- United States

- /

- Hospitality

- /

- NYSE:LVS

Las Vegas Sands (LVS): Assessing Valuation After Q2 Earnings Beat and Strong Macao, Singapore Performance

Reviewed by Simply Wall St

Las Vegas Sands just posted results that have investors sitting up and taking notice. The company’s second-quarter earnings and revenue not only cleared consensus estimates, but did so on the back of strong performances from both Macao and Singapore. Management highlighted that ongoing capital spending is helping push growth forward in these core markets, while also reassuring investors about the company’s healthy cash flows and ability to return capital to shareholders. For anyone considering whether to buy, hold, or sell, these numbers are the kind of catalyst that could tilt the balance.

These upbeat results did not appear in a vacuum. Over the past year, Las Vegas Sands stock has climbed 39%, enjoying a sharp rally of 32% in the past three months alone as investors respond to signs of recovery and improved sentiment. Short-term momentum is clearly in play here, reflecting confidence in expansion plans and the resilience of demand at Marina Bay Sands and across Macao. While the longer-term five-year return of 13% suggests a more uneven path, the company’s recent attention to capital expenditures and strong net income growth has helped shift the narrative toward future potential.

After such a strong run this year, the question is whether there is still room for upside with Las Vegas Sands or if the market has already priced in the next chapter of its growth story.

Most Popular Narrative: 5.5% Undervalued

According to community narrative, Las Vegas Sands is seen as undervalued by 5.5%, based on forward-looking earnings projections and growth drivers in its core Asian resort markets.

The full opening and ramp-up of The Londoner in Macao, with its 2,405 rooms and suites, is expected to boost revenues and cash flows significantly. The property aims to leverage its scale and quality in a competitive market. Marina Bay Sands (MBS) in Singapore reported record EBITDA from high-value tourism and is expected to continue its growth trajectory, supported by increased visitor capacity after renovations. This is anticipated to have a direct impact on revenue and EBITDA growth.

Is the future fully priced in? The analyst consensus is based on aggressive projections for both top-line and bottom-line expansion, driven by flagship properties and a recalibration of key profitability metrics. Interested in what kind of growth rates and margin improvements support this fair value? The full narrative details the math behind this valuation, allowing readers to understand the factors driving these projections and assess the outlook independently.

Result: Fair Value of $58.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges in Macao market growth and intensified competition in the premium mass segment could hinder Las Vegas Sands' revenue and profitability outlook.

Find out about the key risks to this Las Vegas Sands narrative.Another View: A Different Way to Value

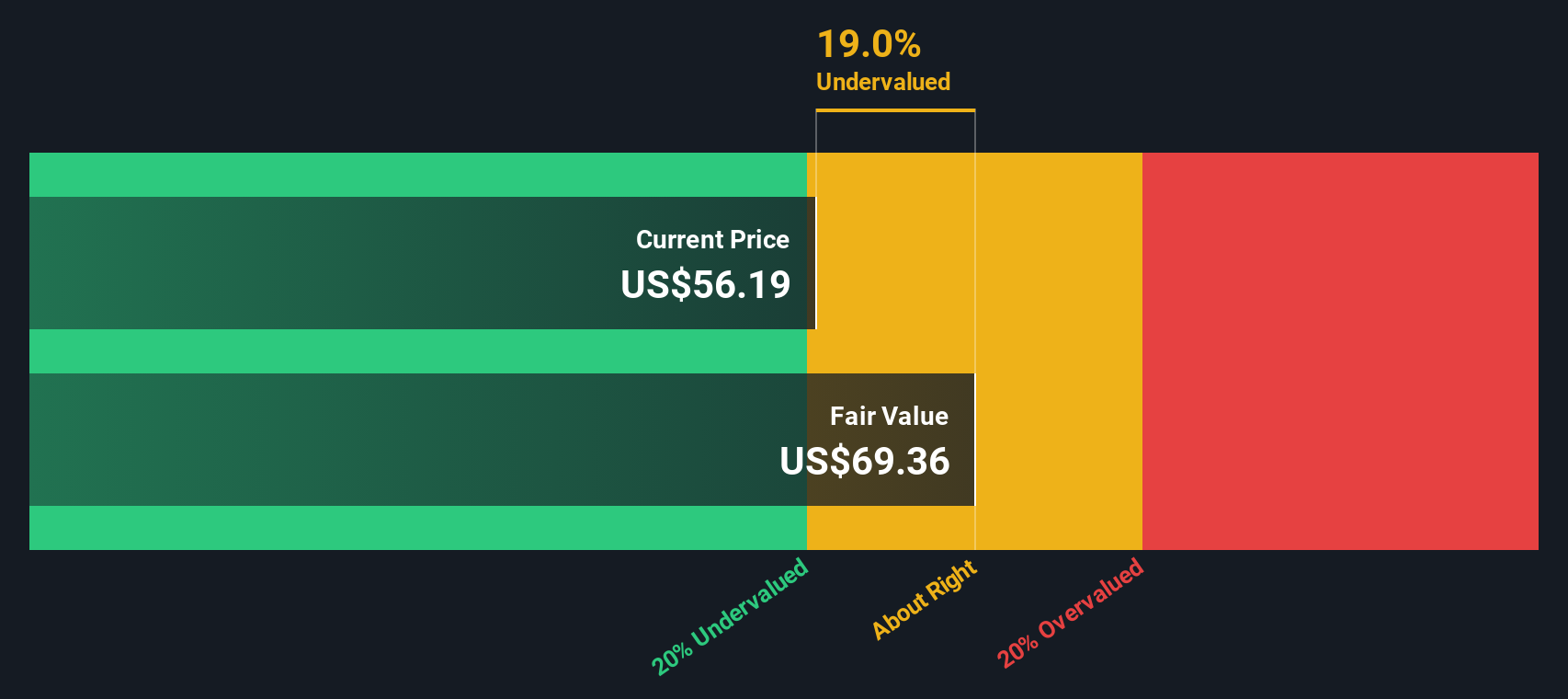

Looking at Las Vegas Sands through our DCF model tells a very different story. On this basis, the shares appear even more undervalued than the previous method suggests. Which approach should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Las Vegas Sands Narrative

If you see things differently or want to draw your own conclusions, creating a custom data-driven narrative is quick and easy. Just do it your way.

A great starting point for your Las Vegas Sands research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Winning Investment Ideas?

Do not limit your opportunities to just one company. The market is full of emerging trends and proven concepts waiting for a smart investor like you to take notice. Stay a step ahead and seize fresh chances before others catch on by putting these handpicked strategies to work for you:

- Uncover steady income prospects by checking out dividend stocks with yields > 3%, which offers attractive yields for long-term stability.

- Get exposure to tomorrow’s tech breakthroughs when you browse leading AI penny stocks that are transforming industries with artificial intelligence innovation.

- Spot under-the-radar gems by evaluating undervalued stocks based on cash flows, which are trading below their true worth and may offer potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVS

Las Vegas Sands

Owns, develops, and operates integrated resorts in Macao and Singapore.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives