- United States

- /

- Hospitality

- /

- NYSE:GENI

How Investors Are Reacting To Genius Sports (GENI) Securing Long-Term Exclusive NFL and NCAA Data Rights

Reviewed by Simply Wall St

- In June 2025, the NFL extended its data rights partnership with Genius Sports through 2029, and the NCAA awarded Genius Sports an exclusive data rights agreement running through 2032, both providing the company with multi-year access to valuable sports data assets. This increased contract duration offers significant long-term visibility into licensing costs and potential revenue streams for Genius Sports.

- We'll explore how these long-term exclusive sports data contracts could shape Genius Sports' investment outlook and future growth trajectory.

AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Genius Sports Investment Narrative Recap

Investors in Genius Sports need to believe in the company's ability to maintain and monetize exclusive sports data rights, driving long-term recurring revenues amid fast-growing global sports betting markets. The NFL and NCAA contract extensions bring greater revenue and cost visibility through the next decade, but these updates do not eliminate the primary risk: future renegotiations could still pressure profit margins if data rights costs climb unexpectedly.

Among recent announcements, the exclusive partnership secured with Serie A complements the NFL and NCAA deals by further solidifying Genius Sports' data access, which underpins its main growth catalyst, expansion of global sports betting and fan engagement platforms. This consistent stream of long-term contracts supports the view that Genius Sports is cementing a defensible position among leagues and data customers.

However, the biggest risk investors should keep in mind is that, despite these multi-year agreements, future rights renegotiations could still present...

Read the full narrative on Genius Sports (it's free!)

Genius Sports' narrative projects $929.9 million in revenue and $120.6 million in earnings by 2028. This requires 18.5% yearly revenue growth and a $198.5 million increase in earnings from the current -$77.9 million.

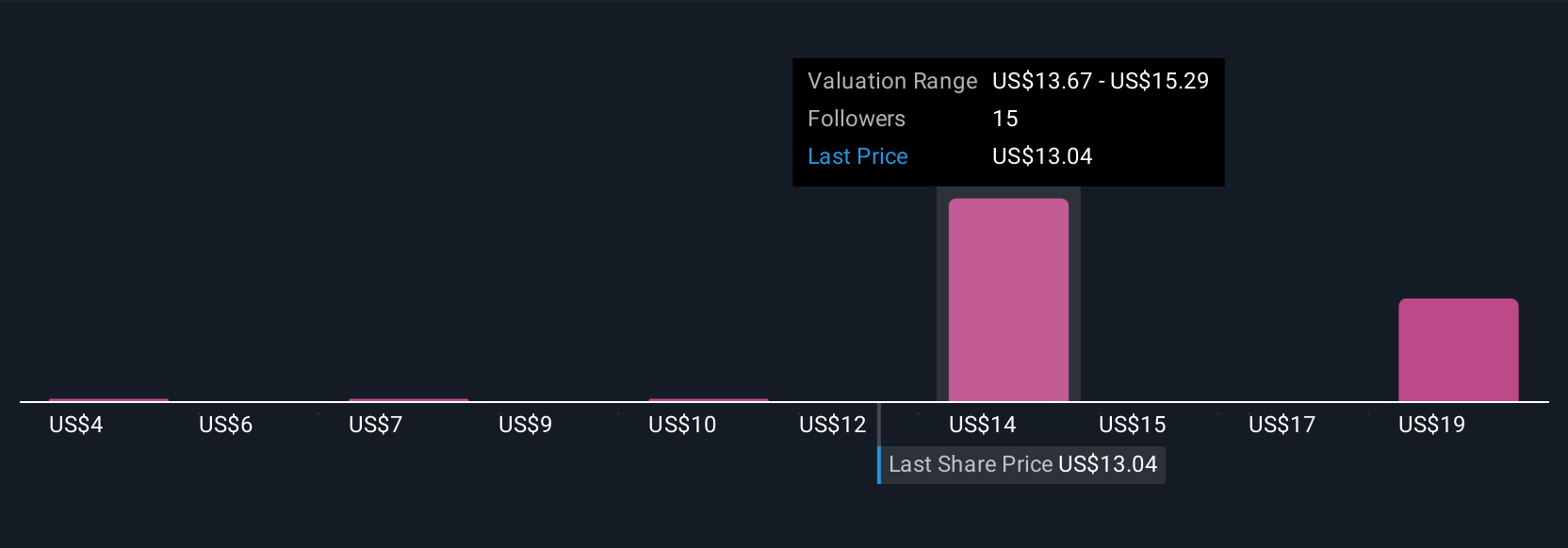

Uncover how Genius Sports' forecasts yield a $14.59 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community place Genius Sports shares anywhere from US$3.97 to US$20.14. While many see current recurring agreements as a revenue stabilizer, ongoing competition for data rights remains a factor that could sway long-term optimism in very different ways.

Explore 6 other fair value estimates on Genius Sports - why the stock might be worth less than half the current price!

Build Your Own Genius Sports Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genius Sports research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Genius Sports research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genius Sports' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GENI

Genius Sports

Engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives