- United States

- /

- Hospitality

- /

- NYSE:SHAK

Jefferies Upgrade and Marketing Push Could Be a Game Changer for Shake Shack (SHAK)

Reviewed by Sasha Jovanovic

- Earlier this week, Jefferies upgraded Shake Shack from Underperform to Hold, citing a recent pullback alongside new marketing efforts and product launches aimed at boosting same-store sales and customer traffic.

- This upgrade highlights how analysts see Shake Shack's expanded menu and promotional deals as potential stabilizers even as broader consumer sentiment remains cautious due to macroeconomic pressures.

- We'll explore how the emphasis on product innovation and marketing initiatives could alter Shake Shack's investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Shake Shack Investment Narrative Recap

To be a shareholder in Shake Shack, you need to believe that the brand’s focus on menu innovation, digital engagement, and domestic expansion can deliver sustainable sales and margin growth despite economic headwinds. The recent Jefferies upgrade draws attention to near-term catalysts, namely product launches and promotions to drive sales. However, the biggest risk for the business remains that customer traffic may not consistently recover without ongoing discounts, so these announcements only modestly reduce near-term uncertainty.

Of the recent developments, Jefferies’ recognition of the French Onion Soup Burger and Coffee Shake launch is particularly relevant. These limited-time offerings, paired with promotional deals, directly address concerns about stagnant customer traffic but also put the spotlight on whether short-term volume gains can be maintained as macro pressures continue.

Yet, with inflation and cautious consumer spending still lingering, investors should be aware that promotional-driven traffic may not translate into lasting sales momentum if...

Read the full narrative on Shake Shack (it's free!)

Shake Shack's narrative projects $2.0 billion revenue and $107.9 million earnings by 2028. This requires 14.8% yearly revenue growth and a $88 million increase in earnings from $19.9 million today.

Uncover how Shake Shack's forecasts yield a $132.48 fair value, a 44% upside to its current price.

Exploring Other Perspectives

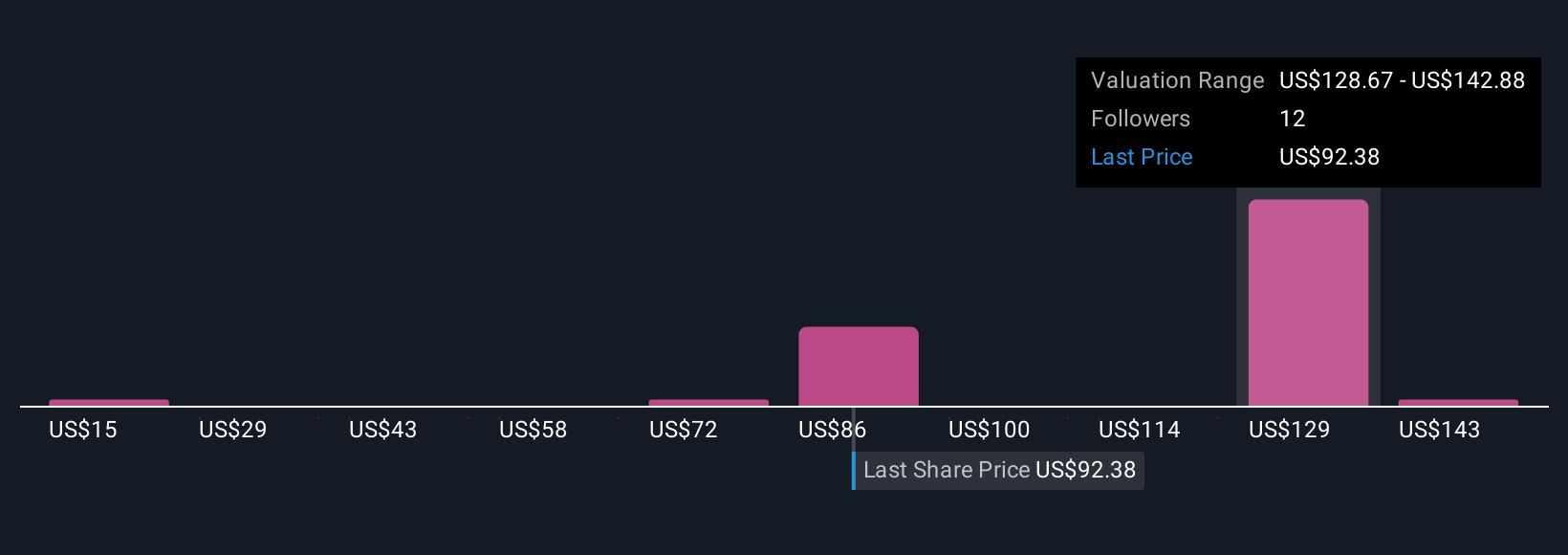

Five Simply Wall St Community members provide fair value estimates for Shake Shack ranging from US$15 to US$157.09 per share. While opinions vary, several weigh traffic recovery and promotional activity as key factors influencing future performance.

Explore 5 other fair value estimates on Shake Shack - why the stock might be worth as much as 70% more than the current price!

Build Your Own Shake Shack Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shake Shack research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Shake Shack research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shake Shack's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHAK

Shake Shack

Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives