- United States

- /

- Hospitality

- /

- NYSE:H

How Investors May Respond To Hyatt Hotels (H) Expanding Into Upper Mid-Scale U.S. Hotel Markets

Reviewed by Sasha Jovanovic

- Hyatt Hotels recently announced the launch and anticipated expansion of its Hyatt Select brand, targeting the upper mid-scale hotel segment in secondary and tertiary U.S. markets.

- This initiative signals Hyatt’s intent to diversify its offerings and capture new revenue by appealing to a broader customer base within underserved regions.

- We will explore how the Hyatt Select brand launch could reshape Hyatt's revenue growth outlook and broader investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hyatt Hotels Investment Narrative Recap

To be a Hyatt shareholder today, you need to believe in the company's ability to expand into new market segments, with the Hyatt Select brand launch serving as a key catalyst for revenue opportunities in secondary and tertiary U.S. markets. However, the biggest near-term risk remains the potential for shifting U.S. booking trends and economic volatility, both of which could quickly counteract any positive sentiment generated by the expansion announcement if market headwinds worsen; as of now, the impact of Hyatt Select is promising but not yet material to near-term financial results.

Among Hyundai's recent moves, the continued global expansion of its Park Hyatt luxury brand stands out, further strengthening its footprint in high-end hospitality. While this development supports Hyatt's efforts to broaden its portfolio, the real test for performance will likely come from the company’s ability to execute and scale new initiatives like Hyatt Select against potential demand softness and wider market risks.

In contrast, investors should also be aware that even as Hyatt pursues new market opportunities, ongoing changes in U.S. leisure and business travel habits may...

Read the full narrative on Hyatt Hotels (it's free!)

Hyatt Hotels is projected to reach $8.4 billion in revenue and $551.3 million in earnings by 2028. This forecast requires 37.6% yearly revenue growth and a $119.3 million increase in earnings from $432.0 million today.

Uncover how Hyatt Hotels' forecasts yield a $156.95 fair value, a 7% upside to its current price.

Exploring Other Perspectives

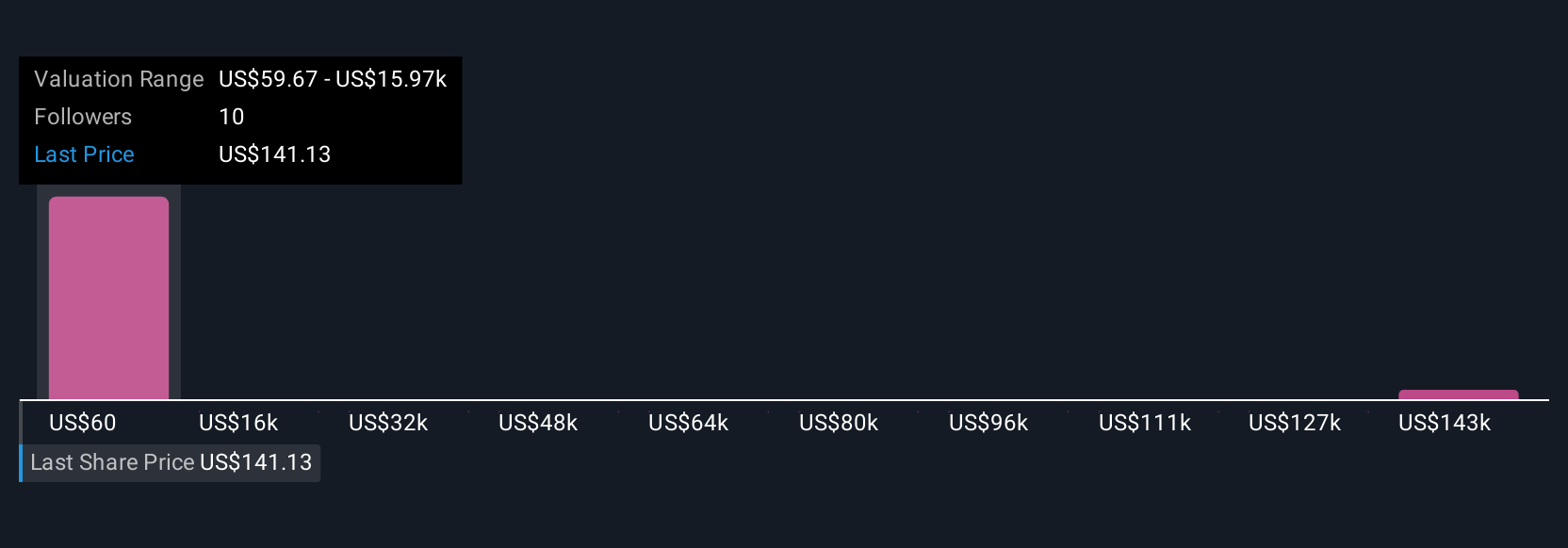

Six fair value estimates from the Simply Wall St Community for Hyatt range from US$66 to a remarkable US$159,128 per share. While perspectives vary greatly, the potential for revenue growth through new brand launches is a key theme shaping expectations for future performance.

Explore 6 other fair value estimates on Hyatt Hotels - why the stock might be worth less than half the current price!

Build Your Own Hyatt Hotels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hyatt Hotels research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Hyatt Hotels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hyatt Hotels' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives