash flows, featuring businesses with strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives