- United States

- /

- Consumer Services

- /

- NYSE:UTI

Universal Technical Institute (UTI) Expands Dallas Campus to Address Skilled Labor Gap and Program Diversity

Reviewed by Sasha Jovanovic

- Universal Technical Institute recently announced a major expansion of its Dallas campus, adding new skilled trades and technology programs and increasing capacity to serve nearly 1,000 additional students, with the new facility set to open in early 2026 subject to regulatory approval.

- This expansion underscores UTI's growing commitment to addressing the skilled labor shortage while expanding its footprint and diversifying its program offerings across Texas and the Southeast.

- We'll now explore how the Dallas campus expansion and new course offerings influence Universal Technical Institute's investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Universal Technical Institute Investment Narrative Recap

To own shares of Universal Technical Institute, you must believe in the long-term value of practical, career-focused education and the company’s ability to execute its campus expansion and program diversification strategy. The Dallas campus expansion signals ongoing investment in growth and risk mitigation through new verticals, but the short-term catalyst remains enrollment response and regulatory approval, while the largest risk is that heavy capital investments may not yield the expected gains if demand falls short, so the impact of this new facility won’t be material until those factors are clear.

Among recent announcements, UTI’s planned San Antonio campus, also centered on skilled trades and opening in 2026, echoes the Dallas strategy and ties directly to current catalysts, filling persistent labor market gaps and establishing a broader Texas educational network, thus reinforcing the near-term focus on enrollment growth and program adoption as the primary drivers to watch.

By contrast, investors should be aware that if new student demand doesn’t match expanded capacity and investment levels…

Read the full narrative on Universal Technical Institute (it's free!)

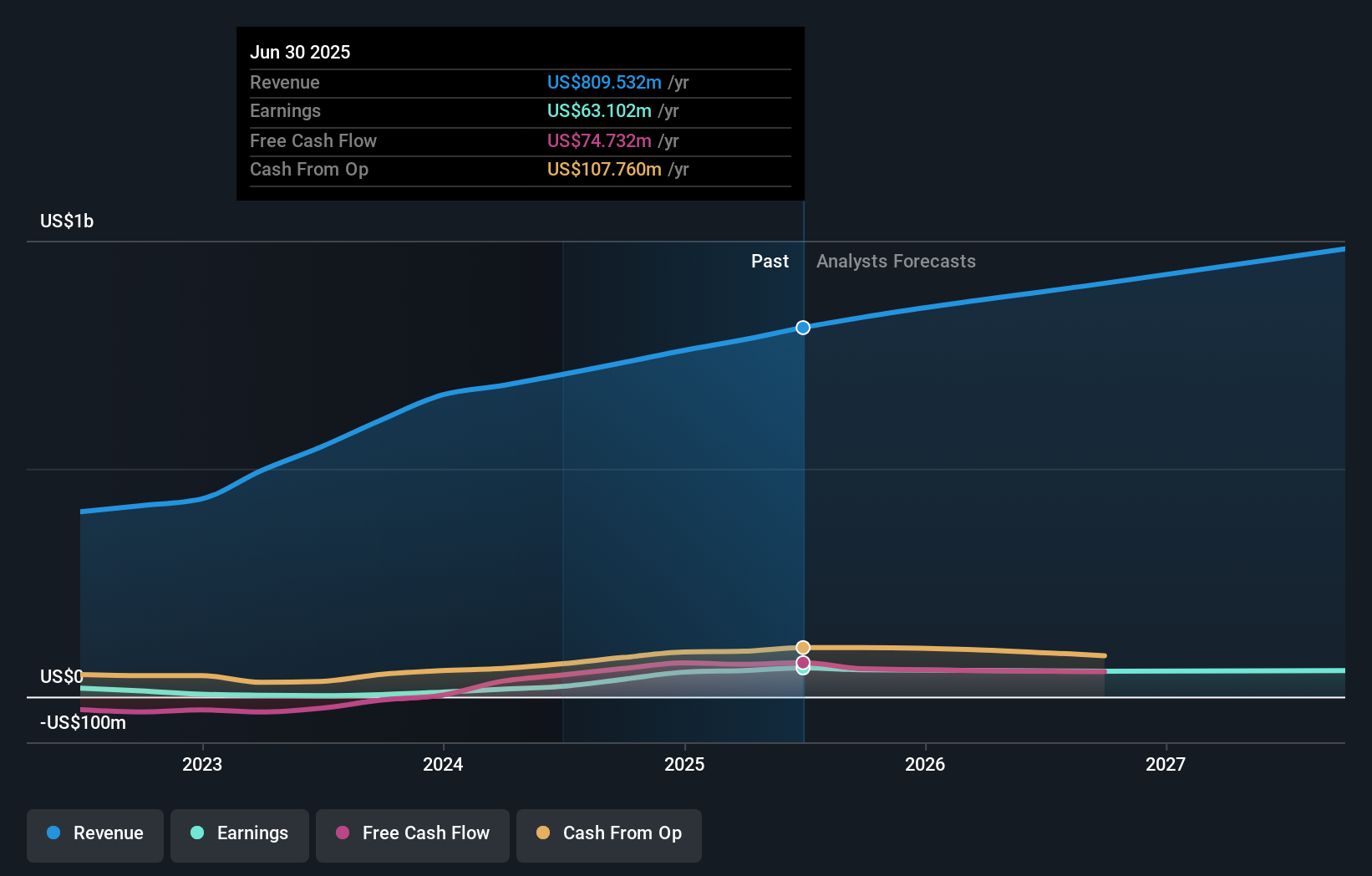

Universal Technical Institute's narrative projects $1.0 billion in revenue and $54.0 million in earnings by 2028. This requires 8.9% yearly revenue growth and a decrease in earnings of $9.1 million from the current $63.1 million.

Uncover how Universal Technical Institute's forecasts yield a $37.60 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span US$17.86 to US$37.60 across just 2 perspectives, showing sharply different outlooks. With new campuses launching and significant expansion underway, compare your view to these alternatives as student demand becomes a central performance factor.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth as much as 19% more than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives