- United States

- /

- Hospitality

- /

- NYSE:RCL

Royal Caribbean Cruises (NYSE:RCL) rallies 4.8% this week, taking one-year gains to 46%

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Royal Caribbean Cruises Ltd. (NYSE:RCL) share price is 46% higher than it was a year ago, much better than the market decline of around 0.2% (not including dividends) in the same period. That's a solid performance by our standards! And shareholders have also done well over the long term, with an increase of 39% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Royal Caribbean Cruises

SWOT Analysis for Royal Caribbean Cruises

- No major strengths identified for RCL.

- Interest payments on debt are not well covered.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

Royal Caribbean Cruises wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Royal Caribbean Cruises grew its revenue by 318% last year. That's a head and shoulders above most loss-making companies. While the share price gain of 46% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Royal Caribbean Cruises. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

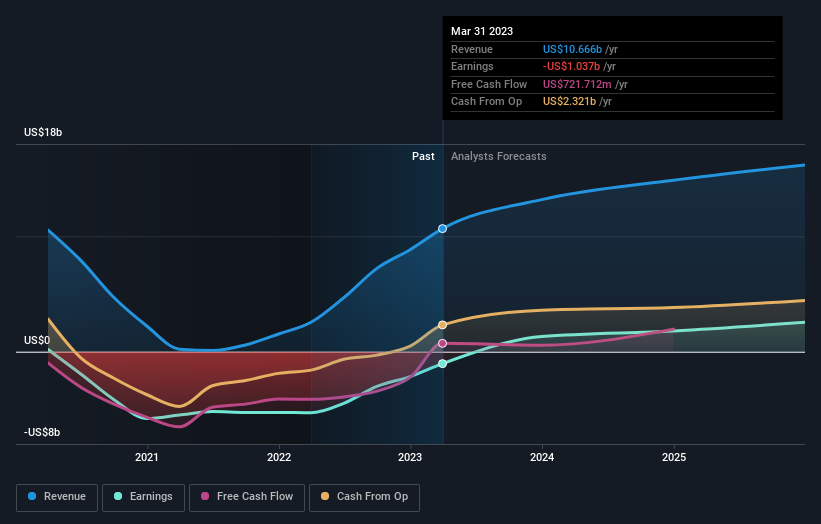

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Royal Caribbean Cruises

A Different Perspective

It's good to see that Royal Caribbean Cruises has rewarded shareholders with a total shareholder return of 46% in the last twelve months. That certainly beats the loss of about 3% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Royal Caribbean Cruises is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RCL

Undervalued with solid track record.

Market Insights

Community Narratives