- United States

- /

- Hospitality

- /

- NYSE:MTN

Vail Resorts (MTN) Q1 2026: Wider EPS Loss Tests Bullish Margin‑Improvement Narrative

Reviewed by Simply Wall St

Vail Resorts (MTN) opened fiscal Q1 2026 with revenue of about $271 million, a basic EPS loss of roughly $5.20, and net income excluding extra items of around negative $187 million, setting a cautious tone for the new season. The company has seen quarterly revenue move from about $260 million in Q1 2025 to roughly $271 million in Q1 2026, while basic EPS shifted from a loss of about $4.62 to a loss of roughly $5.20 over the same period, giving investors a mixed read on top line stability against persistent quarterly losses. With trailing twelve month EPS at about $7.25 and net margins improving in the background, this update sets the stage for investors to examine how durable those profitability gains really are.

See our full analysis for Vail Resorts.With the headline numbers on the table, the next step is to weigh them against the dominant market narratives around Vail Resorts, to see which stories the latest margins support and which ones the new data calls into question.

See what the community is saying about Vail Resorts

Five year EPS growth at 15.4% vs 14.2% latest trend

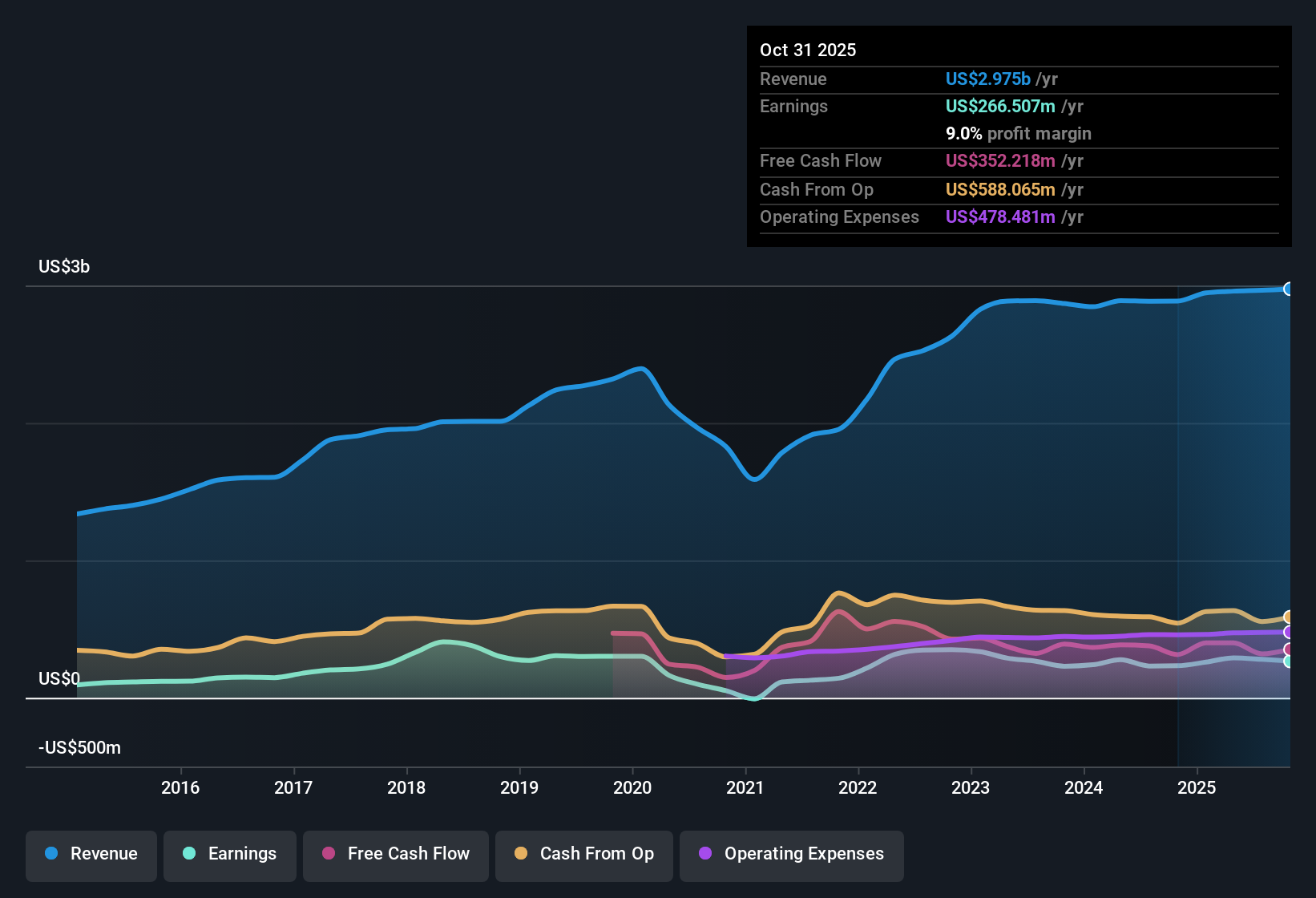

- Over the last twelve months, earnings grew about 14.2%, slightly behind the five year EPS growth pace of 15.4% per year, while trailing twelve month net income reached roughly $266.5 million on about $3.0 billion of revenue.

- Consensus narrative sees cost efficiencies and technology investment lifting margins over time, which lines up with net margin improving to 9% from 8.1% year over year, yet

- the latest 14.2% earnings growth running just below the five year 15.4% rate suggests that gains may be moderating rather than accelerating,

- so investors following the consensus view will want to see whether planned $100 million in annualized cost efficiencies by fiscal 2026 push margins well beyond the recent 9% level, not just keep them flat.

DCF fair value at about $249 vs $155 share price

- The stock trades around $154.81 per share, materially below a DCF fair value estimate of about $249.41, and at roughly 20.8 times earnings compared with about 23.6 times for the US hospitality industry and 22.9 times for peers.

- Supporters of the bullish narrative point to this valuation gap alongside steady profit expansion, since trailing twelve month revenue is about $3.0 billion and net income about $266.5 million, yet

- analysts are only expecting earnings to grow about 6.5% per year, well below the broader US market’s growth forecasts,

- so the bullish case depends on investors eventually paying up to close the gap to DCF fair value despite slower forecast growth than the wider market.

5.74% dividend and high debt under pressure

- The dividend yield sits around 5.74%, yet it is flagged as not being well covered by either earnings or free cash flow, and the company is also noted as carrying a high level of debt.

- Bears emphasize that slower revenue growth of about 2.9% over the last year, together with only modest forecast earnings growth of roughly 6.5% per year, makes that 5.74% payout and higher leverage a key weak point, because

- even with net margin improving to 9%, any slip in profitability from softer visitation or foreign exchange could quickly squeeze coverage of the dividend,

- and a high debt load means more cash must go to interest and repayment, which competes directly with funding both shareholder returns and ongoing resort upgrades.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vail Resorts on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and want your view to be heard? Turn that insight into a complete narrative in minutes, starting with Do it your way.

A great starting point for your Vail Resorts research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Vail Resorts pairs improving margins with only mid single digit earnings growth, a stretched dividend, and high debt that could strain cash priorities in a downturn.

If you want stronger financial cushioning instead of worrying whether leverage and payouts can hold, use our solid balance sheet and fundamentals stocks screener (1944 results) today to find businesses built on sturdier, crisis ready balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTN

Vail Resorts

Operates mountain resorts and regional ski areas in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)