- United States

- /

- Hospitality

- /

- NYSE:LUCK

Is Lucky Strike Entertainment Set for a Comeback After Recent 5.6% Share Price Jump?

Reviewed by Bailey Pemberton

Let’s dig into Lucky Strike Entertainment, the stock that might have you wondering whether it is time to pounce or hold off a bit longer. After all, with so many choices in entertainment stocks, you want to know if this one offers real value, or if recent price moves are just fleeting moments in a volatile market. Recently, Lucky Strike’s shares have edged up 1.5% over the last week and 5.6% in the past month, hinting at renewed optimism among investors. That is quite a change after a year where the stock slipped -8.0%, and even more so given its three-year return of -12.9%. What is behind this shift? Some investors point to sector-wide developments, such as the reopening of entertainment venues and a more confident outlook for consumer spending, as key drivers for the bounce back.

But here is the real question: is Lucky Strike Entertainment actually undervalued, or are you just catching it at a moment of buzz? According to our value score, where companies get one point for each of six valuation checks they pass, Lucky Strike comes in at a solid 4 out of 6. This number matters, but it is only part of the story. Next, we will break down how each valuation method stacks up and why there might be an even smarter way to evaluate what this stock is really worth. Stay with us as we get into the details.

Why Lucky Strike Entertainment is lagging behind its peers

Approach 1: Lucky Strike Entertainment Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company’s worth by projecting its future cash flows and then discounting them back to their present value. This approach helps investors look beyond near-term market swings and focus on a business’s long-term cash-generating power.

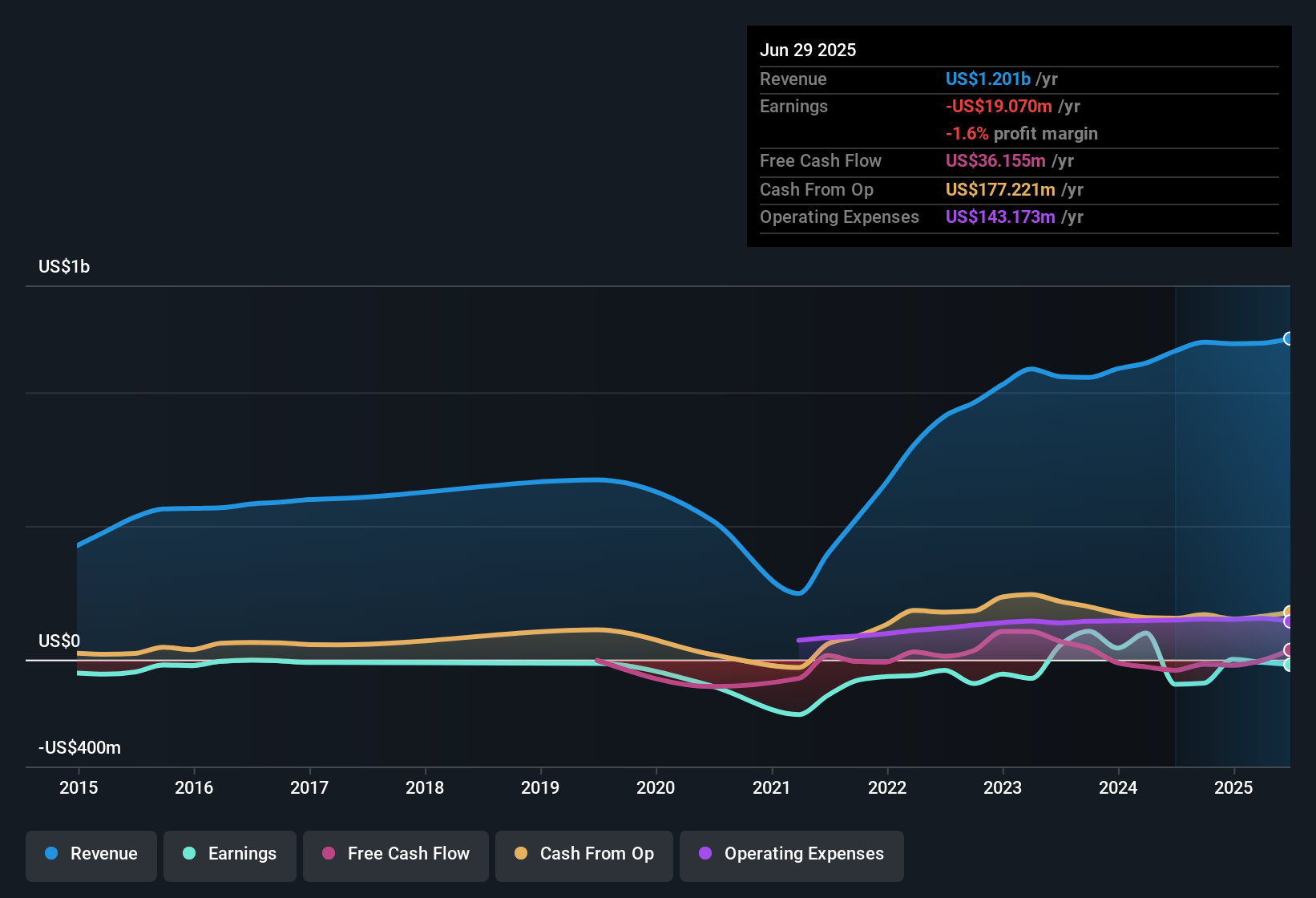

For Lucky Strike Entertainment, the most recently reported Free Cash Flow stands at $6.87 Million. Analysts provide cash flow estimates through to 2028, at which point annual Free Cash Flow is projected to reach $264 Million. Beyond 2028, projections are extrapolated and show consistent growth, with Free Cash Flow potentially surpassing $660 Million by 2035. These estimates combine both analyst consensus and Simply Wall St’s long-term assumptions about the company’s expansion pace and industry conditions.

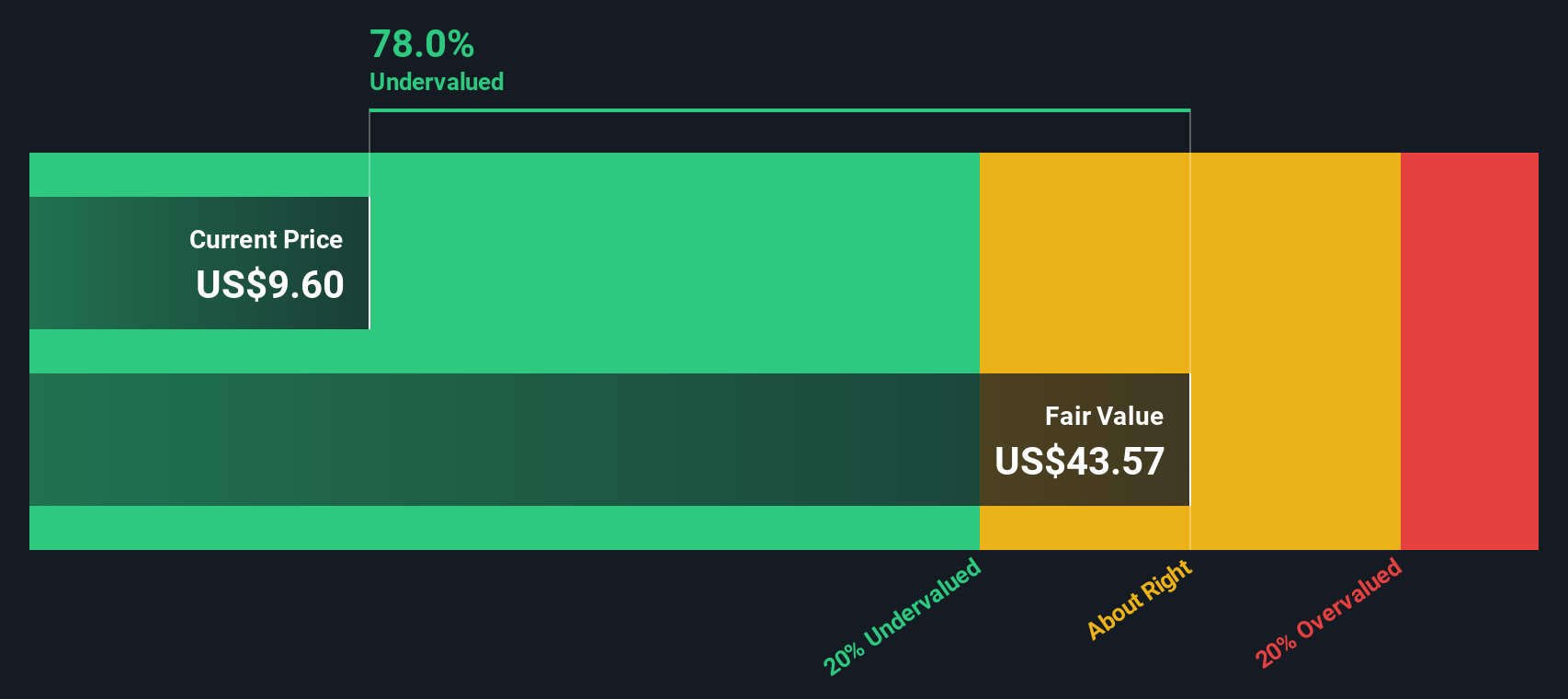

Based on these cash flow projections and the company’s 2 Stage Free Cash Flow to Equity model, the DCF calculation suggests a fair value of $30.48 per share. Compared to the current trading price, this implies the stock is trading at a 65.4% discount to its intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lucky Strike Entertainment is undervalued by 65.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Lucky Strike Entertainment Price vs Sales

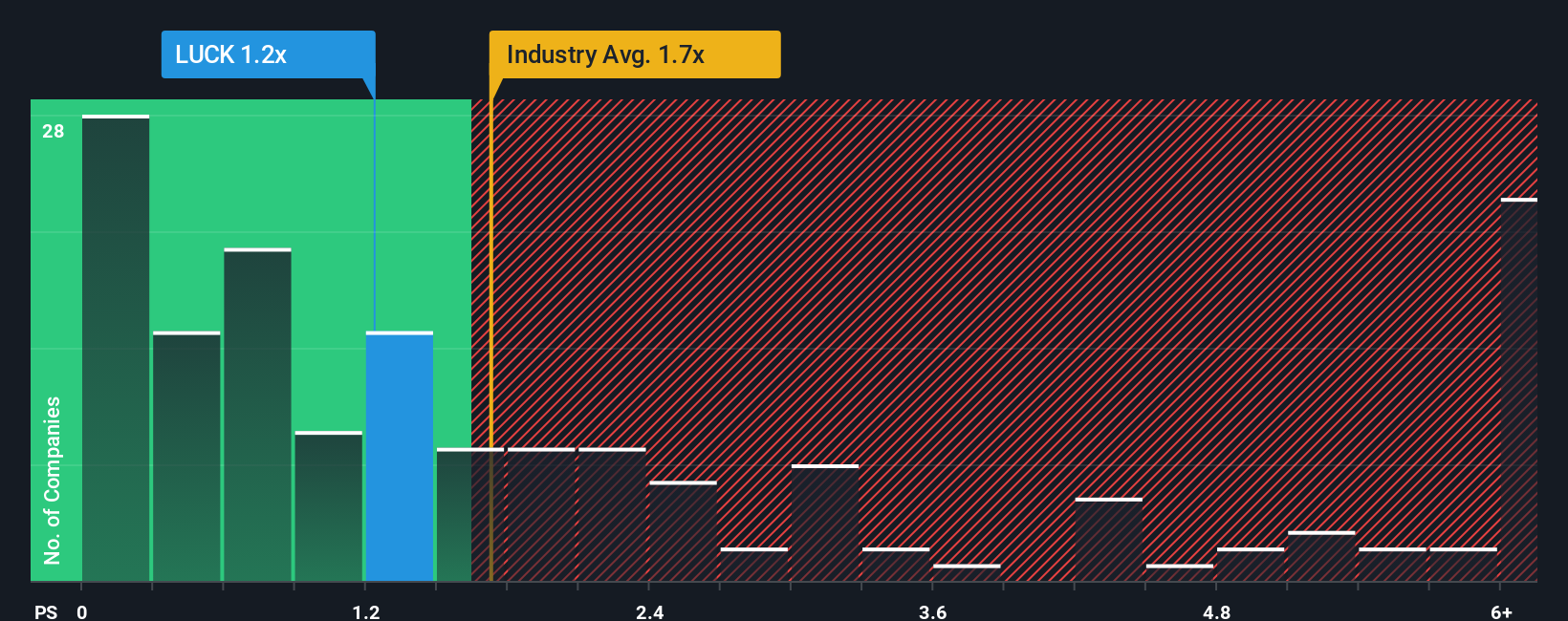

The Price-to-Sales (P/S) ratio is often the preferred metric for valuing companies like Lucky Strike Entertainment, especially when earnings are volatile or negative. It measures what investors are willing to pay for each dollar of sales, making it a useful gauge for businesses where revenue growth is more predictable than profits.

A "normal" or "fair" P/S ratio depends on both how fast a company is expected to grow sales in the future and how risky that growth outlook appears. Growing companies in stable industries typically command a higher multiple. In contrast, companies facing uncertainty, slowdowns, or tougher competition tend to trade at a discount.

Currently, Lucky Strike’s P/S ratio sits at 1.23x. This is slightly lower than its peer average P/S ratio of 1.26x and well below the Hospitality industry average of 1.72x. In isolation, this suggests the stock could be trading at a modest discount versus rivals and industry standards.

Simply Wall St’s Fair Ratio, however, provides a more nuanced benchmark. Calculated from factors such as Lucky Strike’s expected revenue growth, profit margin, business model, risks, and its place within the Hospitality sector, the Fair Ratio for the company is 1.02x. This tailored approach is more accurate than simply matching the company against its peers or the broad industry because it considers Lucky Strike’s unique strengths and challenges.

Given that Lucky Strike’s actual P/S ratio (1.23x) is very close to the Fair Ratio (1.02x), there is no significant overvaluation or undervaluation. The market pricing looks about right given its profile.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lucky Strike Entertainment Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story about a company, combining your views on its future prospects, including estimates for fair value, sales growth, earnings, and profit margins, into a single, clear framework. Narratives go beyond raw numbers by linking a company’s unique story, such as what you think will drive its success or struggles, to a dynamic financial forecast. This approach helps you translate that big-picture perspective into an actionable fair value.

Narratives are easy to create and access on Simply Wall St’s Community page, where millions of investors contribute their insights and check their assumptions against real-time market data. They empower you to make smart decisions about when to buy or sell by directly comparing your Fair Value estimate to the current Share Price. In addition, Narratives are automatically refreshed whenever there is a major company update or new data becomes available, ensuring your investment thesis always stays current.

For example, with Lucky Strike Entertainment, some investors’ Narratives focus on the company’s brand strength, urban expansion, and loyalty programs to justify a fair value near $18.00 per share. Others are more cautious about digital competition and operational risks, estimating fair value closer to $9.00.

Do you think there's more to the story for Lucky Strike Entertainment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUCK

Lucky Strike Entertainment

Operates location-based entertainment venues in North America.

Good value with moderate growth potential.

Market Insights

Community Narratives