- United States

- /

- Hospitality

- /

- NYSE:MCD

Is Customer Backlash Over Meal Prices Altering The Investment Case For McDonald’s (MCD)?

Reviewed by Sasha Jovanovic

- Recently, McDonald’s faced strong online criticism in the US over an US$8 10-piece McNugget meal and broader concerns about pricing and value, even as it continued rolling out seasonal menu items and marketing collaborations across key markets.

- This clash between customer frustration over affordability and evidence of resilient sales has sharpened investor focus on how McDonald’s balances value perception with growth.

- We’ll now examine how this growing backlash over perceived meal affordability could influence McDonald’s broader investment narrative and outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

McDonald's Investment Narrative Recap

To own McDonald’s, you need to believe its global scale, brand, and tech-led efficiency can keep converting steady traffic into resilient cash flows, even when customers push back on price. The recent US$8 McNugget meal backlash reinforces that near term, value perception in key markets is the main catalyst and the biggest risk, but so far it has not materially dented reported comparable sales momentum.

The most relevant update here is CEO Chris Kempczinski’s acknowledgment that combo meals above US$10 hurt value perceptions, alongside Q3 2025 global comparable sales growth of 3.6%. This combination keeps pricing discipline and guest traffic, especially among lower income consumers, at the center of the McDonald’s investment story over the next few quarters.

Yet behind the promotions and seasonal launches, a different risk tied to sustained traffic pressure from lower income customers is something investors should also be aware of...

Read the full narrative on McDonald's (it's free!)

McDonald's narrative projects $30.6 billion revenue and $10.4 billion earnings by 2028. This requires 5.5% yearly revenue growth and a $2.0 billion earnings increase from $8.4 billion today.

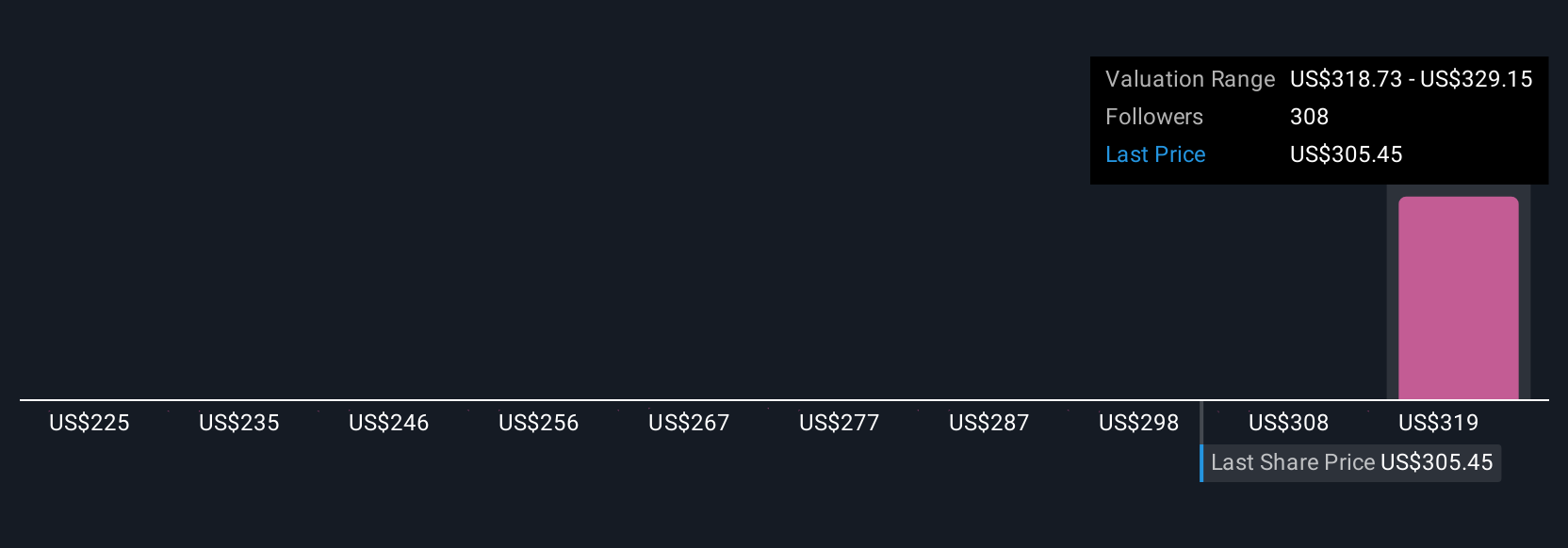

Uncover how McDonald's forecasts yield a $331.53 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community currently see McDonald’s fair value between US$260.64 and US$331.53, underlining how far opinions can spread. Set against this, concerns about ongoing traffic softness among lower income guests could meaningfully shape how those different views on the company’s performance play out over time.

Explore 10 other fair value estimates on McDonald's - why the stock might be worth as much as 8% more than the current price!

Build Your Own McDonald's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free McDonald's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McDonald's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026