- United States

- /

- Hospitality

- /

- NYSE:HGV

Hilton Grand Vacations (HGV): Evaluating Value as U.S. Consumer Confidence Slides to Five-Month Low

Reviewed by Kshitija Bhandaru

U.S. consumer confidence has slipped for a second month, now reaching a five-month low as worries over inflation and job security mount. Uncertainty around a looming federal government shutdown is also rattling the market.

See our latest analysis for Hilton Grand Vacations.

Hilton Grand Vacations has seen its share price hold fairly steady over the past year, even as the broader market wrestles with shifting consumer confidence and hints of slowing discretionary spending. The company’s five-year total shareholder return of nearly 90% shows that long-term holders have still been rewarded. However, recent price momentum is more muted as investors weigh macro risks against potential growth opportunities in the travel sector.

If you’re interested in what else might be gaining ground as travel and leisure names react to changing economic signals, consider broadening your search and discover fast growing stocks with high insider ownership

With Hilton Grand Vacations now trading at a notable discount to analyst targets and enjoying strong long-term returns, could this be a rare buying opportunity, or is the market already pricing in its future growth?

Most Popular Narrative: 18.7% Undervalued

The market is pricing Hilton Grand Vacations well below the consensus fair value, suggesting potential upside for investors who buy in at these levels. Analyst expectations and strategic moves set the stage for more than just a recovery.

Ongoing strength in HGV Max and integration of Bluegreen and Diamond Resorts are driving sustained contract sales momentum, enhanced customer loyalty, and a rapidly growing, highly engaged membership base. Together with the rollout of additional premium features, this supports higher revenue growth and margin improvement.

What’s really fueling this ambitious valuation? It all comes down to integrating major acquisitions and unlocking new levels of loyalty. The full story breaks out bold assumptions and reveals the financial drivers behind the narrative’s target. Find out what’s predicted to push revenue and margins higher for Hilton Grand Vacations.

Result: Fair Value of $53.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently weak loan repayments and sluggish new owner growth could challenge expectations. These factors could act as headwinds for both profit forecasts and future returns.

Find out about the key risks to this Hilton Grand Vacations narrative.

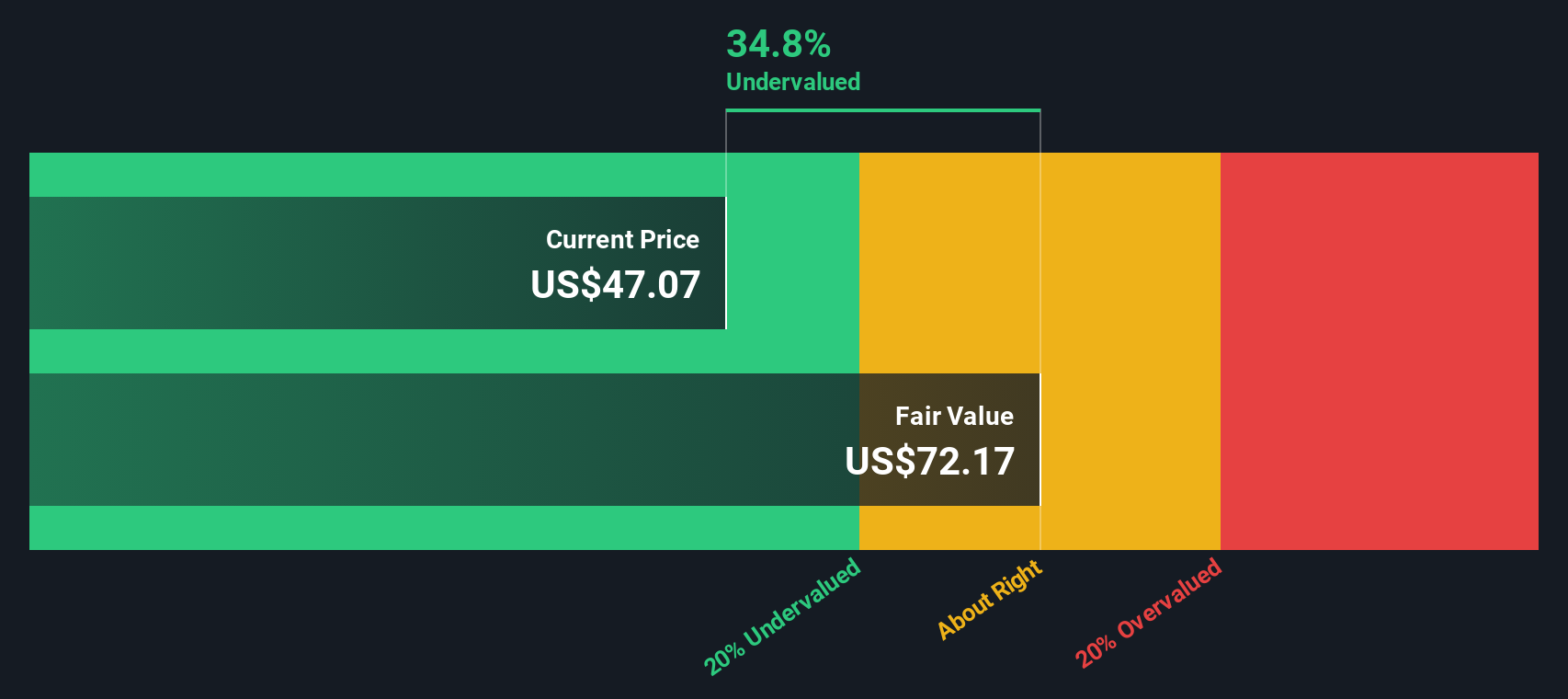

Another View: The SWS DCF Model

While analyst consensus points to Hilton Grand Vacations being undervalued, our DCF model tells a similar story. The SWS DCF model calculates a fair value for HGV stock at $72.17, which is much higher than the current price. This suggests an even greater undervaluation based on future cash flows. However, questions remain about whether this fully reflects the risks related to customer loans and integration.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hilton Grand Vacations Narrative

If you want to dig deeper and form your own perspective, the tools are here to help you assemble your narrative in just minutes. Do it your way

A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you’re serious about maximizing your portfolio, now is your chance to catch tomorrow’s winners before the crowd. The best opportunities are easy to spot once you know where to look.

- Lock in consistent payouts by tapping into these 19 dividend stocks with yields > 3% which offers high yields and time-tested income streams.

- Accelerate your investment journey with these 24 AI penny stocks that fuel innovation in artificial intelligence and automation breakthroughs.

- Supercharge your search for bargain opportunities by using these 900 undervalued stocks based on cash flows to pinpoint stocks trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

Develops, markets, sells, manages, and operates the resorts, timeshare plans, and ancillary reservation services under the Hilton Grand Vacations brand in the United States and Europe.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives