- United States

- /

- Hospitality

- /

- NYSE:VIK

Discovering 3 US Stocks That May Be Trading Below Their Estimated Values

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed results with the S&P 500 snapping its three-week winning streak, investors are closely watching economic indicators and Federal Reserve decisions that could influence future market directions. In this environment, identifying stocks that may be trading below their estimated values can present opportunities for investors seeking potential value plays amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Argan (NYSE:AGX) | $142.96 | $278.24 | 48.6% |

| UMB Financial (NasdaqGS:UMBF) | $122.18 | $244.24 | 50% |

| First Solar (NasdaqGS:FSLR) | $199.67 | $395.15 | 49.5% |

| Business First Bancshares (NasdaqGS:BFST) | $27.87 | $54.95 | 49.3% |

| West Bancorporation (NasdaqGS:WTBA) | $23.40 | $46.43 | 49.6% |

| Equity Bancshares (NYSE:EQBK) | $46.49 | $92.69 | 49.8% |

| Constellium (NYSE:CSTM) | $11.16 | $21.75 | 48.7% |

| Freshpet (NasdaqGM:FRPT) | $146.89 | $283.12 | 48.1% |

| Equifax (NYSE:EFX) | $265.81 | $530.33 | 49.9% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $463.73 | $913.99 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

Mr. Cooper Group (NasdaqCM:COOP)

Overview: Mr. Cooper Group Inc. operates as a non-bank servicer of residential mortgage loans in the United States, with a market cap of approximately $6.20 billion.

Operations: The company's revenue segments include $1.48 billion from servicing and $416 million from originations.

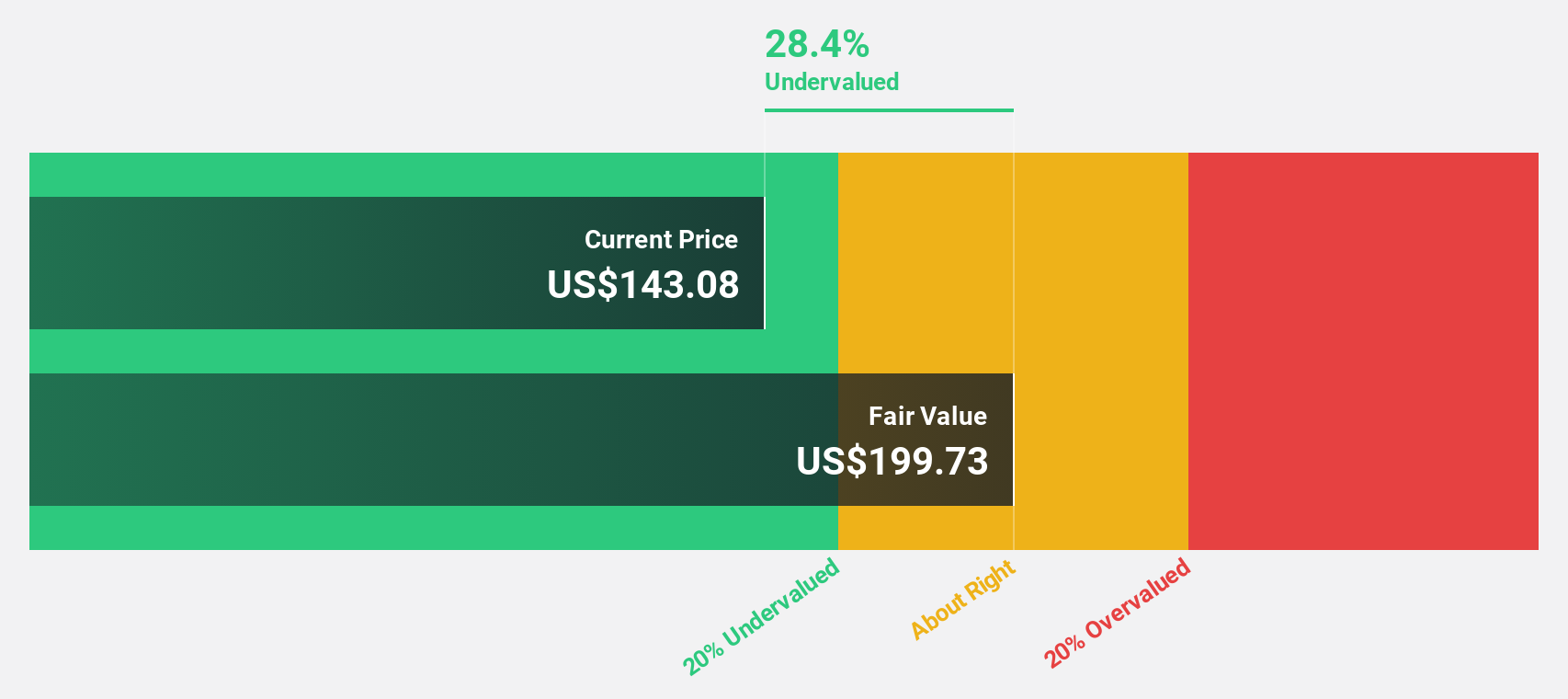

Estimated Discount To Fair Value: 43%

Mr. Cooper Group is trading at a significant discount, approximately 43% below its estimated fair value of US$169.75, suggesting it may be undervalued based on cash flows. Despite a recent decline in quarterly revenue and net income, the company has shown resilience with nine-month revenues increasing to US$1.57 billion from US$1.39 billion year-over-year. Forecasts indicate strong annual profit growth of over 21%, outpacing the broader U.S. market expectations.

- According our earnings growth report, there's an indication that Mr. Cooper Group might be ready to expand.

- Click here to discover the nuances of Mr. Cooper Group with our detailed financial health report.

Range Resources (NYSE:RRC)

Overview: Range Resources Corporation is an independent company engaged in the production of natural gas, natural gas liquids (NGLs), crude oil, and condensate in the United States, with a market cap of approximately $8.53 billion.

Operations: The company generates its revenue of $2.33 billion from the exploration and production of oil and gas.

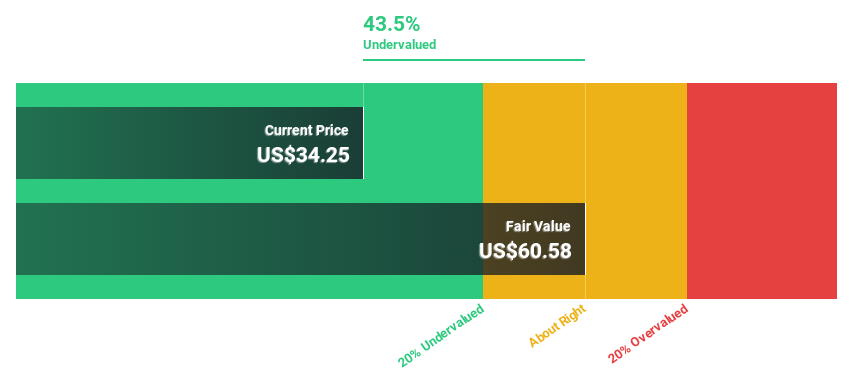

Estimated Discount To Fair Value: 42.8%

Range Resources is trading at a significant discount, around 42.8% below its estimated fair value of US$61.82, highlighting potential undervaluation based on cash flows. Despite a drop in profit margins from 43.6% to 20.4%, earnings are forecasted to grow significantly at 20% annually, outpacing the broader U.S. market's expected growth of 15.3%. However, insider selling has been substantial recently, which might warrant caution for investors considering this stock.

- The analysis detailed in our Range Resources growth report hints at robust future financial performance.

- Navigate through the intricacies of Range Resources with our comprehensive financial health report here.

Viking Holdings (NYSE:VIK)

Overview: Viking Holdings Ltd operates in the passenger shipping and transport sector across North America, the United Kingdom, and internationally, with a market cap of $19.63 billion.

Operations: The company generates revenue from its Viking Ocean segment, which accounts for $2.12 billion, and its Viking River segment, contributing $2.51 billion.

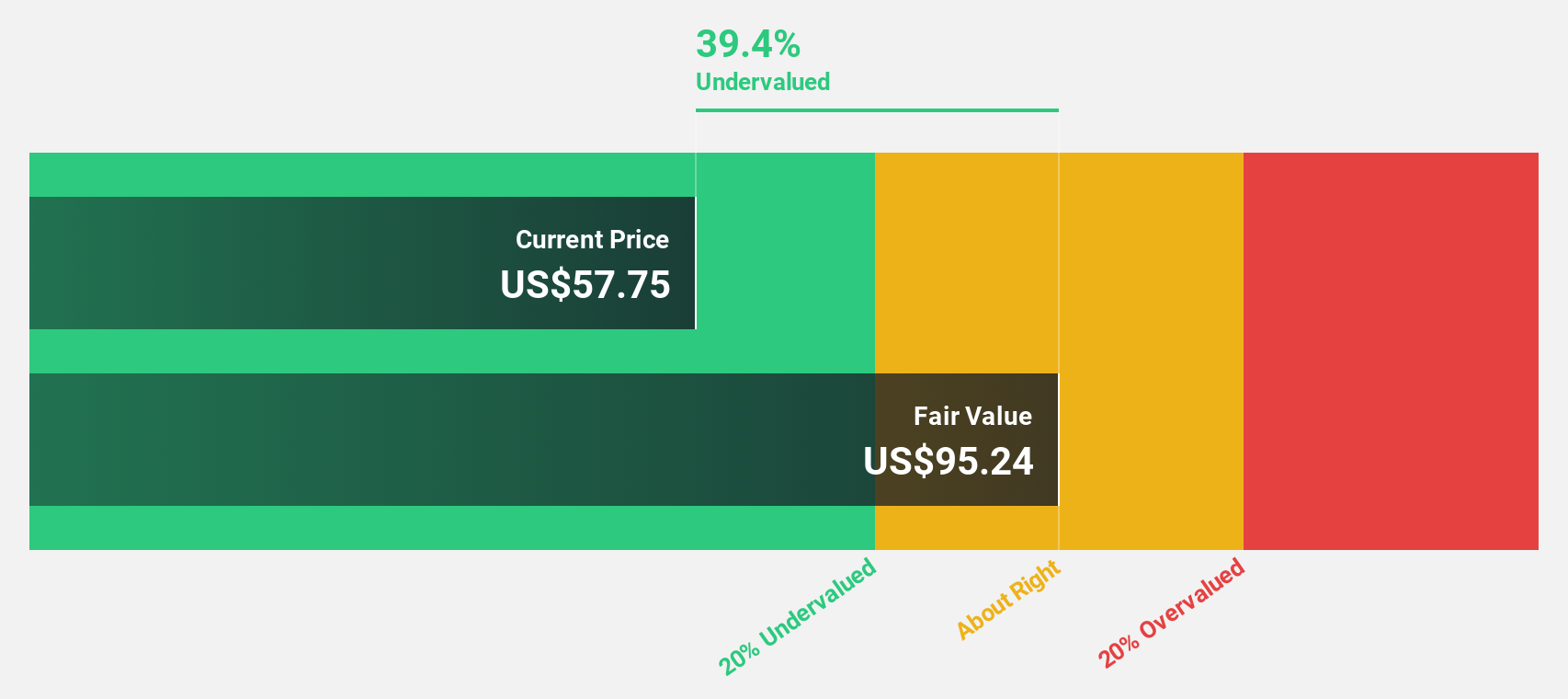

Estimated Discount To Fair Value: 39.9%

Viking Holdings appears undervalued, trading at US$45.49, which is 39.9% below its estimated fair value of US$75.63. Recent earnings show a turnaround with net income of US$375.09 million compared to a significant loss last year, driven by strong revenue growth to US$1.68 billion for the quarter. The company is expanding its fleet on the Nile River, potentially enhancing future cash flows and supporting its valuation recovery trajectory over time.

- Our growth report here indicates Viking Holdings may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Viking Holdings stock in this financial health report.

Seize The Opportunity

- Gain an insight into the universe of 191 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential and fair value.