- United States

- /

- Hospitality

- /

- NYSE:DIN

The Market Lifts Dine Brands Global, Inc. (NYSE:DIN) Shares 26% But It Can Do More

Despite an already strong run, Dine Brands Global, Inc. (NYSE:DIN) shares have been powering on, with a gain of 26% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 10.0% over the last year.

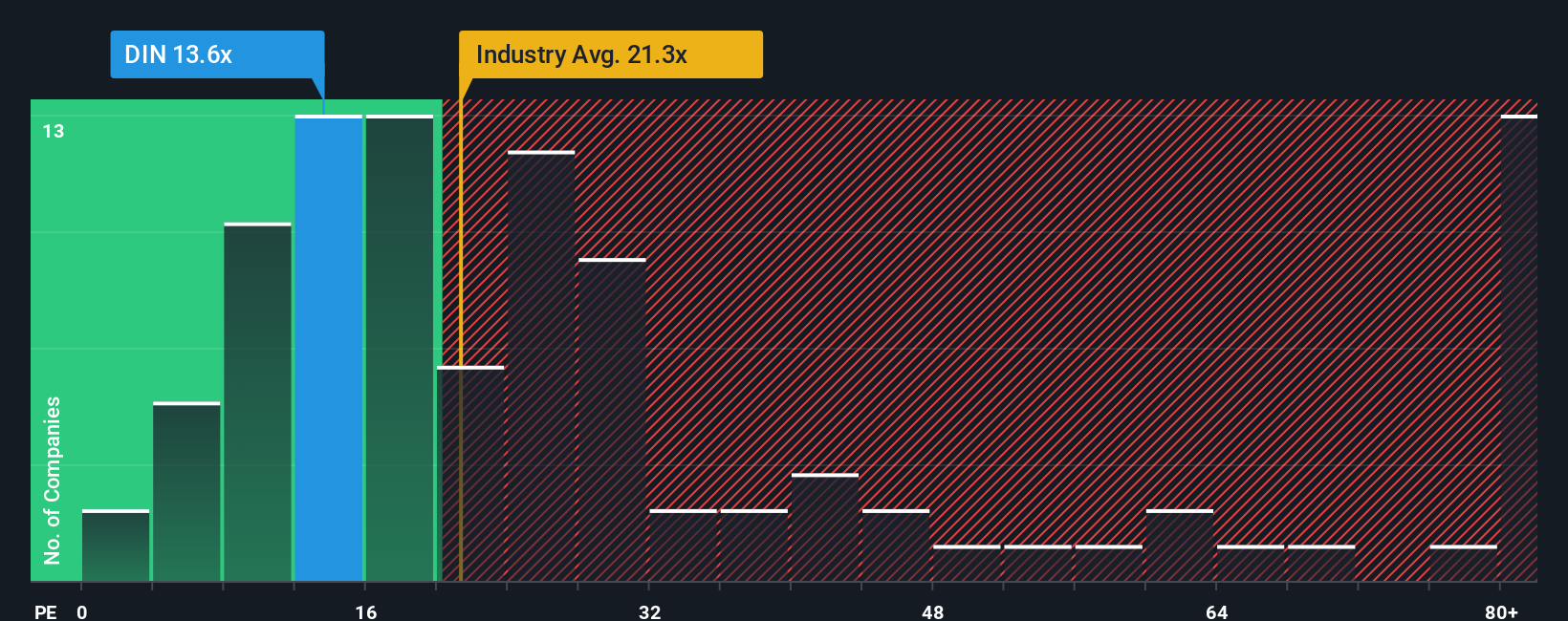

Even after such a large jump in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Dine Brands Global as an attractive investment with its 13.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, Dine Brands Global's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Dine Brands Global

Is There Any Growth For Dine Brands Global?

In order to justify its P/E ratio, Dine Brands Global would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 63% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 57% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 62% as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 16% growth forecast for the broader market.

In light of this, it's peculiar that Dine Brands Global's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Dine Brands Global's P/E?

Dine Brands Global's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Dine Brands Global's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Plus, you should also learn about these 4 warning signs we've spotted with Dine Brands Global (including 1 which is a bit unpleasant).

You might be able to find a better investment than Dine Brands Global. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DIN

Dine Brands Global

Owns, franchises, and operates restaurants in the United States and internationally.

Undervalued with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026