- United States

- /

- Hospitality

- /

- NYSE:RCL

Royal Caribbean Cruises (NYSE:RCL) Unveils Bold New Ship With Show-Stopping Entertainment

Reviewed by Simply Wall St

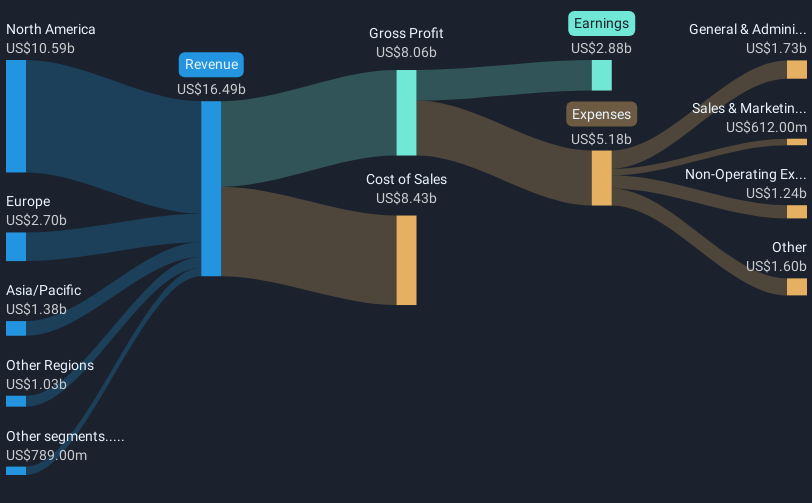

Royal Caribbean Cruises (NYSE:RCL) recently announced exciting new offerings for its upcoming ship, Star of the Seas, featuring an array of entertainment and dining experiences. This announcement, alongside strong financial results in Q1 2025 with increased revenue and net income, likely supported the notable 29% rise in the company's share price last month. Additionally, Royal Caribbean's completion of a share buyback program reflects its commitment to shareholder value. Despite a generally cautious market environment with attention on tariff negotiations and Federal Reserve comments, the company's positive developments may have buoyed investor sentiment, enhancing returns.

You should learn about the 2 risks we've spotted with Royal Caribbean Cruises.

Royal Caribbean Cruises' recent advancements with the Star of the Seas and their financial successes in Q1 2025 not only influence current investor sentiment but also set a positive outlook that aligns with analysts' projected revenue and earnings growth. The company's focus on new ships and exclusive destinations boosts pre-cruise purchases and onboard spending, potentially increasing both revenue and earnings. These developments support a favorable environment for the company to meet its financial targets.

Over a five-year span, Royal Caribbean's total shareholder return, including share price appreciation and dividends, was an impressive 505.78%, which illustrates a very large gain. This strong performance indicates effective strategic progress and positions the company as a robust player in the cruise industry. When viewed against the backdrop of industry performance over the past year, Royal Caribbean has exceeded the US Hospitality industry's return of 6.8% as well as the US Market's 8.2% return.

The introduction of new ships and enhancements to onboard experiences emphasize the company's continued effort to drive growth, supporting analysts' predictions of 9.4% annual revenue growth and a rise in profit margins to 25.9% within the next three years. With a current share price of US$216.58 and an analyst consensus price target of US$265.01, the stock is trading at a discount. Its potential for a higher valuation is reinforced by the company's consistent performance and the broader market trends, providing room for investors to consider its fair value.

Assess Royal Caribbean Cruises' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Royal Caribbean Cruises, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives