Stock Analysis

- United States

- /

- Entertainment

- /

- NYSE:SPOT

Unveiling US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. market rebounds from a recent tech selloff, with major indexes showing signs of recovery, investors are keenly observing shifts across various sectors. In this context, growth companies with high insider ownership may offer unique advantages, as aligned interests between shareholders and management can be crucial during periods of volatility and economic uncertainty.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Duolingo (NasdaqGS:DUOL) | 15% | 47.9% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Underneath we present a selection of stocks filtered out by our screen.

New Oriental Education & Technology Group (NYSE:EDU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: New Oriental Education & Technology Group Inc., operating in the education sector, has a market capitalization of approximately $12.51 billion.

Operations: The business overview already provided does not include specific revenue segment details for New Oriental Education & Technology Group. Please provide the relevant data on revenue segments for a comprehensive summary.

Insider Ownership: 12%

Revenue Growth Forecast: 18.4% p.a.

New Oriental Education & Technology Group, a growth-oriented company with high insider ownership, has recently become profitable. Its revenue is expected to increase by 18.4% annually, outpacing the US market's 8.7%. While its Return on Equity might seem modest at 14% in three years, the firm's earnings are set to rise significantly by 27.7% per year. Analysts believe its stock price could surge by 35.1%. Additionally, the company extended its buyback plan until May 2025, underscoring confidence in its financial health.

- Take a closer look at New Oriental Education & Technology Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of New Oriental Education & Technology Group shares in the market.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

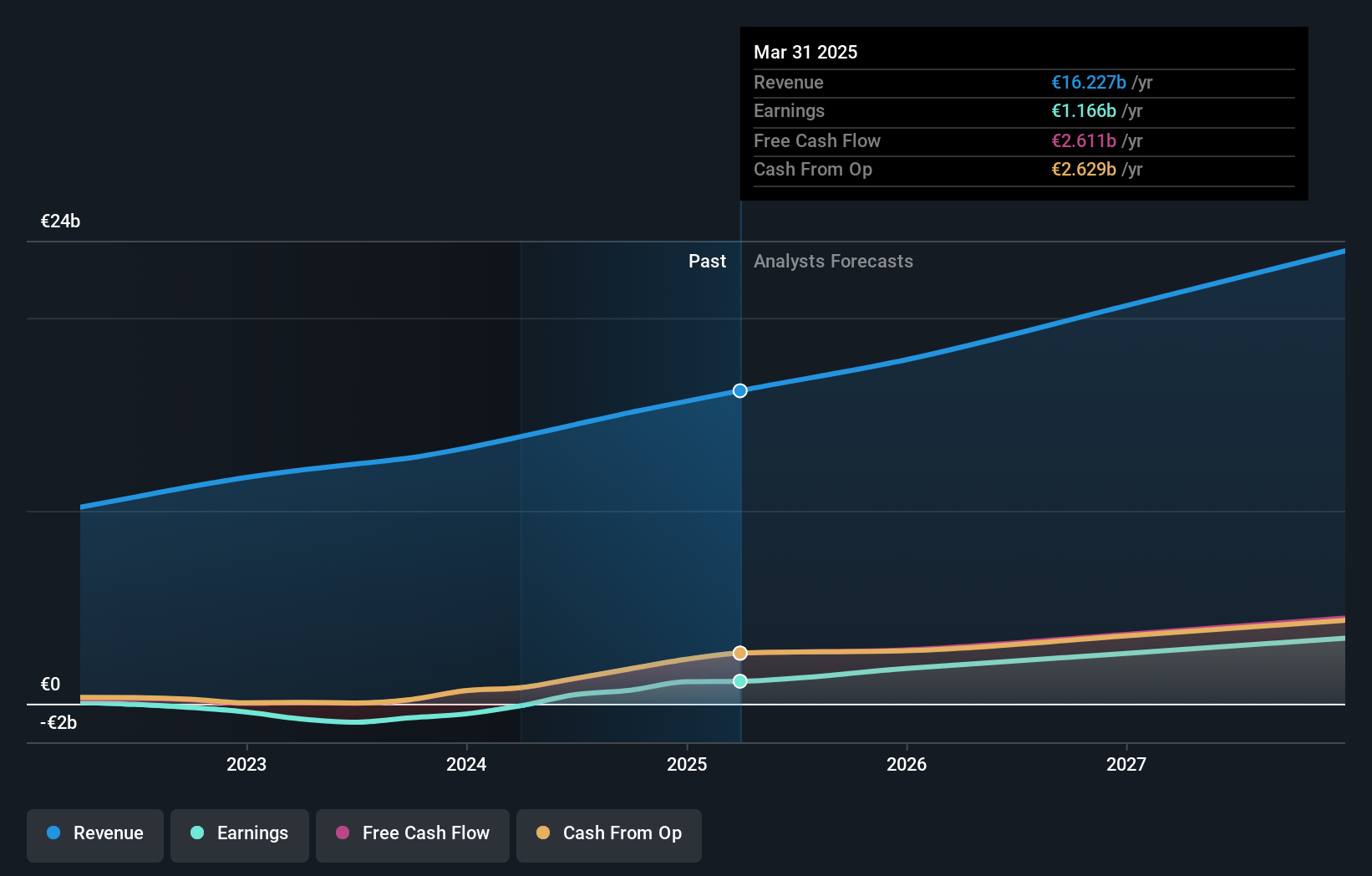

Overview: Spotify Technology S.A., along with its subsidiaries, operates globally as a provider of audio streaming subscription services, boasting a market capitalization of approximately $65.85 billion.

Operations: The company generates revenue primarily through two segments: Premium subscriptions, which brought in €12.10 billion, and ad-supported services, contributing €1.74 billion.

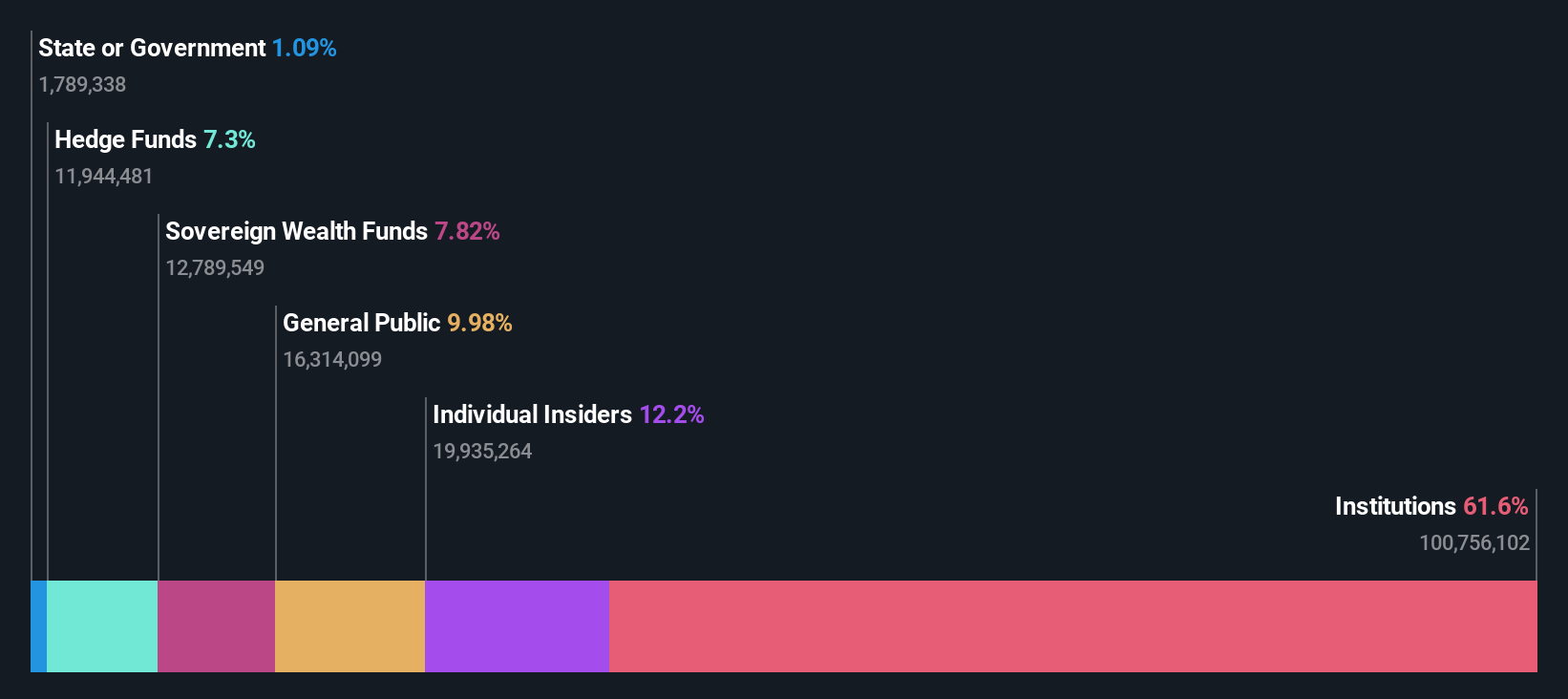

Insider Ownership: 17.9%

Revenue Growth Forecast: 12.1% p.a.

Spotify Technology, currently trading at 18.6% below its estimated fair value, is poised for significant growth with expected profitability within three years. Despite past shareholder dilution, earnings are projected to increase by 38.02% annually. Recent financial reports show a robust recovery, with Q2 sales rising to €3.81 billion and net income switching from a loss of €302 million to a profit of €274 million year-over-year. This performance aligns with its addition to the Russell Top 200 Growth Index while exiting the Midcap indices.

- Click here and access our complete growth analysis report to understand the dynamics of Spotify Technology.

- According our valuation report, there's an indication that Spotify Technology's share price might be on the expensive side.

TAL Education Group (NYSE:TAL)

Simply Wall St Growth Rating: ★★★★☆☆

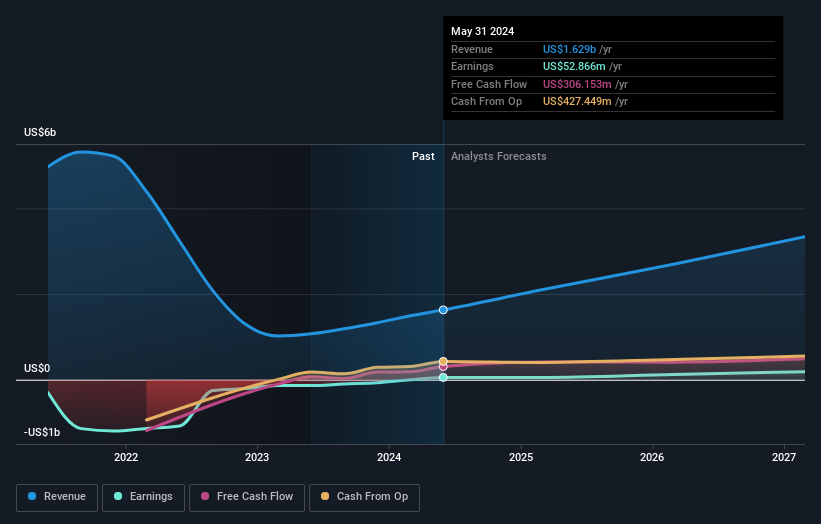

Overview: TAL Education Group, operating in the People's Republic of China, offers K-12 after-school tutoring services and has a market capitalization of approximately $6.41 billion.

Operations: The company generates its revenue primarily through K-12 after-school tutoring services, totaling approximately $1.49 billion.

Insider Ownership: 31.7%

Revenue Growth Forecast: 19.6% p.a.

TAL Education Group has shown a robust recovery, with its annual sales increasing to US$1.49 billion from US$1.02 billion, and a significant reduction in net loss to US$3.57 million from US$135.61 million year-over-year. The company is expected to become profitable within three years, with forecasted earnings growth of 42.11% annually, outpacing the market's average. Despite trading 46.6% below its fair value and slower-than-ideal revenue growth at 19.6% annually, analysts predict a substantial price increase of 51.8%.

- Delve into the full analysis future growth report here for a deeper understanding of TAL Education Group.

- Upon reviewing our latest valuation report, TAL Education Group's share price might be too pessimistic.

Taking Advantage

- Access the full spectrum of 184 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with excellent balance sheet.