- United States

- /

- Hospitality

- /

- NYSE:NCLH

Results: Norwegian Cruise Line Holdings Ltd. Exceeded Expectations And The Consensus Has Updated Its Estimates

Last week, you might have seen that Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) released its quarterly result to the market. The early response was not positive, with shares down 5.5% to US$17.35 in the past week. Revenues were US$2.4b, approximately in line with whatthe analysts expected, although statutory earnings per share (EPS) crushed expectations, coming in at US$0.35, an impressive 23% ahead of estimates. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Norwegian Cruise Line Holdings

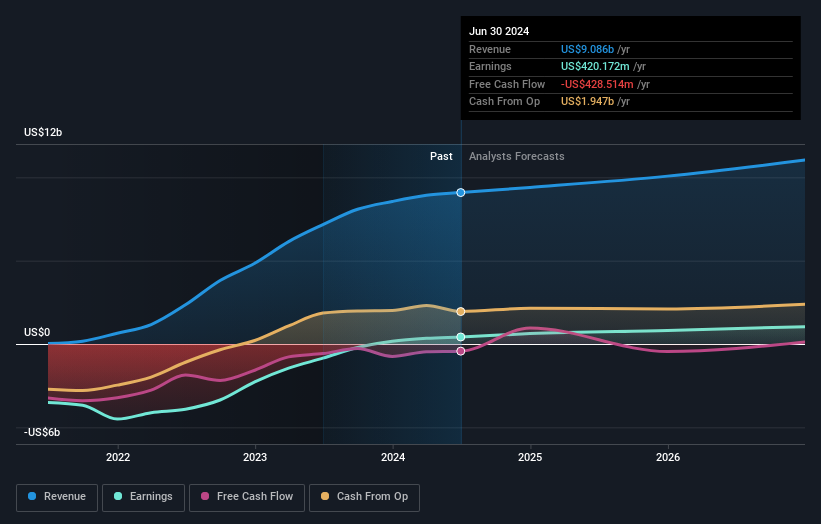

Taking into account the latest results, the current consensus from Norwegian Cruise Line Holdings' 16 analysts is for revenues of US$9.40b in 2024. This would reflect a modest 3.4% increase on its revenue over the past 12 months. Per-share earnings are expected to jump 27% to US$1.22. In the lead-up to this report, the analysts had been modelling revenues of US$9.37b and earnings per share (EPS) of US$1.20 in 2024. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

The analysts reconfirmed their price target of US$22.77, showing that the business is executing well and in line with expectations. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Norwegian Cruise Line Holdings, with the most bullish analyst valuing it at US$32.00 and the most bearish at US$16.50 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Norwegian Cruise Line Holdings' past performance and to peers in the same industry. It's pretty clear that there is an expectation that Norwegian Cruise Line Holdings' revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 6.9% growth on an annualised basis. This is compared to a historical growth rate of 16% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 9.6% per year. Factoring in the forecast slowdown in growth, it seems obvious that Norwegian Cruise Line Holdings is also expected to grow slower than other industry participants.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Norwegian Cruise Line Holdings' revenue is expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Norwegian Cruise Line Holdings going out to 2026, and you can see them free on our platform here..

You still need to take note of risks, for example - Norwegian Cruise Line Holdings has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives