- United States

- /

- Hospitality

- /

- NYSE:SHAK

Shake Shack (SHAK): Is the Burger Chain’s Valuation Overlooked After Recent Growth?

Reviewed by Simply Wall St

Shake Shack (SHAK) has been moving sideways recently, but the price action is starting to turn heads among both casual investors and seasoned traders. With its shares closing at $97.59, there is a sense that the market is reassessing the company’s growth narrative in light of its most recent revenue and net income numbers. As investors weigh the steady year-over-year revenue growth and even stronger earnings expansion, questions are building around whether Shake Shack’s current valuation leaves room for optimism or caution.

Over the past year, Shake Shack’s stock has managed a small upside with a 2% gain, even as it faced pressure earlier this year and saw declines over the past month and quarter. Despite the ebb and flow of short-term volatility, its three-year return of 92% stands out. This is a reminder that the company has delivered meaningful gains over a longer horizon. Meanwhile, recent annual growth rates in both revenue and net income point to operational momentum, although the stock price has yet to reflect any sudden positive shifts.

After this year’s muted run, it is worth asking whether this pullback is a new buying opportunity, or if the market is simply adjusting its view to account for expected growth ahead.

Most Popular Narrative: 28% Undervalued

Based on the most widely followed narrative, Shake Shack is currently viewed as undervalued, with analysts seeing a notable gap between the share price and its fair value.

The company's strategic focus on urban expansion and accelerated domestic and international store openings, especially in untapped markets and through new formats such as drive-thru and licensed partnerships (e.g., casinos, Panama), directly taps into growing urbanization and demand for experiential fast-casual dining. This supports long-term, system-wide revenue growth.

Curious why this target jumps so far above the current price? This narrative is banking on rapid growth, bold margin improvement, and a profit multiple that even tech companies might envy. Want to know the key assumptions that could shake up the valuation? The numbers behind this story reveal the true ambition fueling these analyst expectations.

Result: Fair Value of $135.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising commodity costs or sluggish guest traffic could quickly challenge these optimistic projections. This could make the valuation narrative less certain.

Find out about the key risks to this Shake Shack narrative.Another View: A Multiple-Based Take

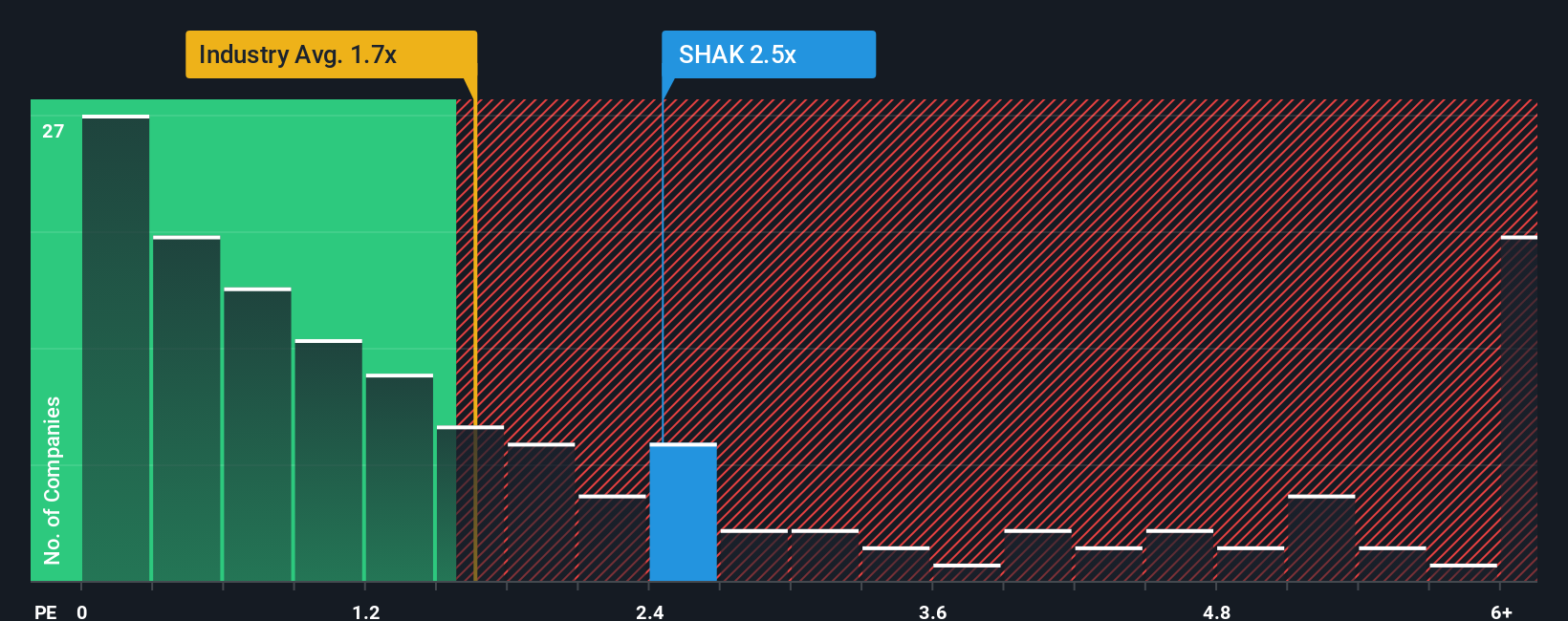

While analysts see strong upside, some investors look at how Shake Shack trades versus the overall hospitality industry. On this basis, the business currently appears expensive and offers a more cautious perspective on valuation. Could both sides be missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Shake Shack to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Shake Shack Narrative

If you have a different perspective or want to dive deeper on your own, shaping a personalized Shake Shack story is quick and straightforward. Do it your way.

A great starting point for your Shake Shack research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Standout Opportunities?

Smart investors always keep an eye out for under-the-radar gems and tomorrow’s leaders. Don’t miss your chance to unlock fresh opportunities and sharpen your investing edge with these powerful research tools.

- Uncover the best bargains on the market by using undervalued stocks based on cash flows to spot quality companies trading for less than they are really worth.

- Catch the next tech breakthrough early and fuel your portfolio’s growth with AI penny stocks, featuring innovative businesses at the forefront of artificial intelligence.

- Maximize your income potential by seeking out dividend stocks with yields > 3% that combine strong financials with robust, above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:SHAK

Shake Shack

Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)