- United States

- /

- Hospitality

- /

- NYSE:HLT

Hilton (HLT) Valuation in Focus as Outset Collection Launch and New Openings Highlight Growth Strategy

Reviewed by Kshitija Bhandaru

Hilton Worldwide Holdings (NYSE:HLT) has been making moves that spotlight its push into new and fast-evolving segments. The recent debut of the Outset Collection, two high-profile hotel openings, and awards recognition all signal Hilton’s multi-pronged growth strategy.

See our latest analysis for Hilton Worldwide Holdings.

Hilton’s latest property launches and its big brand push come amid a solid run for investors. The stock’s 11.0% total shareholder return over the past year reflects continued confidence in both Hilton’s expansion strategy and its ability to capture higher-margin demand. Momentum has cooled a bit in recent months, but the long-term trend remains impressive. Three- and five-year total returns have comfortably outpaced many peers as the company focuses on growth and innovation in hospitality.

If Hilton's steady climb has you thinking about what other names could be next, consider discovering fast growing stocks with high insider ownership.

With Hilton’s momentum on full display, the question for investors becomes clear: is the company’s impressive run of expansion and accolades already reflected in the share price, or could there still be room for upside?

Most Popular Narrative: Fairly Valued

With Hilton trading just above the consensus fair value, expectations are evenly matched with the current share price, reflecting a cautious optimism among analysts. Attention now turns to what specific factors support this equilibrium and whether upcoming catalysts might change the balance.

The rapid expansion of Hilton's development pipeline, including opening 221 hotels in the quarter and a record 510,000 rooms in progress, with strategic focus on emerging markets (Asia-Pacific, Africa, India), positions Hilton to capture rising demand from growing middle-class travelers worldwide. This supports long-term revenue and earnings growth. Hilton's emphasis on new lifestyle and luxury brands, plus robust conversion activity leveraging its existing portfolio, enables the company to address shifting consumer preferences toward experiential travel and premium accommodations. This fuels future RevPAR growth and higher net margins.

Want to unpack the bold expansion thesis behind Hilton’s valuation? It hinges on new hotels, emerging market ambitions, and a roadmap that could rewrite earnings expectations. Which growth bets are analysts really counting on? Click to see the full playbook.

Result: Fair Value of $273.5 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in RevPAR and economic headwinds in key regions could limit Hilton’s ability to deliver on its ambitious growth story.

Find out about the key risks to this Hilton Worldwide Holdings narrative.

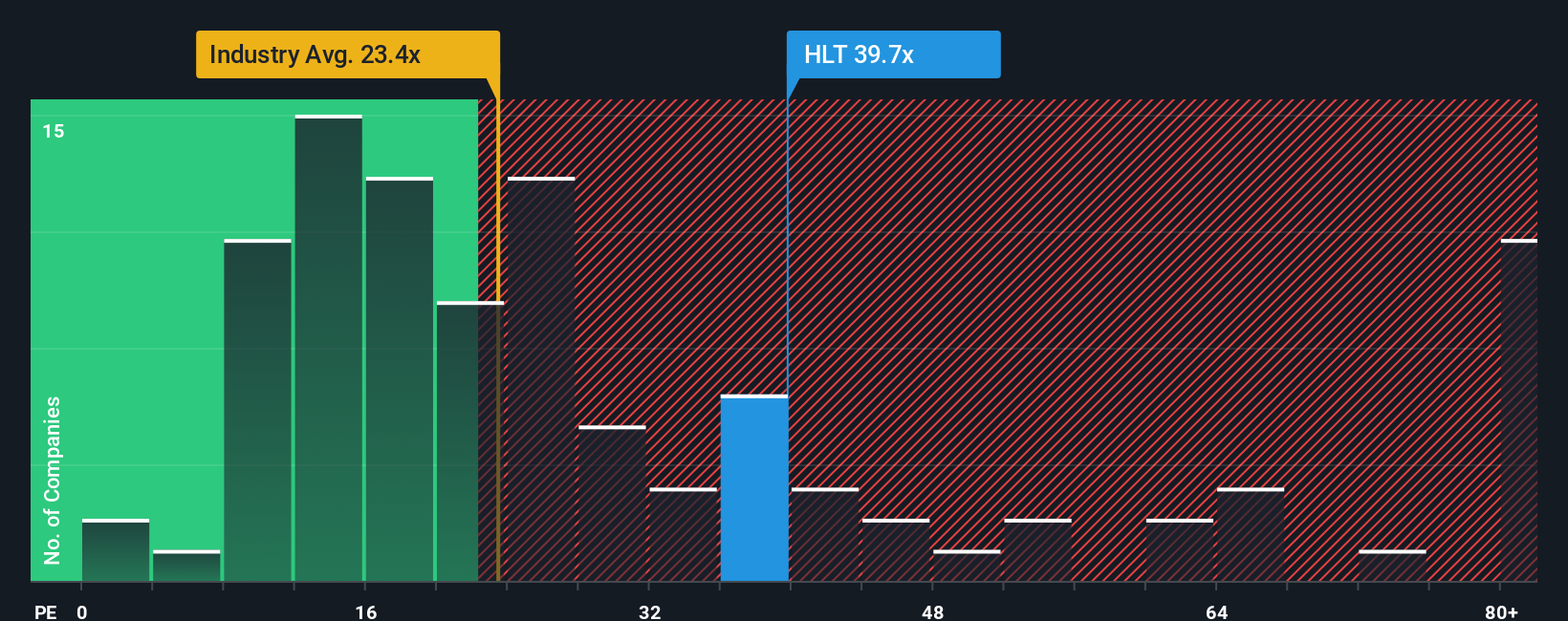

Another View: Market Multiples Raise a Flag

Stepping away from fair value estimates, Hilton's current price-to-earnings ratio sits at 39x, which is well above both the industry average of 23.1x and a fair ratio of 31.1x. This premium could mean investors are paying up for growth, but it also signals elevated valuation risk compared to peers. Is the market pricing in too much optimism, or will Hilton's story justify the stretch?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hilton Worldwide Holdings Narrative

If you see the Hilton story differently or want to dig into the numbers yourself, building your own narrative is quick and straightforward. Do it your way.

A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at Hilton when there are so many smart opportunities waiting to be uncovered? Take control and back your instincts with fresh ideas from these tailored lists:

- Tap into high growth by reviewing these 25 AI penny stocks shaping major trends in automation and real-world applications for artificial intelligence.

- Lock in potential long-term income by browsing these 18 dividend stocks with yields > 3% featuring attractive yields from financially solid companies.

- Spot value plays that others might be missing. See these 881 undervalued stocks based on cash flows driven by strong cash flows and favorable market sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives