- United States

- /

- Hospitality

- /

- NYSE:NCLH

Norwegian Cruise Line Holdings (NCLH): How Analyst Upgrades and Growth Forecasts Are Shaping Its Valuation Outlook

Reviewed by Kshitija Bhandaru

If you’ve been scanning the waves for your next investment idea, Norwegian Cruise Line Holdings (NCLH) might have just caught your eye. The company recently drew renewed attention as several analysts raised their earnings estimates, citing strong forward-looking growth expectations. This sharp uptick in sentiment, paired with a flurry of value-focused ratings, puts the stock squarely on the radar for anyone tracking shifts in both sentiment and fundamentals.

Zooming out, NCLH’s stock has delivered a 21% gain for investors over the past year, while racking up a dramatic 31% rise in the past 3 months alone. There has been some volatility; returns in the year to date are still slightly in the red, but the latest momentum and chatter from analysts suggest the company’s story is evolving. Meanwhile, headlines have recently included both a sizeable equity offering and a run of valuation upgrades, making this a dynamic moment for long-term holders and new investors alike.

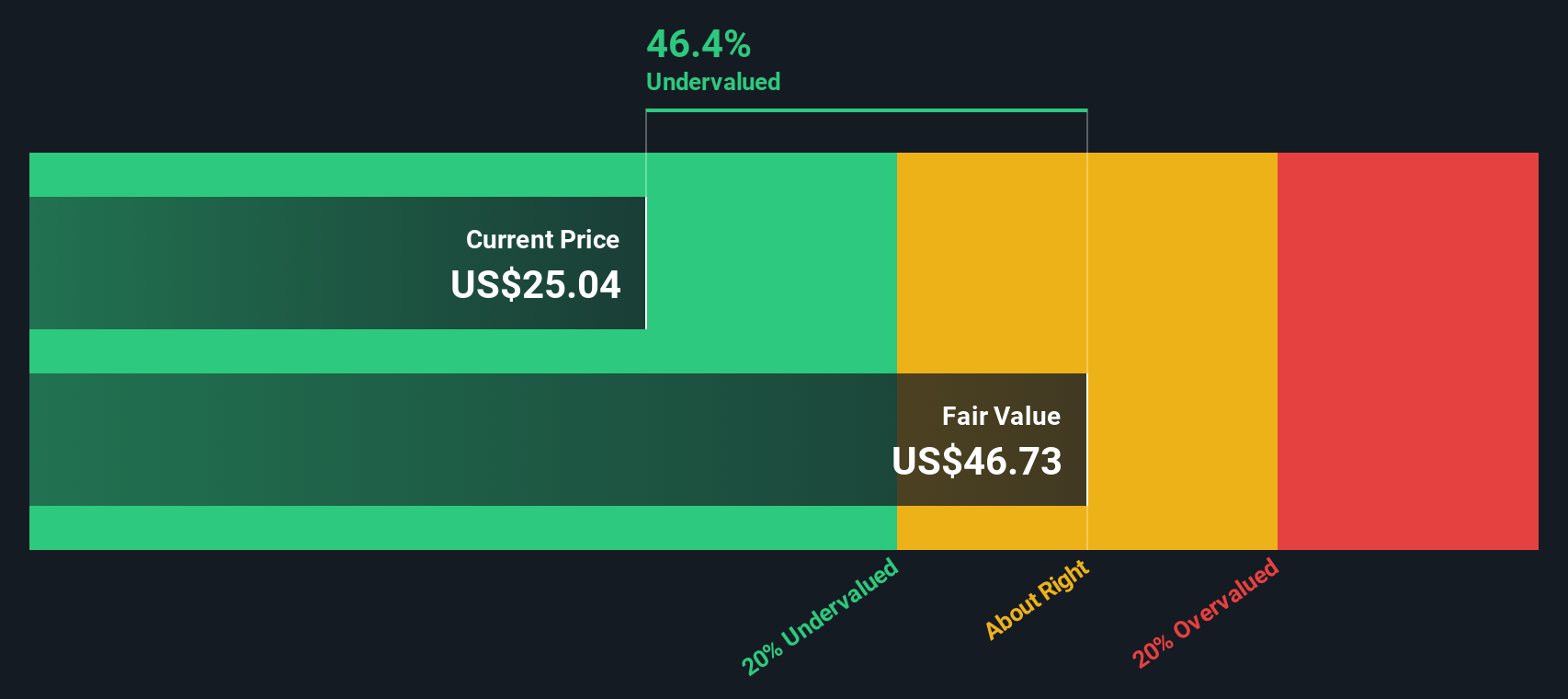

After this surge in optimism and the latest price action, the big question remains: is Norwegian Cruise Line Holdings trading at a discount to its true value, or is the market already pricing in the full extent of its recovery and growth prospects?

Most Popular Narrative: 17.5% Undervalued

The prevailing narrative points to Norwegian Cruise Line Holdings as materially undervalued, with analysts forecasting significant upside from current levels.

Norwegian's expansion and transformation of its private island (Great Stirrup Cay) into a multi-generational, experience-driven destination, with new amenities like the Great Tides Waterpark and family/adult targeted spaces, should capitalize on the rising demand for experiential, multi-generational travel among aging populations with higher discretionary income. This directly supports higher onboard spend, potential pricing power, increased occupancy, and enhanced revenue growth.

Curious what could power a near 20% upside? There is one major upgrade, supported by bold analyst projections, that could reshape the company’s growth map over the next few years. Want to see what future profits and margins they are banking on? The most popular narrative reveals the blueprint behind this bullish valuation.

Result: Fair Value of $30.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high debt and changing itinerary mixes could constrain Norwegian’s profitability and limit the full upside that bullish scenarios suggest.

Find out about the key risks to this Norwegian Cruise Line Holdings narrative.Another View: Discounted Cash Flow

Looking at Norwegian Cruise Line Holdings through our DCF model provides a different perspective. This approach also points to undervaluation. As with all models, however, the result depends on future assumptions. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Norwegian Cruise Line Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Norwegian Cruise Line Holdings Narrative

If the mainstream outlook does not quite fit your view or you prefer to dig into the numbers personally, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Norwegian Cruise Line Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Broaden your investment horizons and seize fresh opportunities with Simply Wall Street’s powerful screener tools. Your next high-potential stock could be just a click away.

- Uncover promising up-and-comers by checking out penny stocks with strong financials through penny stocks with strong financials and spot hidden gems before the crowd.

- Tap into fast-changing healthcare breakthroughs by using healthcare AI stocks to find companies harnessing AI for medical innovation and patient care.

- Boost your income potential by finding dividend stocks with yields over 3%, all highlighted in dividend stocks with yields > 3%, and let your money work harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives