- United States

- /

- Hospitality

- /

- NYSE:QSR

Restaurant Brands International (NYSE:QSR) investors are sitting on a loss of 17% if they invested a year ago

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Restaurant Brands International Inc. (NYSE:QSR) have tasted that bitter downside in the last year, as the share price dropped 20%. That contrasts poorly with the market return of 26%. On the bright side, the stock is actually up 8.5% in the last three years. Furthermore, it's down 16% in about a quarter. That's not much fun for holders.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Restaurant Brands International

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Restaurant Brands International share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Restaurant Brands International's revenue is actually up 15% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

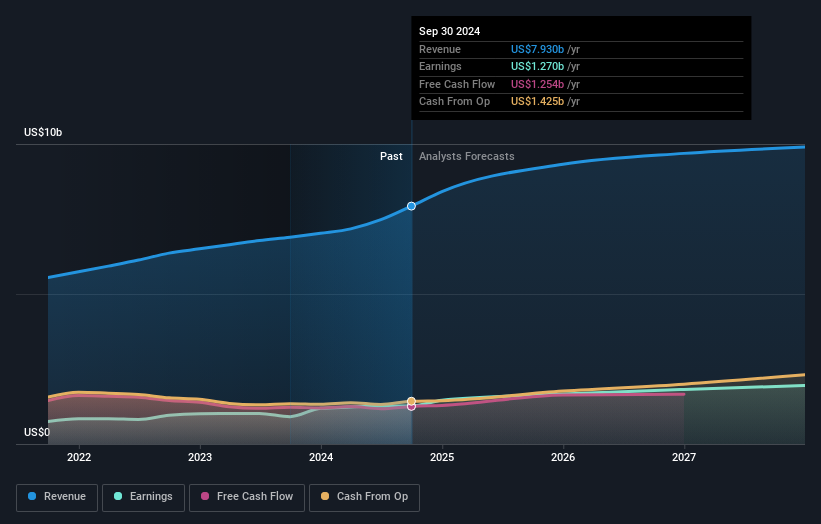

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Restaurant Brands International is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Restaurant Brands International in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Restaurant Brands International the TSR over the last 1 year was -17%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Restaurant Brands International shareholders are down 17% for the year (even including dividends), but the market itself is up 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Restaurant Brands International better, we need to consider many other factors. Take risks, for example - Restaurant Brands International has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives