- United States

- /

- Consumer Services

- /

- NYSE:UTI

A Look at Universal Technical Institute’s Valuation Following Dallas Campus Expansion and New Program Launches

Reviewed by Kshitija Bhandaru

Universal Technical Institute (UTI) is making waves with its recently announced expansion of the Dallas campus. The expansion will introduce new programs in aviation, HVACR, electrical, robotics, and wind turbine technology. The new facility is set to accommodate nearly 1,000 additional students starting early 2026. This builds on UTI’s broader North Star strategy aimed at meeting labor market demands.

See our latest analysis for Universal Technical Institute.

It has been a busy period for Universal Technical Institute, with its Dallas expansion following upbeat quarterly results and the recent anniversary of its Sacramento campus. Despite a brief market pullback related to sector headwinds, UTI’s long-term momentum stands out. While the 1-month share price return is almost 10%, the total shareholder return over the past year is an impressive 88%, and a remarkable 485% over five years. This surge reflects investor enthusiasm, even as current valuations appear stretched by conventional metrics.

If this kind of growth story has you thinking about what else is on the move, it could be the perfect time to uncover fast growing stocks with high insider ownership.

With such rapid gains and the promise of continued expansion, the critical question becomes whether Universal Technical Institute’s current valuation offers room for further upside, or if the market has already priced in all that future growth.

Most Popular Narrative: 20.5% Undervalued

Universal Technical Institute’s fair value, according to the most widely followed narrative, stands nearly a fifth above the recent close. This has sparked fresh debate about what is really driving the share price higher. This sharp divergence with market pricing puts a spotlight on the expansion and its financial impact.

Strategic investments in campus expansion, new program rollouts (notably in HVAC, aviation, and allied health), and digitization efforts are expected to support top-line expansion. At the same time, the consolidation of core systems should facilitate operating efficiencies and drive long-term margin improvement beyond the near-term investment cycle.

Want to know why this bullish target could surprise even optimistic investors? The valuation is anchored in bold projections for future revenue, margins, and student growth. The numbers behind it may make you rethink what’s next for Universal Technical Institute.

Result: Fair Value of $37.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if enrollment demand falls short or integration challenges intensify, Universal Technical Institute’s ambitious growth plans could deliver less upside than bullish forecasts suggest.

Find out about the key risks to this Universal Technical Institute narrative.

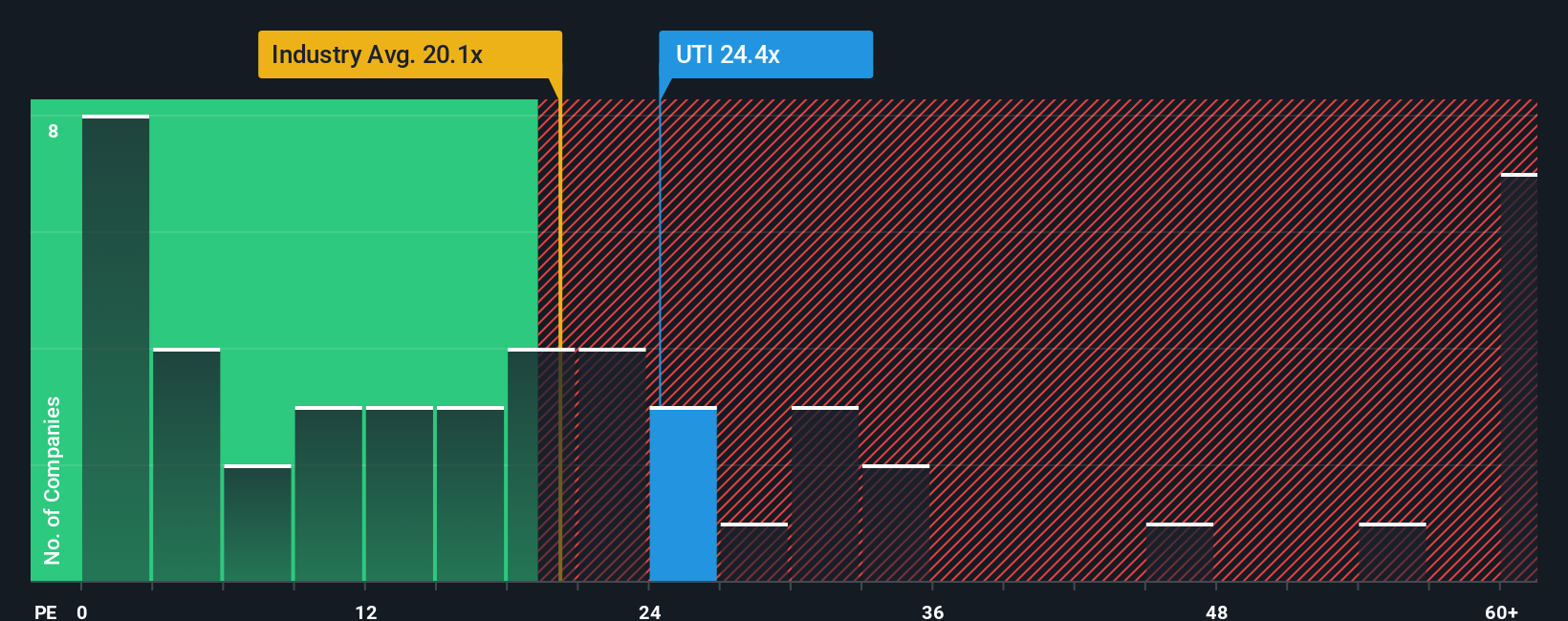

Another View: Market Ratios Signal Caution

Looking at valuation through the lens of the price-to-earnings ratio, Universal Technical Institute stands out as expensive. Its current ratio is 25.8 times earnings, notably higher than the US Consumer Services industry average of 17x, the peer average of 19.2x, and the fair ratio of 14x. This sizeable gap suggests the stock price may be factoring in a lot of future success already. This raises the question of whether investors are justified in paying such a premium or if risk is building for a pullback.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Universal Technical Institute Narrative

If you see the story playing out differently, or want to follow your own instincts, you can build a narrative yourself in just a few minutes, and Do it your way.

A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that new opportunities appear every week. Propel your portfolio forward by targeting hidden gems and tomorrow’s trends before the crowd notices.

- Accelerate your search for companies backed by strong cash flows and see why now is the time to evaluate these 892 undervalued stocks based on cash flows before the market catches on.

- Target reliable passive income streams and get ahead with these 19 dividend stocks with yields > 3%, which features high-yield opportunities others might overlook.

- Jump into groundbreaking innovation and seize your edge by reviewing these 24 AI penny stocks, the leaders in artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives