- United States

- /

- Hospitality

- /

- NYSE:PRKS

Here's Why SeaWorld Entertainment (NYSE:SEAS) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like SeaWorld Entertainment (NYSE:SEAS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for SeaWorld Entertainment

How Fast Is SeaWorld Entertainment Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, SeaWorld Entertainment has achieved impressive annual EPS growth of 58%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of SeaWorld Entertainment shareholders is that EBIT margins have grown from 26% to 30% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

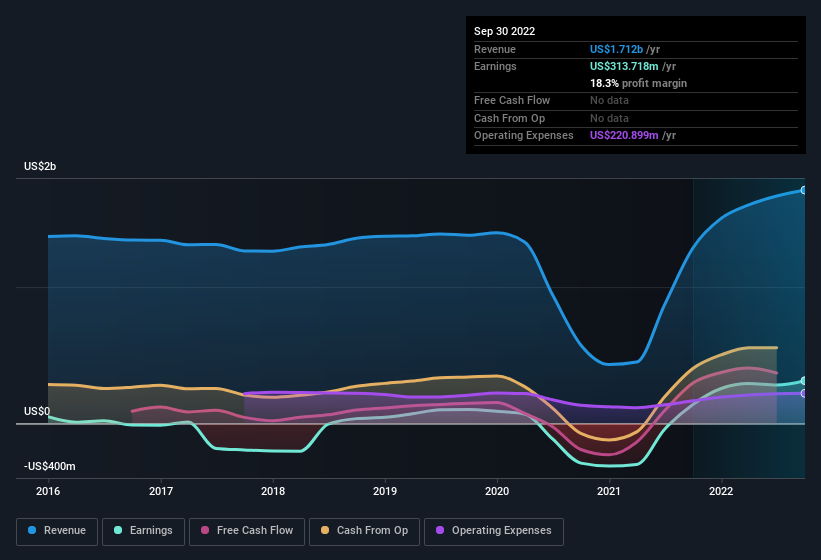

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of SeaWorld Entertainment's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are SeaWorld Entertainment Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at SeaWorld Entertainment were both selling and buying shares; but happily, as a group they spent US$76k more on stock, than they netted from selling it. On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by CFO & Treasurer Michelle Adams for US$2.0m worth of shares, at about US$51.03 per share.

Along with the insider buying, another encouraging sign for SeaWorld Entertainment is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at US$41m. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 1.1%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Marc Swanson is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to SeaWorld Entertainment, with market caps between US$2.0b and US$6.4b, is around US$6.6m.

The CEO of SeaWorld Entertainment only received US$2.0m in total compensation for the year ending December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add SeaWorld Entertainment To Your Watchlist?

SeaWorld Entertainment's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest SeaWorld Entertainment belongs near the top of your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for SeaWorld Entertainment that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, SeaWorld Entertainment isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRKS

United Parks & Resorts

Operates as a theme park and entertainment company in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives