- United States

- /

- Hospitality

- /

- NYSE:FLUT

Can Flutter (FLUT) Sustain Its Edge as Prediction Markets Win Major Backing From Financial Giants?

Reviewed by Sasha Jovanovic

- In recent days, Intercontinental Exchange, the parent company of the New York Stock Exchange, announced a major multi-billion dollar investment in prediction market platform Polymarket, sparking renewed debate about the future of traditional sports-betting operators. This development has prompted investors and analysts to focus on how established companies like Flutter Entertainment can respond as prediction markets gain broader regulatory access and attract partnerships with major financial platforms.

- This shift highlights the increasing importance of innovation and adaptability for leading digital betting firms facing new forms of federally regulated competition that could change industry norms.

- We'll explore how intensifying competitive pressure from rapidly expanding prediction markets could reshape Flutter Entertainment's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Flutter Entertainment Investment Narrative Recap

To be a shareholder in Flutter Entertainment right now, investors need confidence in the company's ability to grow in newly regulated, high-growth markets through product innovation, operational leverage and successful integration of recent acquisitions. The recent surge of attention on prediction markets, following Intercontinental Exchange's investment in Polymarket, puts competitive threats from new federally regulated formats in the spotlight. For now, the most important short-term catalyst, expansion into these new markets, remains the key driver, while competition from prediction markets introduces stronger risk but doesn't materially change that core focus.

One particularly relevant development is Flutter's recent upward revision of its 2025 revenue guidance to US$17,260 million. This positive outlook is consistent with the ongoing U.S. and Brazilian growth catalysts, but also highlights why investors are scrutinizing the potential impact of emerging, federally regulated prediction markets on Flutter's prospective market share in these same regions.

However, against expectations for accelerated expansion, investors should be aware of mounting risks arising from...

Read the full narrative on Flutter Entertainment (it's free!)

Flutter Entertainment's outlook points to $23.5 billion in revenue and $2.5 billion in earnings by 2028. This implies a yearly revenue growth rate of 16.4% and an increase in earnings of $2.13 billion from the current $366 million.

Uncover how Flutter Entertainment's forecasts yield a $341.53 fair value, a 41% upside to its current price.

Exploring Other Perspectives

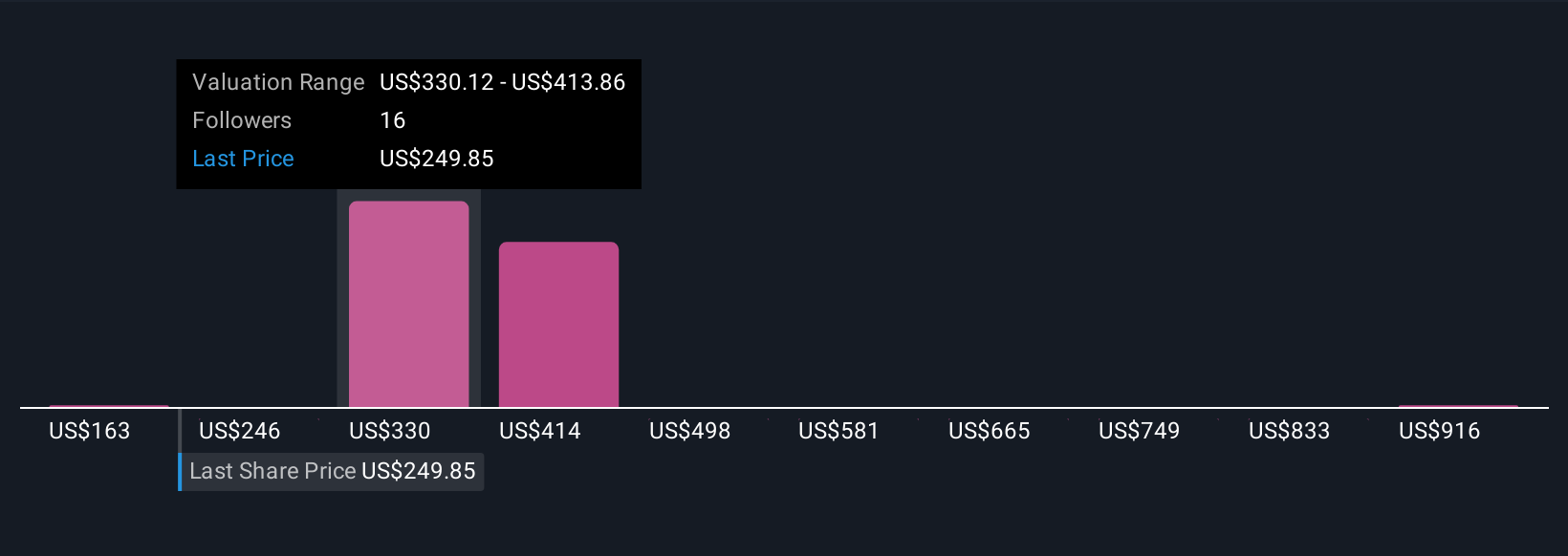

Seven members of the Simply Wall St Community have valued Flutter Entertainment between US$162.65 and US$1,000, showing significant divergence in outlooks. Amid these contrasting opinions, intensifying competition from prediction markets could have broader implications for sustained revenue growth and profit margins, explore how different forecasts weigh these risks and opportunities.

Explore 7 other fair value estimates on Flutter Entertainment - why the stock might be worth 33% less than the current price!

Build Your Own Flutter Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flutter Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Flutter Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flutter Entertainment's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLUT

Flutter Entertainment

Operates as a sports betting and gaming company in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives