- United States

- /

- Hospitality

- /

- NYSE:HGV

How HGV’s Flat Revenue and Earnings Miss May Reshape Hilton Grand Vacations’ Growth Narrative

Reviewed by Sasha Jovanovic

- Earlier this month, Hilton Grand Vacations reported revenues of about US$1.30 billion, essentially flat year on year and around 5% below analyst expectations, alongside a significant shortfall in adjusted operating income estimates.

- The company also delivered the weakest performance versus analyst forecasts among its travel and vacation provider peers, raising fresh questions about its ability to meet the ambitious growth and margin gains embedded in consensus views.

- We’ll now explore how this flat revenue performance and earnings miss may alter Hilton Grand Vacations’ previously optimistic investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Hilton Grand Vacations Investment Narrative Recap

To be a shareholder in Hilton Grand Vacations, you have to believe the vacation ownership model can still compound value through owner growth, upgrades and successful integration of acquisitions like Diamond and Bluegreen. The latest quarter’s flat US$1.30 billion in revenue and earnings shortfall matters because it directly challenges the near term catalyst of margin expansion, while also amplifying the key risk that weaker demand and higher bad debt could keep profitability under pressure.

Against that backdrop, the company’s aggressive share buybacks stand out, with about US$500 million used to repurchase roughly 13% of shares under the August 2024 plan, followed by a new US$600 million authorization. While this capital return supports per share metrics, it sits uncomfortably alongside recent earnings misses and already tight interest coverage, which could constrain flexibility if integration benefits or owner growth take longer to show up.

Yet while buybacks can support the share price in the short term, investors should also be aware that rising bad debt and default rates could...

Read the full narrative on Hilton Grand Vacations (it's free!)

Hilton Grand Vacations’ narrative projects $6.4 billion revenue and $785.5 million earnings by 2028. This requires 12.6% yearly revenue growth and about a $728.5 million earnings increase from $57.0 million today.

Uncover how Hilton Grand Vacations' forecasts yield a $51.70 fair value, a 22% upside to its current price.

Exploring Other Perspectives

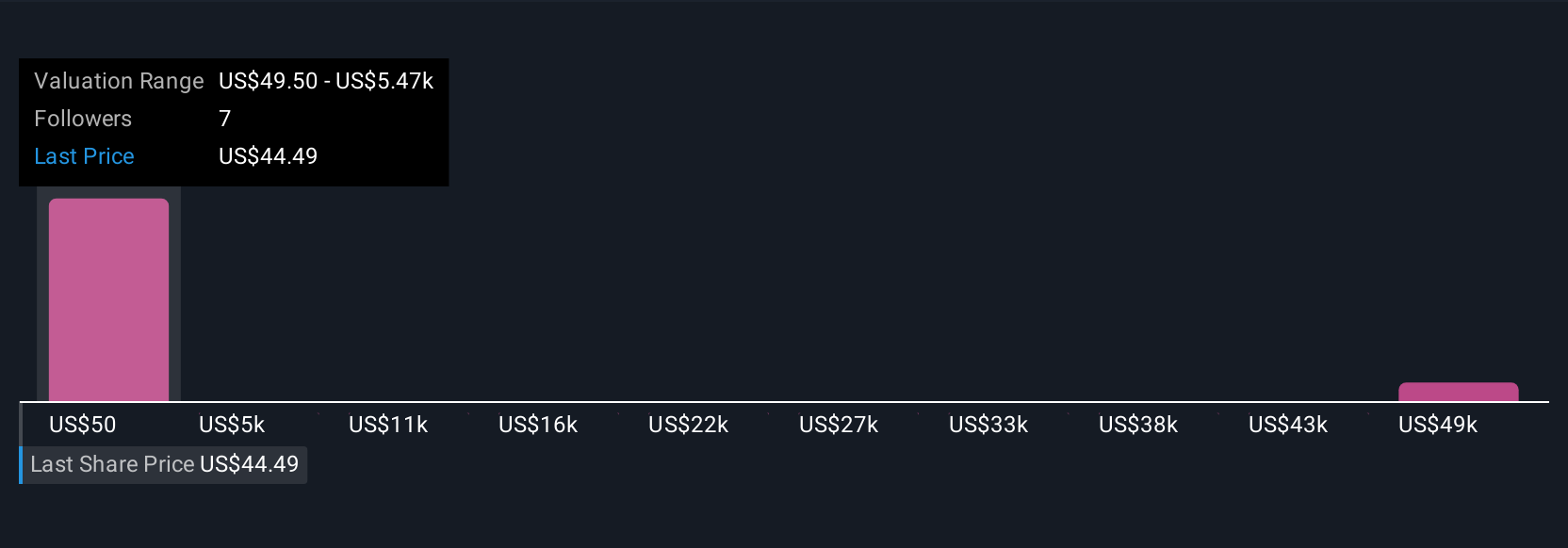

Four fair value estimates from the Simply Wall St Community span from US$51.70 to US$54,269.95, showing just how far apart individual views can be. Set against HGV’s recent revenue miss and pressure on margins, this wide spread underlines why you may want to compare several perspectives before forming your own view.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be worth just $51.70!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

Develops, markets, sells, manages, and operates the resorts, timeshare plans, and ancillary reservation services under the Hilton Grand Vacations brand in the United States and Europe.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026