- United States

- /

- Hospitality

- /

- NYSE:FLUT

Flutter Entertainment (NYSE:FLUT): Assessing Valuation After FanDuel Buyout, Share Buyback, and CME Partnership

Reviewed by Simply Wall St

If you have been watching Flutter Entertainment (NYSE:FLUT) lately, the company has just rolled out a series of moves that position it for future growth. The completion of two high-profile deals with Boyd Gaming, acquiring the last 5% slice of FanDuel and extending their collaboration through 2038, means Flutter now has full control of one of its cornerstone assets. In addition, the board authorized a fresh $245 million share buyback, sending a clear signal that management believes in the business’s underlying value. The newly announced partnership with CME Group to create an event contracts platform also points to continued strategic progress for Flutter.

The market appears to be taking notice. Over the past year, Flutter’s shares have gained 35%, with momentum building in recent months. The stock is up 16% year-to-date and 10% in the past quarter. While much of the year’s move followed broader strength in consumer-facing stocks, the most recent string of announcements highlights that Flutter is actively pursuing further growth initiatives. Recent revenue and profit growth numbers provide additional evidence of the company's ongoing progress.

After this series of positive news and strong price momentum, investors may be considering whether Flutter Entertainment is an undervalued opportunity or if the market has already factored in the anticipated growth.

Most Popular Narrative: 14.4% Undervalued

According to the most widely followed narrative, Flutter Entertainment is trading notably below its estimated fair value, as analysts see substantial upside based on future growth and profitability projections.

"Ongoing expansion of online gambling and iGaming in newly regulated and high-growth markets (e.g., Brazil and the U.S.) is expected to accelerate Flutter's revenue and earnings, leveraging increasing global internet and smartphone penetration and regulatory liberalization."

Curious what is fueling this bullish price target? This approach leans heavily on eye-catching revenue, profit, and margin projections, as well as a bold future profit multiple. Want to see what happens when analysts bet big on Flutter’s path to 2028? Dive into the narrative’s fair value math to learn what could drive the next breakout.

Result: Fair Value of $345.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high debt and increasing regulatory scrutiny in key markets could limit profitability. These factors may challenge the current bullish outlook for Flutter Entertainment.

Find out about the key risks to this Flutter Entertainment narrative.Another View: What Do Valuation Multiples Suggest?

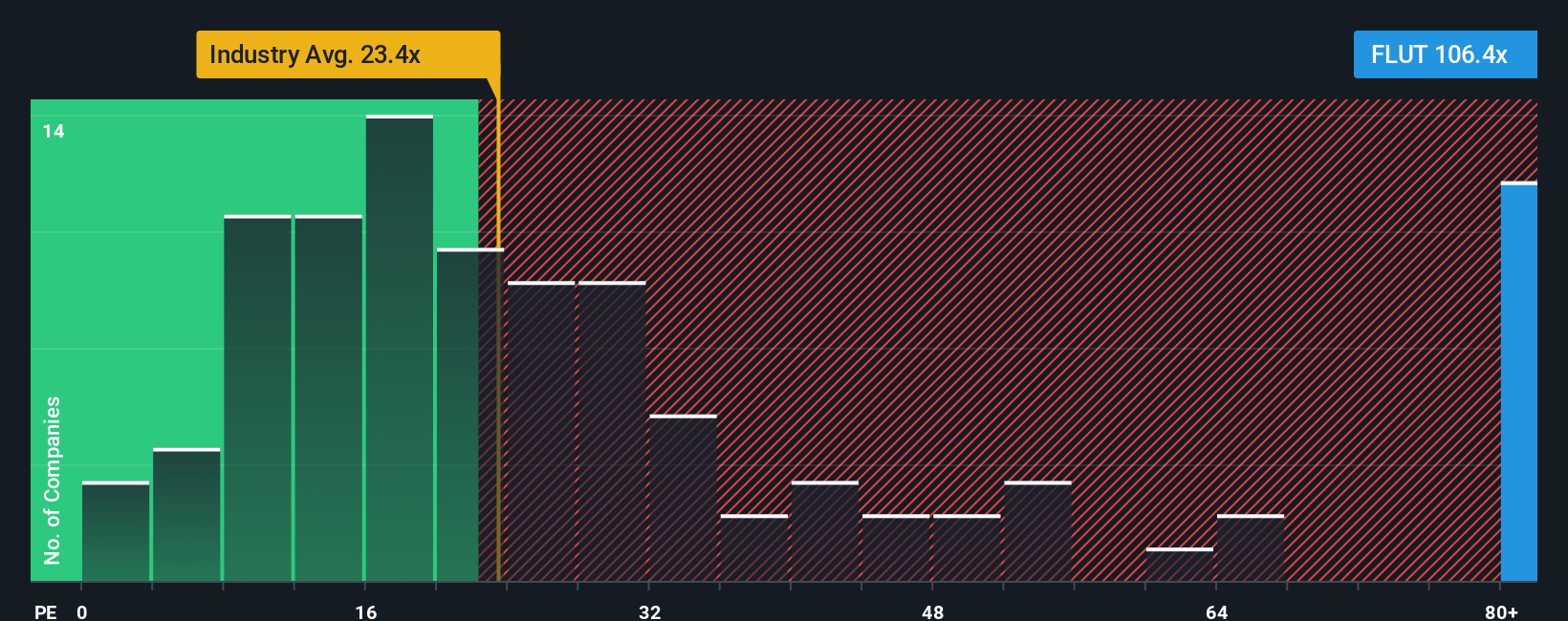

While the main narrative points to untapped value, a closer look at standard valuation multiples paints a less optimistic picture. Compared to the broader industry, Flutter appears expensive on this basis. Could the market be getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flutter Entertainment Narrative

If the prevailing narratives do not resonate with your perspective, you can quickly dive into the data yourself and construct your own view in just a few minutes. Do it your way.

A great starting point for your Flutter Entertainment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Make your next investment even more strategic by unlocking fresh ideas beyond Flutter. The Simply Wall Street Screener puts powerful investing trends at your fingertips, so you never miss tomorrow’s top performer.

- Kick off your search for up-and-coming market disruptors with penny stocks that boast strong financials by browsing our penny stocks with strong financials.

- Find steady income sources and build resilience into your portfolio with dividend stocks offering impressive yields through our dividend stocks with yields > 3%.

- Stay ahead of the curve by targeting overlooked gems that are undervalued based on their cash flows, all in our comprehensive undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:FLUT

Flutter Entertainment

Operates as a sports betting and gaming company in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion