- United States

- /

- Hospitality

- /

- NYSE:QSR

Assessing Restaurant Brands International (NYSE:QSR) Valuation as Shares Trade Sideways

Reviewed by Kshitija Bhandaru

See our latest analysis for Restaurant Brands International.

Over the past year, Restaurant Brands International’s share price has hovered without much momentum, with a total shareholder return of -3.2% suggesting some caution in the market. Still, its 3- and 5-year total returns of 34.9% and 41.1% indicate the brand’s longer-term story has been more rewarding for patient investors.

If you’re interested in discovering what’s outperforming lately, this could be a perfect moment to broaden your perspective and check out fast growing stocks with high insider ownership

The question now is whether Restaurant Brands International’s current share price offers a bargain for long-term investors, or if the market has already factored in the company’s future growth prospects. Is there still a buying opportunity here?

Most Popular Narrative: 12.5% Undervalued

According to the prevailing market narrative, Restaurant Brands International’s fair value sits above its recent close, giving bulls reason to lean in. This view centers on international expansion and digital advances helping to unlock significant future growth.

Rapid international expansion, particularly through the franchise-led model in markets such as China, India, Turkey, Japan, and Brazil, is driving double-digit unit and system-wide sales growth. This directly supports recurring, capital-light revenue streams and higher long-term earnings visibility.

Want to see the playbook that’s fueling this optimism? Hidden behind the headline is a bold view on scaling margins, faster growth abroad, and a future profit leap. This outlook is built on detailed, forward-looking analyst expectations. Curious which assumptions power that fair value calculation? Don’t miss the full breakdown that reveals all the numbers.

Result: Fair Value of $76.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity inflation and tough international challenges could easily weigh on future margins and test the bullish outlook for Restaurant Brands International.

Find out about the key risks to this Restaurant Brands International narrative.

Another View: The Multiples Perspective

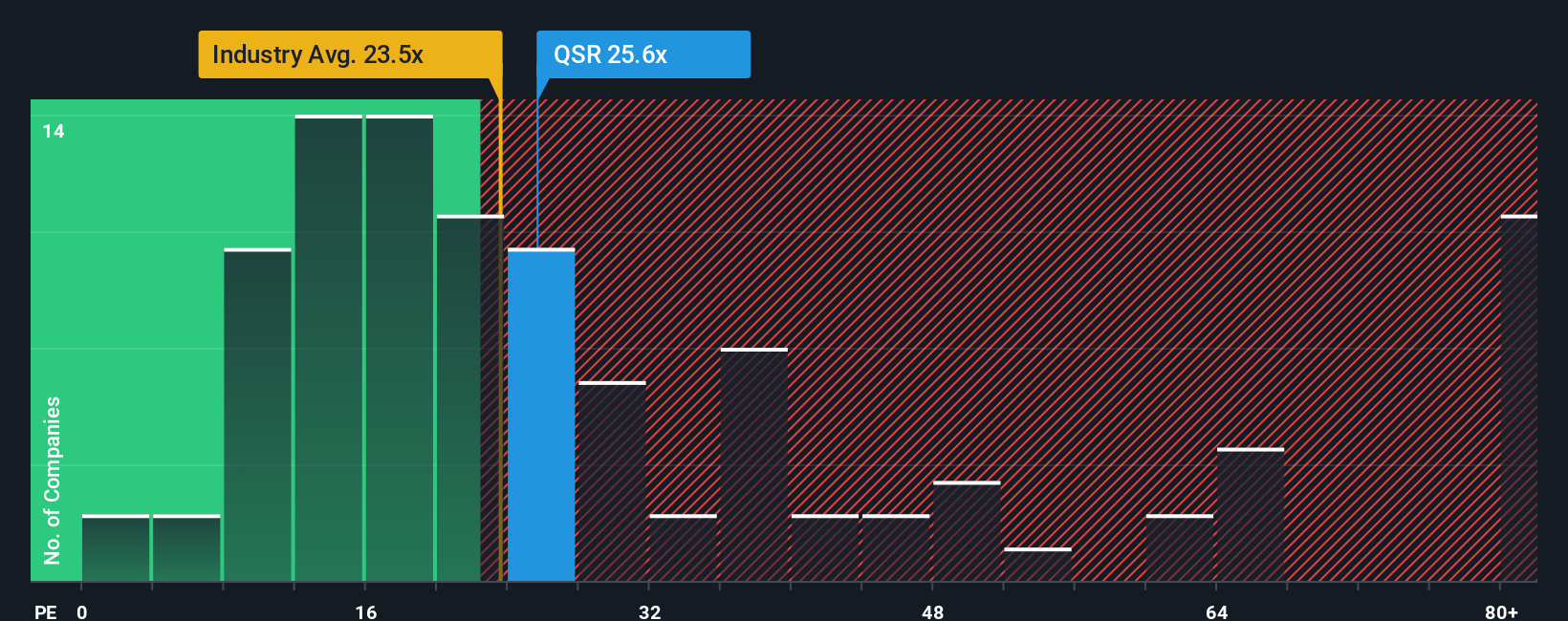

While the fair value estimate points to Restaurant Brands International being undervalued, the market’s pricing ratio tells a different story. Its price-to-earnings stands at 25.4, higher than both the hospitality industry average of 23.1 and its peer group’s 24.8. However, it is still below its fair ratio of 31.4. This gap hints at both valuation risk and opportunity. Which side will win out as market sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Restaurant Brands International Narrative

If you’re thinking of looking at the numbers differently or have your own take, it’s simple to build your own view in just a couple of minutes with Do it your way.

A great starting point for your Restaurant Brands International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great investing opportunities pass you by. There are plenty of standout stocks with strong potential waiting just outside the obvious picks. Let’s get you ahead of the curve.

- Boost your returns by targeting companies generating stable cash flows and value, starting with these 887 undervalued stocks based on cash flows that screen for the most promising financial metrics.

- Secure steady income streams by leveraging these 18 dividend stocks with yields > 3%, your shortcut to companies offering attractive dividend yields that can strengthen your portfolio’s foundation.

- Catalyze your portfolio’s growth by scouting tomorrow’s medical leaders through these 33 healthcare AI stocks, featuring stocks harnessing artificial intelligence to revolutionize healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives