- United States

- /

- Hospitality

- /

- NYSE:MTN

Does Vail Resorts Offer Opportunity After Recent Share Price Slide in 2025?

Reviewed by Bailey Pemberton

If you’re deciding what to do with Vail Resorts stock, you’re definitely not alone. The company’s roller coaster share price is enough to have even seasoned investors raising an eyebrow. After a dip of -5.3% over the past week, you might wonder if the market is telling us something new, or simply reacting to shifts in the broader leisure and travel scene. Despite a turbulent ride over the last few years, including a return of -25.1% over five years, Vail’s most recent 30-day move actually paints a slight rebound of 3.0%. This leaves the stock at $148.77 as of the last close, still down -15.1% since the start of 2024.

With all this in mind, is Vail Resorts a value play or a value trap? If you’re looking at the numbers, Vail comes in with a valuation score of 4 out of 6, meaning it’s currently undervalued on four key metrics investors typically rely on. But before jumping in, it’s crucial to look at how these different valuation tools actually measure what matters for this company and whether they paint the full picture. Let’s walk through each of these methods and, toward the end, I’ll introduce an even sharper way to get to the heart of Vail Resort’s true worth.

Why Vail Resorts is lagging behind its peers

Approach 1: Vail Resorts Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected cash flows into the future and then discounting those back to today's value. This provides a data-driven way to gauge what the business is truly worth, independent of daily price swings.

For Vail Resorts, the DCF analysis starts with the company's most recent Free Cash Flow (FCF), which stands at $296.6 Million. Analysts expect this cash flow to increase steadily, with projections reaching $603 Million by 2028. While analyst estimates typically run for about five years, further cash flow growth projections out to 2035 are extrapolated by Simply Wall St, with 2035 FCF estimated at $852.4 Million (discounted to $325.3 Million in today's dollars).

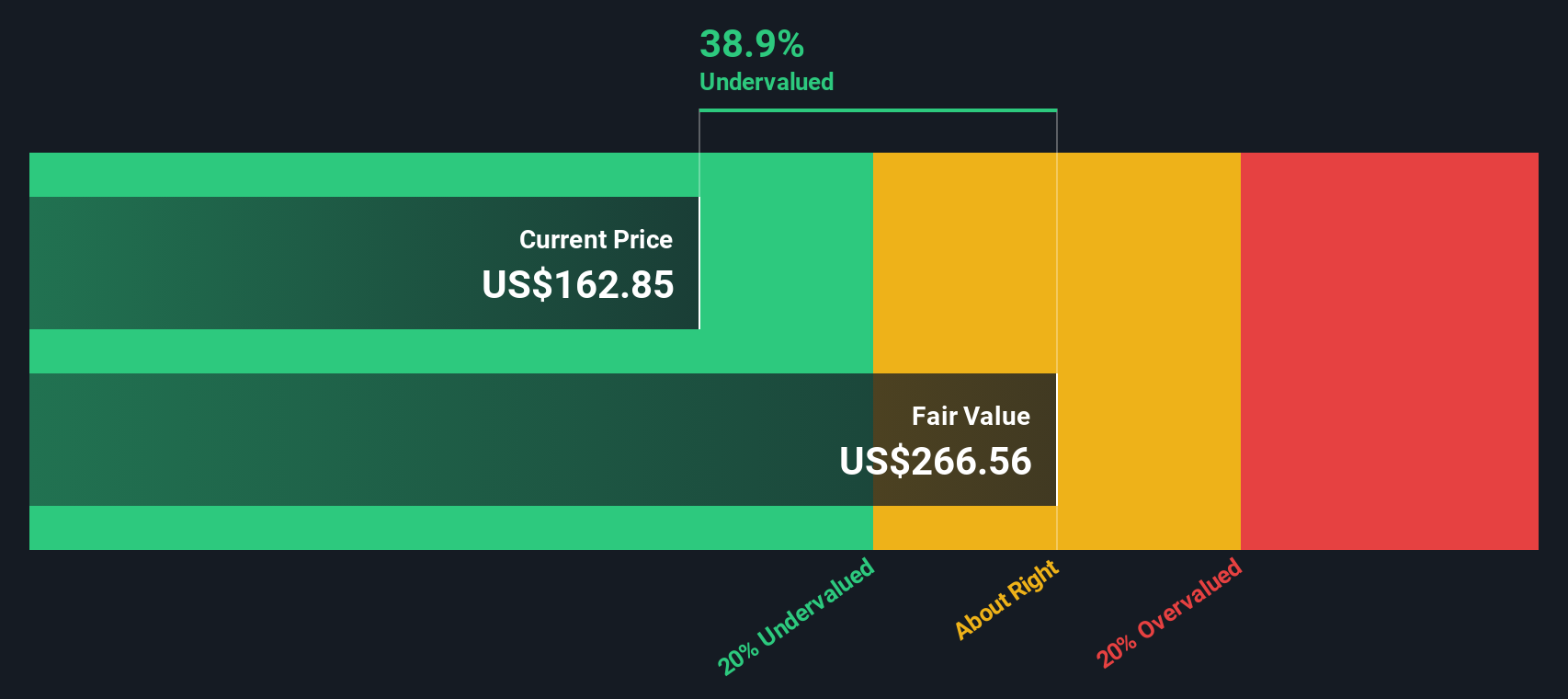

After running these projections through the 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value for Vail Resorts stock is calculated at $247.03 per share. Compared to its recent market price of $148.77, this suggests the stock is trading at a 39.8% discount and may be significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vail Resorts is undervalued by 39.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Vail Resorts Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly measures how much investors are willing to pay for each dollar of a company’s earnings. For businesses like Vail Resorts that have established profitability, the PE ratio offers a clear gauge for comparing relative value across peers and industries.

However, what qualifies as a “normal” or fair PE ratio varies. Growth expectations and risk are central to this judgment; faster-growing or less risky companies typically deserve to trade at higher PE multiples, while slower-growing or riskier firms warrant lower ones. So, the context behind the number really matters.

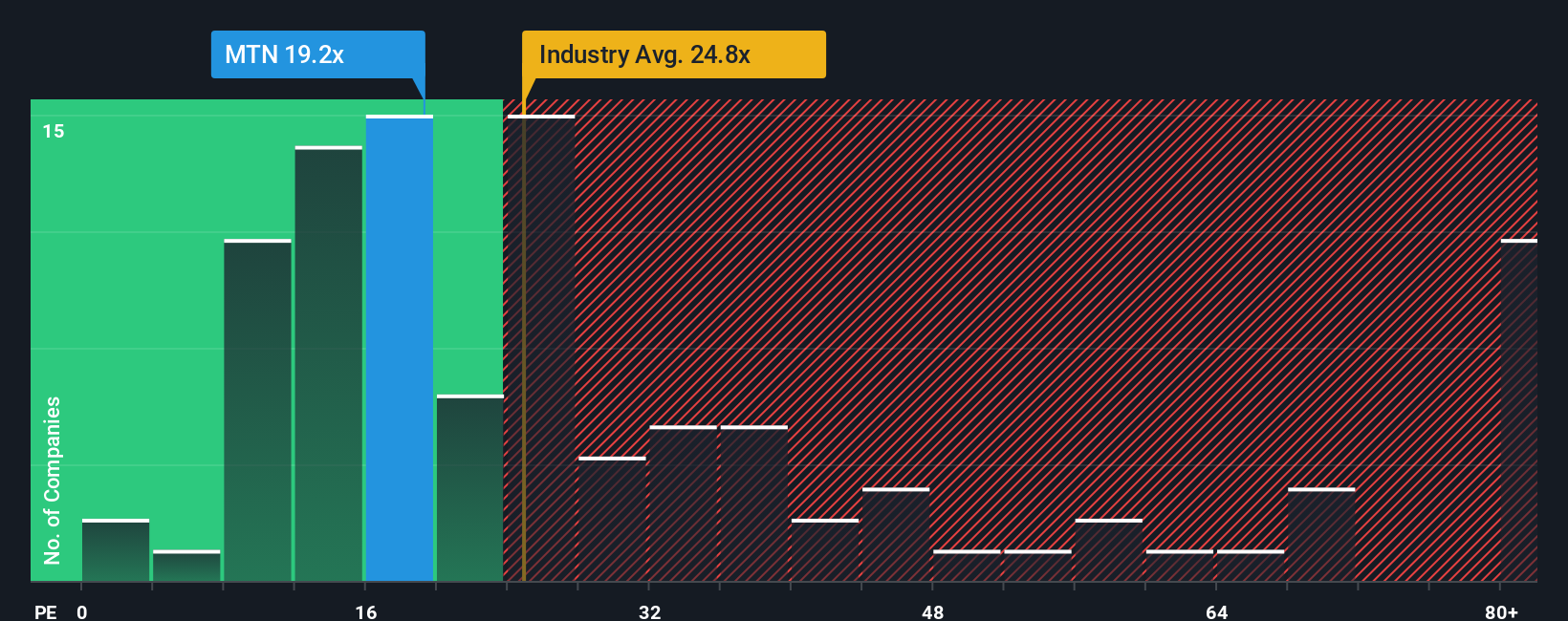

Vail Resorts currently trades at a PE ratio of 19.07x. To put that in perspective, the average PE across the Hospitality industry is 24.10x, and the average among Vail’s closest peers is higher still at 34.91x. This seems to position Vail’s valuation as on the lower end versus benchmarks.

This is where Simply Wall St’s “Fair Ratio” comes in. For Vail Resorts, this proprietary metric amounts to 18.89x. It is designed to provide a customised benchmark that reflects not just the industry or peers, but also core factors like Vail’s own earnings growth outlook, profit margins, size, and risk profile. In other words, it answers, “What should the right multiple really be, given everything we know about this business?”

Comparing Vail’s 19.07x PE to its Fair Ratio of 18.89x, the company appears to be valued about right by the market based on this method. The slight difference between the two (less than 0.10x) suggests the share price fairly reflects Vail’s current fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vail Resorts Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is your investment story. It is a clear, customizable way to link your view of a company’s business outlook to your own forecasts and estimate of fair value. Instead of just looking at numbers in isolation, Narratives let you connect your perspective on things like Vail Resorts’ guest experience investments, market position, or potential risks to a financial forecast, then see what that means for the ideal buy or sell price.

It’s a simple and accessible feature, available directly in Simply Wall St’s Community page, where millions of investors share, update, and compare Narratives in real time. As news breaks, earnings are released, or assumptions change, your Narrative and your fair value update automatically.

This tool helps investors make smarter, more dynamic decisions by comparing Fair Value to the current share price and adjusting for what really matters in each story. For example, one investor may create an optimistic Vail Resorts Narrative based on aggressive revenue growth or peak margins, resulting in a fair value of $244.0 per share. Another may focus on risks like declining visitation or currency impacts and come up with a much lower value around $146.0 per share. Narratives help you see these differing perspectives, test your own, and take action with confidence.

Do you think there's more to the story for Vail Resorts? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTN

Vail Resorts

Operates mountain resorts and regional ski areas in the United States and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives