- United States

- /

- Hospitality

- /

- NYSE:CMG

Those Who Invested In Chipotle Mexican Grill Five Years Ago Are Up 437%

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Chipotle Mexican Grill, Inc. (NYSE:CMG) share price. It's 437% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. And in the last month, the share price has gained 16%. But the price may well have benefitted from a buoyant market, since stocks have gained 7.5% in the last thirty days.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

Check out our latest analysis for Chipotle Mexican Grill

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

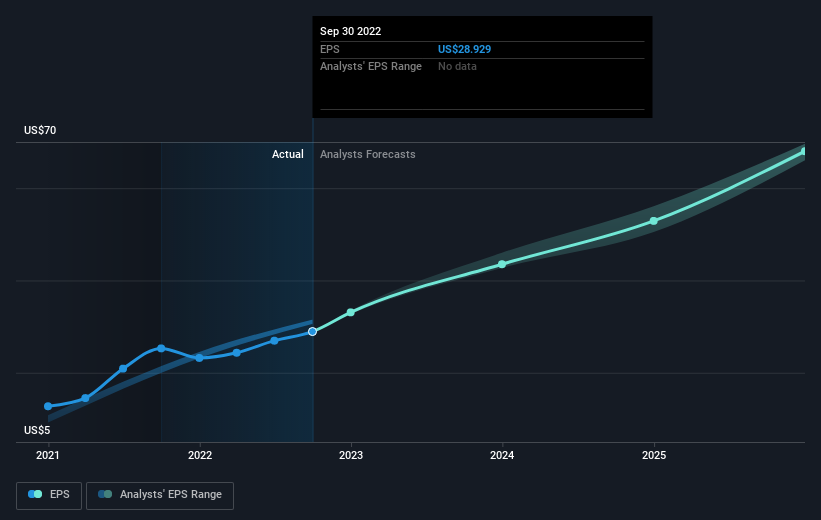

Over half a decade, Chipotle Mexican Grill managed to grow its earnings per share at 41% a year. That makes the EPS growth particularly close to the yearly share price growth of 40%. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. In fact, the share price seems to largely reflect the EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Chipotle Mexican Grill's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Chipotle Mexican Grill shareholders have received a total shareholder return of 8.6% over the last year. However, that falls short of the 40% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Chipotle Mexican Grill , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Solid track record with excellent balance sheet.