- United States

- /

- Hospitality

- /

- NYSE:HLT

How Investors Are Reacting To Hilton Worldwide Holdings (HLT) Beating Q2 2025 Estimates and Expanding Portfolio

Reviewed by Simply Wall St

- Hilton Worldwide Holdings recently reported second-quarter 2025 results, surpassing analyst expectations for both earnings and revenues, while adding 221 hotels to its portfolio despite ongoing headwinds from reduced government spending and softer international travel.

- This performance highlights Hilton’s ability to maintain growth momentum through its continued expansion across luxury and lifestyle brands in the face of industry challenges.

- Let's explore how Hilton's strong quarterly performance and ongoing portfolio growth influence the company's broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hilton Worldwide Holdings Investment Narrative Recap

Shareholders in Hilton Worldwide Holdings generally need to believe in the company’s power to drive growth through disciplined hotel expansion, even when core travel markets face pressure. The recent earnings beat and strong portfolio growth appear to support Hilton’s case for resilience, but the largest near-term catalyst, unit expansion offsetting flat RevPAR, remains intact, while ongoing softness in key travel demand still poses a material risk.

Of Hilton’s recent announcements, the launch of the LivSmart Studios brand stands out, especially since this new extended-stay offering directly ties into Hilton’s focus on capturing more diversified travel segments, a key factor in sustaining growth as RevPAR stagnates. The continued introduction of niche brands may offer additional revenue streams, but effective execution will be closely watched as investors assess whether brand proliferation truly mitigates softer traditional demand.

However, the contrast between Hilton’s growth story and persistent uncertainty in key markets is a risk investors need to be aware of, particularly if...

Read the full narrative on Hilton Worldwide Holdings (it's free!)

Hilton Worldwide Holdings is projected to reach $14.8 billion in revenue and $2.5 billion in earnings by 2028. This outlook assumes a 45.4% annual revenue growth rate and an earnings increase of $0.9 billion from the current $1.6 billion.

Uncover how Hilton Worldwide Holdings' forecasts yield a $273.50 fair value, in line with its current price.

Exploring Other Perspectives

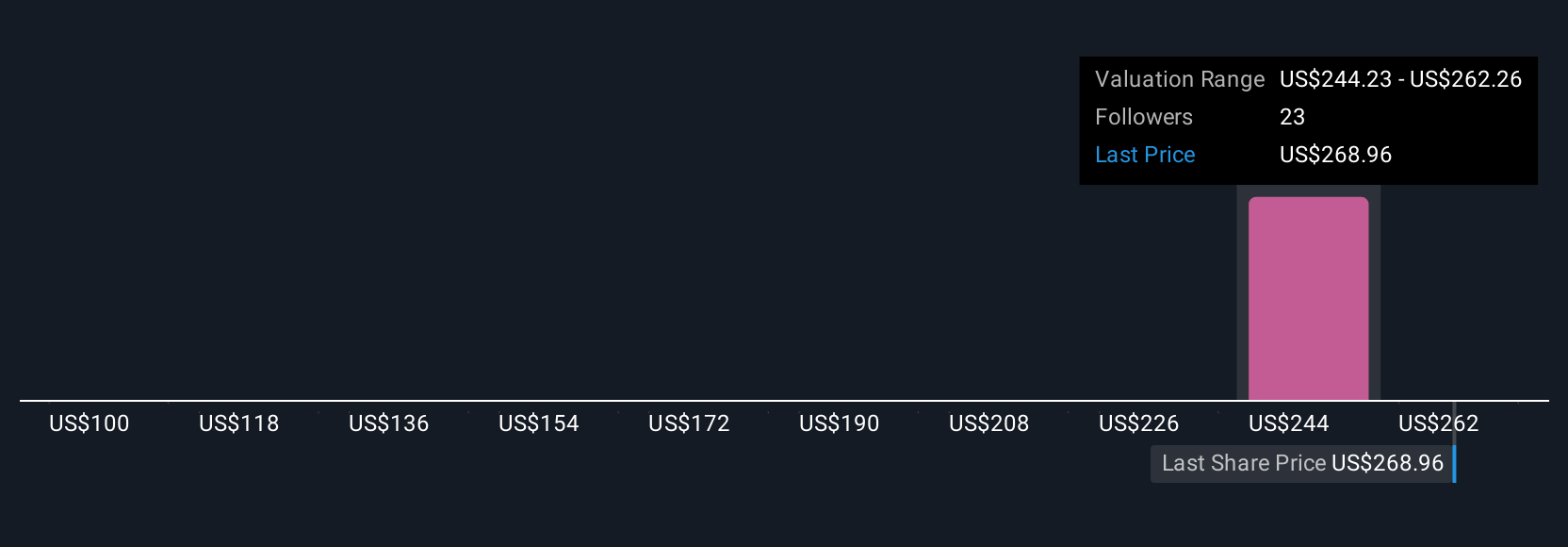

Simply Wall St Community members have published 4 separate fair value estimates for Hilton, ranging from US$100 to US$280.29 per share. With ongoing concerns about sluggish RevPAR growth, these differing views show how opinions can vary significantly and why it pays to explore several approaches.

Explore 4 other fair value estimates on Hilton Worldwide Holdings - why the stock might be worth less than half the current price!

Build Your Own Hilton Worldwide Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hilton Worldwide Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Worldwide Holdings' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives